kpk: 2025 H1 Review for GnosisDAO

This report provides an update on kpk’s contributions and impact for GnosisDAO over the first six months of 2025, focusing on treasury overview, operations, including liquidity and diversification, ecosystem development, technology and governance.

Summary

The first half of 2025 has been a defining period for GnosisDAO, not just in terms of execution, but in sharpening our strategy around deploying capital, rebalancing the treasury, and focusing on cross-chain infrastructure, supporting ecosystem integration, and liquidity enhancement.

At the heart of these efforts, a key objective is making sure Gnosis Chain is capital-efficient, liquid, and a dependable ecosystem that can scale across user bases and use cases.

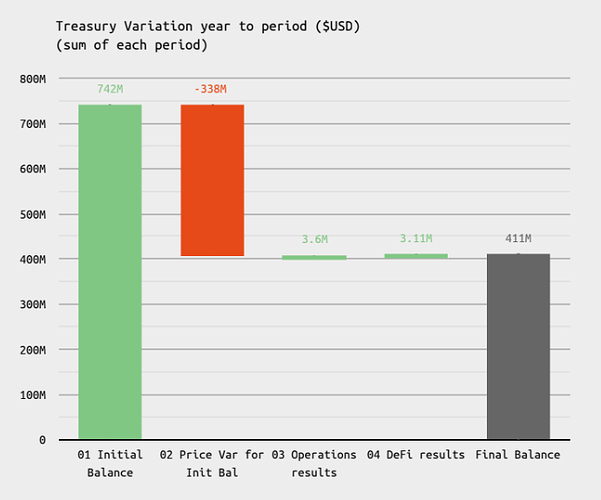

Over H1 2025, GnosisDAO has faced the macro pressures seen across the broader crypto market: sharp drawdowns in asset prices, reduced DeFi activity, and shifting user sentiment. These headwinds impacted the treasury, with its value falling from $742 million to $411 million, primarily due to falling prices in GNO and ETH, which together make up nearly two-thirds of our holdings.

Yet despite these conditions, GnosisDAO treasury management has been proactive rather than reactive. We’ve reallocated capital into higher-yield, higher-alignment strategies, enhanced GNO and stablecoin liquidity across major protocols, and executed ETH sales with discipline to preserve runway and flexibility. These moves reflect our commitment to both risk management and long-term positioning.

We also recognise that liquidity is not just about treasury returns, it’s about ecosystem usability. Users need stable, predictable experiences. That’s why GnosisDAO treasury has supported key infrastructure partners, improved routing and bridging capabilities, and made critical acquisitions like HQ.xyz to strengthen operational execution across global markets.

Ultimately, the desirable state of liquidity we’re working toward is one where:

- Stablecoins are readily available for payments, trading, and lending

- GNO is liquid and efficiently priced across centralised and decentralised venues

- Cross-chain routes are fast, reliable, and cost-effective

- Yield strategies are aligned with ecosystem growth, not just return maximisation

This report reflects a coordinated effort to build a resilient infrastructure, intelligent capital deployment, and strategic focus amid market volatility. As we move into H2 2025, our efforts in the first half will allow GnosisDAO to continue to scale its impact and better serve its ecosystem.

Headline Figures

The figures for the first half of 2025:

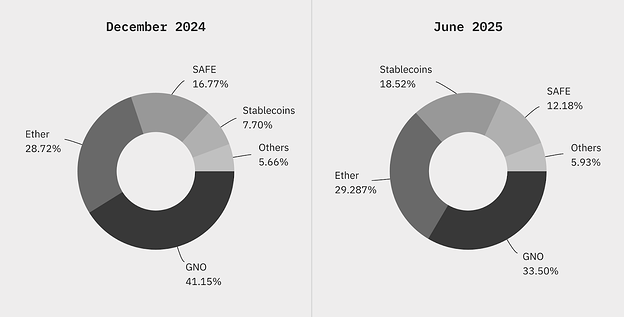

- Treasury Value: The treasury value has declined from $742 million (as of the end of December 2024) to $411 million (as of the end of June). This decline of $331 million is mainly a result of the drop in crypto asset prices over the past 6 months. GNO, which accounts for 33.4% of the DAO’s treasury, has seen a decrease in price by over 57% ($263.64 to $111.59). ETH, which comprises 29.4% of the DAO’s treasury, has seen a similar trend and has declined in price by 25.3%.

