GnosisDAO Forum – GnosisVC Update – Q4 2024

This being the first update post since the GIP-102 vote to launch GnosisVC, we’ll extend the post to a 2024 review instead of just covering updates from the fourth quarter.

The road to GnosisVC

The concept of GnosisVC as a standalone structure began in early 2024, with the initial ideation driven by the Gnosis co-founders. The goal was to create a new home for GnosisDAO’s venture investments that would provide a uniform and transparent way to continue their excellent track record of backing early-stage projects both financially, as well as with knowledge, resources and integrations.

The core team and advisors for GnosisVC were selected by March. They began working out the overall investment strategy while researching the best suited legal structure to deliver on the objective. After the framework and focus verticals were laid out, the team began screening deal flow in April, given the expectation of an uptick in valuations towards the second half of the year and ability to lock in favourable terms in the present. The early investments were warehoused by Gnosis Ltd with the ability to eventually transfer them into the fund (at cost price), which would also decrease blind-pool risk upon launch and thus make fundraising efforts easier to some extent.

GIP-102 to formally launch GnosisVC went live in late June and passed with 99.33% votes in favour. Following the GIP vote, the team initiated the setup of the fund structure in the form of a Cayman partnership with a clearly defined investment mandate and effective control by Gnosis DAO (through the Gnosis Assets Holding I Foundation established based on GIP-91, updated in GIP-94 and GIP-96).

Progress Update

The investment pillars of GnosisVC are: real-world assets, payments middleware, and decentralized infrastructure. These three verticals were selected to advance the Gnosis3.0 vision by backing projects that are suitable to unlock further growth and adoption of the Gnosis product suite.

GnosisVC screened >100 deals in total, of which 5 were deployed and 4 are currently pending execution. Most of the deal flow originates from the wider Gnosis ecosystem and is evaluated in close collaboration with advisors working on GnosisPay and other Gnosis core team members. In addition to the deal flow obtained from within Gnosis DAO, the sourcing channels were further expanded by forging relationships with other venture investors to bi-directionally share investment opportunities. The GnosisVC team was present at the following conferences in 2024: Dappcon Berlin, EthCC Brussels, Token2049 Singapore, Devcon Bangkok, + many other, smaller events.

Fundraising was kicked off in November at Devcon Bangkok and the team has received commitments from 10 investors so far. (The fund aims to raise another 20mio USD in addition to the 20mio committed by Gnosis DAO, see GIP-102 for reference).

Timing of future updates: we’ll generally aim to post updates 3-4 weeks after the end of each quarter, as well as posting about new investments on our X/Twitter account (@GnosisVC).

Portfolio

Among others, the following investments were added to the GnosisVC portfolio in Q4 2024:

-

Monerium: regulated stablecoins in Europe.

With their E-money compliant structure, we expect Monerium to gain additional tailwind from the MiCA regulations in effect since January 2025. The EURe and GBPe stablecoins are the backbone of GnosisPay and also integrated with the Metri wallet. Moreover, Fiat on/offramps are available seamlessly through the Monerium SAFE app supporting batched transactions.

The investment of GnosisVC invested a total of 3.25m USD, leading the latest equity growth round (including the transfer of a warehoused position deployed in Q2 ‘24).

-

Tokenize: At the forefront of equity fundraising innovation, Tokenize.it utilizes blockchain technology to simplify the equity fundraising process for startups through tokenization. By offering a platform that reduces the complexities and costs associated with traditional equity financing, Tokenize.it provides startups with an efficient pathway to access capital. Positioned uniquely in the German market and adhering strictly to local regulations, Tokenize.it has successfully completed its first transaction in 2024 and plans for expansion to other European jurisdictions. The equity tokens issued by Tokenize.it are available on Ethereum and Gnosischain. With our investment, we support their vision to transform startup financing in Europe and bring additional real world assets to the Gnosis ecosystem.

-

FLock: blockchain infrastructure for federated learning and open-source AI models. FLock’s incentivized platform lowers the barriers for accessing AI agent training, fine-tuning, and inferencing for a more equitable distribution of rewards along the value chain and governance by users. This is a strategic follow-on investment from the F.actor portfolio, whereby GnosisVC participated in the SAFT round shortly before the token generation event in December 2024 - coinciding with their mainnet launch.

-

Picnic: onboarding web2 users in Brazil with account abstraction (built on SAFE) and convenient on/offramp with dedicated IBAN bank accounts per user. Picnic already has onboarded >20k users and is planning further expansion across the LatAm region. Together with the upcoming integration with GnosisPay in Brazil, we are optimistic on the outlook of further growth and adoption on their platform. Other items on Picnic’s roadmap are yield products, mobile app, and native Bitcoin withdrawals (using Kinetex, also one of Gnosis DAO’s investments).

Other News:

- In January, GnosisVC invested in the pre-seed round of an e-commerce payments network. We have also committed to were executed in January

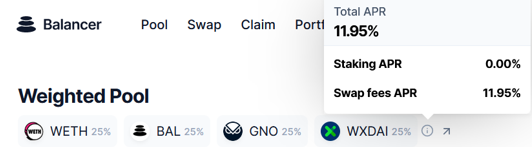

- Balmy (F.actor portfolio company) launched their Earn Guardian on Base with a 300k rewards program: x.com

The full list of investments (including F.actor portfolio companies) can be found here: Gnosis