GIP-35: The target total supply should be 3M GNO ?

- Let’s do this!

- Make no changes

GIP: 35

title: The target total supply should be 3M GNO ?

author: Karpatkey (phase 1) & Smenaamix (phase 2)

type: Meta

created: 2022/04/10

Simple Summary

The goal of this proposal is to kickstart discussions about drastically reducing the total GNO supply (which will add visibility and community participation in the coming years).

This GIP would improve economics and clarity of GNO rules by targeting 3M GNO total supply. It would also formally veto the GnosisDAO treasury for voting, giving more voting power to GNO holders.

Abstract

We have been discussing the GNO distribution problem for a long time:

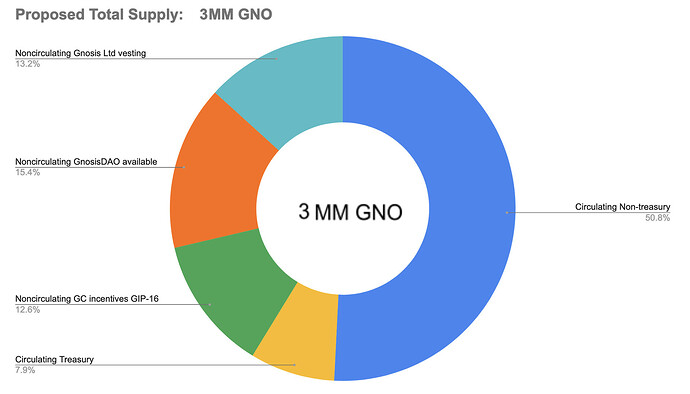

A wider distribution can be achieved with the right set of rules and economic incentives that would attract investors who understand GNO’s potential. A straightforward measure is to target 3M GNO total supply (reducing it from 10M to 3.M GNO).

The difference between the current circulating supply and the target supply can be withdrawn from the vesting contract once the proposal is accepted. GNO, which is held in the DAO contract is not considered circulating but part of the total supply. The remaining GNO in the vesting contract is not part of the circulating not total supply.

Motivation

- Clear rules for GNO economics will attract new investors: Greatly reduced uncertainties about future emissions impacting the secondary market and potential execution risks

- Empower current GNO token holders and multiply the representation of new GNO community members: Increase more than 3X the ownership and voting power

- Gnosis 2.0 as the future of decentralised teams: Given the current vision of future rewards for GNO token holders with project tokens, the need for new GNO is reduced.

Specification

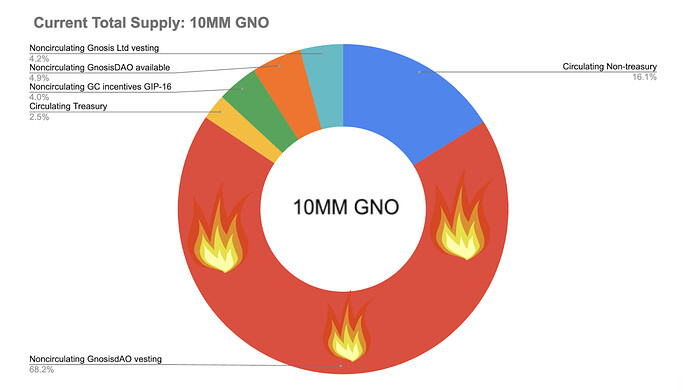

Non-circulating GnosisDAO vesting: 6.8MM GNO. These are the GNO vesting from the original GnosisDAO announcement : 8MM GNO, vesting for 8 years. This proposal intends to lock and progressively burn this amount (enforced by contracts).

Non Circulating Gnosis Ltd vesting: 0.4MM GNO

Non Circulating GnosisDAO available: 0.5MM GNO. GNO already vested, without considering the GIP-16 commitment.

Non Circulating GC incentives GIP-16: 0.4MM GNO. Incentives program proposed in GIP-16 for the Gnosis Chain

Circulating Treasury: 0.25MM GNO. GNO holdings on the GnosisDAO treasury, used for market making and DeFi strategies. Most of these GNO were acquired in the open market and OTC deals during the last 2 years. See GIP-20 for more information.

Circulating Non-treasury: 1.6MM GNO. Circulating shown on Coingecko, discounting the treasury holdings.

Note: This is an approximation and it does not consider any future proposal that the teams and core units may be working on right now.

Implementation

There will be transaction data corresponding to funds to be lock and burn here when this proposal moves to phase 3.

GnosisDAO Snapshot

There will be a Snapshot link added here when this proposal moves to phase 3.