- Performance by Category:

- DeFi Results: $496,190 in June, with an overall total of $3.11 million for the first six months. This performance primarily reflects gains from ETH deployments across multiple DeFi protocols.

- Operations Results: June saw operation results of -$1.6 million, which is reflective of the DAO’s ongoing monthly expenses and partnership payments. However, due to the results of operational swaps and rewards, the overall result for the first half of the year amounted to a positive $3.6 million.

- Change in Market Value: A decline of -$43.3 million was recorded in June, contributing to a total of $338 million over the first six months. As mentioned above, this is in line with the overall market and decline in treasury asset prices.

- Gnosis Chain Metrics:

- DeFi TVL: $342 million in December 2024 - $254 million in June. Given that TVL is highly price-sensitive, the broad decline in asset prices across the market has been reflected in Gnosis’s TVL, which has fallen by over 25%.

- DeFi Volume: There has been a decline of nearly 50% since December 2024, falling from $381 million to $193 million by the end of June. Lower trading volumes reflect reduced market participation amid ongoing uncertainty and heightened volatility in the current market environment.

This report derives all details on GnosisDAO’s portfolio performance from kpk’s monthly reports, which are published on the website. Information regarding the aggregate performance of Gnosis Chain is sourced from DefiLlama’s website.

Treasury Operations

Liquidity and Diversification

Liquidity, Withdrawals, Allocations and Yield Generation

-

Over the first 6 months of 2025, GnosisDAO deployed significant amounts into the Uniswap V3 instance (via Oku Trade) on Gnosis Chain, in order to enhance trading depths on the chain. This also proved a good opportunity to improve on the recent performance of stable assets within the DAO’s treasury, as Uniswap V3 offers greater yields where liquidity is deployed more densely in a narrow price range, compared to standard full-range positions. This work included:

- In total, assets to the value of $3.2 million were deployed into various Uniswap V3 pools. This achieved a noticeable reduction in price impact on swaps across the targeted liquidity pools.

- The creation of four new pools on Uniswap V3 via Oku Trade:

- wETH / wstETH

- EURe / USDC.e

- USDC.e/xDAI

- USDC.e/sDAI

- Several pools were also created to enable Metri functionality in tandem with Circles. These pools are all under $10k TVL.

-

Significant capital reallocation was executed to iterate on idle assets in the DAO’s treasury via yield-generating DeFi protocols:

- $3 million USDC deployed to wstUSR Pendle pool in May. This strategy aimed to capture premium yields on real-world asset-backed tokens while maintaining exposure to USR-based collateral.

- Initiated an ETHx strategy with an allocation of 10 ETHx into the Stader Hyperloop vault on Enzyme, testing performance scalability. This was positive, and we increased allocation by 248 ETHx in May.

- Transferred significant amounts of ETH to Lido (10,000 ETH), Ether.fi (1,500 ETH), and Stader (1,500 ETH), and subsequently deposited the resulting assets into Aave

- Allocated 128 ETH each to Chorus One, Stakeway, and NodeSet via StakeWise Vaults to further .

-

GnosisDAO also withdrew funds from multiple DeFi platforms, such as Hyperdrive, Arrakis, Diva, and many others, in order to facilitate the capital reallocation plans outlined in the previous bullet point.

-

ETH liquid-staking token positions were migrated from Sommelier to Aura Finance to benefit from the stronger incentive alignment established through our participation in Aura. The DAO has participated in Aura’s biweekly gauge votes to drive future incentives to pools according to preferences. Rewards are claimed and locked to compound yield and support long-term ecosystem participation. Consolidating assets from Sommelier into our Aura portfolio enhances efficiency and unlocks greater incremental value per dollar invested due to modest economies of scale.

-

As part of the of the liquidity endeavors led by AAVE DAO we borrowed, swapped and managed a liquidity pool for stkGHO/GHO on Maverick and a 1 million limit order for stkGHO, intended to support the AAVE DAO work related to GHO while at the same time directing yield to the treasury stable assets.

Support for Ecosystem Tokens and Cross-Chain Bridging

Stablecoin liquidity on Gnosis Chain forms the backbone of Gnosis Pay’s debit card payment rails and is, therefore, key to growing the real-world audience for our stack of Gnosis products.

- To ensure that liquidity is effective in supporting the ecosystem and giving a stable, high-quality user experience, we continue to actively manage and rebalance liquidity pools for:

- GBPe

- EURe

- BRLA

- USDCe

- sDAI

- wstETH

- USDC assets were transitioned to USDC.e on Aave v3 to comply with Circle’s bridged token standard. The primary benefit of standardised USDC.e is enabling interoperability across chains, allowing protocols to seamlessly plug USDC.e into their systems regardless of which ecosystem they are deploying on. Standardisation becomes a pillar around which different DeFi protocols can build, as it allows for consistent liquidity around a single, durable asset and disincentivises support for other derivatives or alternatives, thereby reducing the number of inefficient alternatives. USDC.e standard willl also ensure Gnosis Chain’s readiness for the eventual rollout of native USDC support

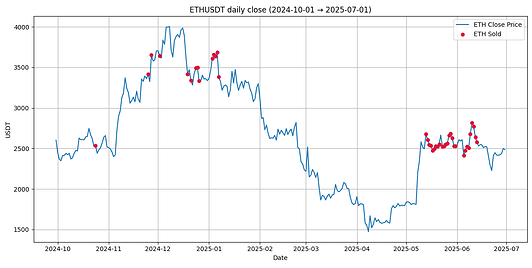

ETH Realisation

- To support treasury diversification, fund ongoing projects and commitments, support the operational runway, and reduce exposure to potential downside in ETH volatility, GnosisDAO began to exchange ETH into Stablecoins from October 2024 and has continued throughout 2025. This measured approach allowed GnosisDAO to gradually convert a portion of its ETH holdings into stable assets, ensuring greater financial stability while maintaining flexibility for future deployments.

- This was underpinned by careful market analysis and executed with strategic timing. This resulted in capturing favourable price points during periods of ETH appreciation and maximising the return for GnosisDAO.

- Since commencement, a total of 19,405.7 ETH was sold for a total of $54,269,957.55 at an average price of $2,796.60. The average price of ETH between October 2024 and June 2025 was $2,654.46. By executing sales at strategically timed points above this average, an additional $2.7 million in value was generated. All selling points are highlighted in the graph below.

- In October, the first point seen on the graph below, 3,051.1 ETH was sold for 6,940,305.48 DAI and 767,584.62 USDC at an average price of 2,526.2. This was executed to fund the VC with the first tranche of funds requested.

- During November and December, a total of 2,762.2 ETH was exchanged for 10,006,497.8 USDC, capitalising on elevated prices averaging 3,622.6.

- Three TWAPs were executed during May and June, resulting in the sale of 12,000 ETH for a total of 30,842,763.50 DAI at an average price of 2,570.20.

- The first TWAP sale involved swapping 3,600 ETH for 9,071,921.30 DAI at an average price of 2,519.98.

- The second TWAP sold 3,500 ETH for 9,042,442.10 DAI at an average price of 2,583.55.

- The third TWAP executed the sale of 4,900 ETH at an average price of 2,597.63, yielding 12,728,400.20 DAI.

| Date | ETH | USDC/DAI/USDT | Avg Price |

|---|---|---|---|

| 1 Oct - 30 June | 19,405.7 | 54,269,957.55 | $2,796.60 |

Validator Deposits and Staking

- Conducted multiple cluster validation tests with Obol. While tests succeeded, the decision was taken not to continue, and all 2,478 GNO were returned.

- Continued to stake PNK in Kleros, supporting decentralised dispute resolution while earning PNK rewards.

- 4,000 GNO was deployed to Balancer’s GNO/osGNO v2 liquidity pool. Stakewise’s liquid-staking osGNO token is also redeemable for GNO through the Stakewise V3 protocol, although with a significant unstaking delay. This liquidity empowers users to enter and exit osGNO quickly, supporting the adoption of liquid staking across the ecosystem. It also adds an alternative yield source for GNO, improving the DAO’s overall return on its substantial GNO portfolio.

Ecosystem Development

Integrations & Partnerships

Real World Asset (RWA) Integration

As part of Gnosis’s commitment to bridging traditional finance and decentralised infrastructure, GnosisDAO advanced its RWA strategy through key partnerships, incentive programmes, and the establishment of a legal framework to enable compliant, scalable on-chain RWA participation.

- Backed

- Following the approval of GIP-117 (which will distribute $1 million worth of GNO incentives), GnosisDAO successfully expanded support for tokenised RWAs on Gnosis Chain through its ongoing partnership with Backed Finance. Both bCSPX (representing the S&P 500 index) and wbTSLA (tokenised Tesla stock) are now live with active GNO incentives to boost liquidity and adoption. The bCSPX/sDAI pool on Balancer has grown to over $5 million in TVL, reflecting strong market interest. Additionally, 22.66 WETH was provided to integrate bCSPX into the PWN lending protocol, enabling users to borrow stablecoins using bCSPX as collateral or access bCSPX by collateralising sDAI, broadening DeFi lending options on Gnosis Chain.

- To further support the RWA ecosystem, GnosisDAO also deployed incentives for the wbTSLA pool on Uniswap V3, reinforcing its commitment to bringing traditional financial exposure into decentralised markets.

- Centrifuge

- In line with GIP-91, GnosisDAO executed a payment of 250 GNO to Centrifuge Prime to support and create a legal conduit for RWAs. This legal framework enables GnosisDAO to compliantly engage in RWA investments through Centrifuge and other platforms and partners. The initiative marked a foundational step in building the infrastructure necessary for GnosisDAO’s long-term participation in the RWA space and ensured regulatory alignment and future scalability.

Market Expansion

To support the expansion and operational growth of Gnosis Pay, GnosisDAO undertook a series of strategic initiatives across infrastructure, incentives, acquisitions, and market liquidity.

- Gnosis Pay

- Supported GnosisDAO’s efforts to expand Gnosis Pay into the Brazilian market by actively assisting with the onboarding and integration of BRLA, a Brazilian real-pegged stablecoin issued by BRLA Digital. This included testing and optimising BRLA routing infrastructure, ensuring smooth transaction flows and resolving technical and pricing issues within the BRLA/sDAI liquidity pool.

- The BRLA liquidity pool was provided with $200k to support Gnosis Pay’s launch in Brazil. This was further increased due to high demand, and 559,582 BRLA + 90,000 sDAI was added to a Balancer BRLA/sDAI pool in May to support fiat-to-crypto conversion infrastructure.

- As part of GIP-110, weekly distributions of cashback rewards to eligible Gnosis Pay users are executed. This ensures consistent, timely incentives that drive user engagement and support the growth of the ecosystem. In addition, we’ve continued to refine and improve its execution. A key enhancement includes the ability to queue transactions directly to the rewards Safe, streamlining the distribution process and improving operational efficiency.

- Headquarters

- As per GIP-120, GnosisDAO officially completed the acquisition of HQ.xyz, which is now rebranded as Gnosis HQ. This included budgeting and facilitating payments to the HQ team.

- This acquisition is in line with Gnosis’s vision and will assist with Gnosis Pay’s future objectives in the Asia markets through existing relationships and regulatory licensing.

GNO

- Efficient Frontier

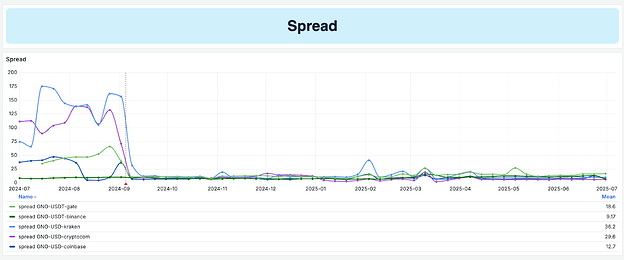

- GnosisDAO entered an 18-month agreement with market maker Efficient Frontier, deploying $3 million to market make GNO across major exchanges. This decision followed strong performance in previous engagements, where Efficient Frontier significantly improved GNO’s spread, depth of order books and trading volumes. Building on that success, the renewed partnership aims to reduce slippage further, strengthen price discovery, and make GNO more accessible to both retail and institutional participants.

Cross-Chain Liquidity and Routing Infrastructure

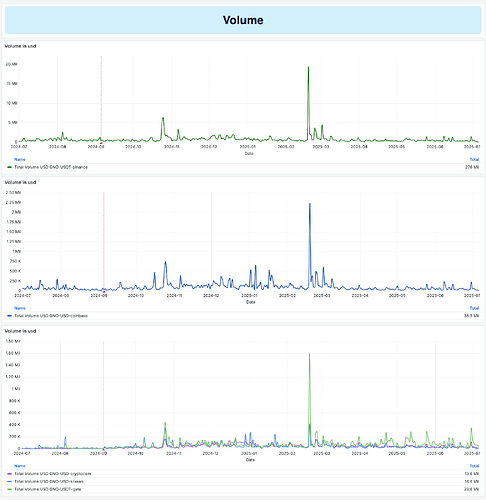

By continuing the work started in 2024 we envisioned Gnosis Chain as an interconnected chain within the DeFi landscape, to that end, GnosisDAO strategically deployed capital across multiple cross-chain bridging and routing protocols, enabling liquidity pathways, improving transaction efficiency, and supporting seamless asset movement across networks. These targeted deployments are designed to reduce friction in cross-chain interactions, offer users access to more diverse and efficient bridging routes, and improve overall usability for developers and end users alike. Volume numbers show that combined bridging volume for Gnosis Chain was below 8 million average but increasing on Q4 2024 and after the work done in the first half of the year we have seen spikes above 12 million monthly.

By integrating with high-impact infrastructure such as Bungee, Stargate, and Symbiosis, Gnosis Chain is advancing its broader mission to build a connected, capital-efficient, and scalable multi-chain ecosystem.

- Bungee

- Allocated 100,000 USDC.e to support their new routing infrastructure, enabling new bridging paths.

- Stargate

- Deployed 2 million USDC.e and 770 WETH (worth $2 million at the time) into Stargate on Gnosis Chain tapping into the 355 million network that they have created for cross-chain liquidity depth.

- Symbiosis

- Deposited 35,000 USDC and 26.3 WETH, along with integration support from kpk, to deploy Symbiosis on Gnosis Chain. This included setting up a non-custodial Safe smart account tailored to the protocol’s custom UI for protocol operations and expanding routing options across ecosystems.

- Squid

- $100,000 (50,000 USDC.e and 19.9 WETH) was provided to Squid to support and maintain the uptime and availability of cross-chain bridging to and from Gnosis Chain.

Gnosis Chain Infrastructure

As part of its commitment to strengthening the foundational infrastructure of Gnosis Chain, GnosisDAO continued funding to key technical partners as part of GIP-70 and GIP-122. Partnerships were continued with Gateway.fm and HOPR to support core node services, a high-availability infrastructure, and secure networking protocols, critical components for ensuring the long-term resilience and scalability of the Gnosis ecosystem.

- Gateway.fm

- In addition to previous funding, 333,110 DAI was transferred to Gateway.fm to continue development in the reliability and scalability of Gnosis Chain’s core infrastructure.

- HOPR

- The first installment of 1.2 million USDC from the total 4.8 million USDC was sent to HOPR. This is an essential step to bring the initial proof-of-concept version of Gnosis VPN (as per GIP-98) to market.

Circles

In preparation for the launch of Circles V2, extensive efforts were dedicated to ensuring the project’s operations.

- Multiple Safe multisigs were established to manage CRC tokens, safeguard idle assets, and enable efficient deployment into liquidity pools.

- To facilitate secure and timely execution, proposer roles were assigned, allowing trusted actors to initiate transactions without compromising the integrity of the system.

- A central focus of this work was on liquidity management, aimed at maintaining CRC price stability and ensuring reliable swap pathways. To this end, 100,000 sDAI was allocated across various Circles liquidity Safes, with strategic support provided to pools on Uniswap and Balancer.

- Additionally, $100,000 was reallocated to the wstETH/WBTC Balancer pool cutting back 1 route hop for wBTC since wstETH is a routing asset on Gnosis Chain and this enabled CRC-related swaps.

Visibility and Commitment

- Strategic ETH Reserve

- Listed GnosisDAO on the Strategic ETH Reserve. GnosisDAO is currently ranked at #6 on the list. By participating, GnosisDAO reinforces its support for Ethereum and joins others in showcasing a collective commitment to the network’s long-term value.

Initiatives & Incentives

- The total weekly distributions of incentives and rewards over six months (January - June 2025) amounted to:

- Gnosis’ Curve liquidity pool:

- The incentives totalled 4.8 wstETH in June. Therefore, cumulative total incentives now sit at 23,431.90 GNO and 113.72 wstETH.

- CoW Solvers:

- A total of 27,381.93 xDAI was awarded to CoW solvers in June, which brings the total solver rewards to 372,581.60 xDAI.

- Backed:

- For bCSPX, 342 GNO ($38,843.58 at time of transfers) has been distributed in June. Since the start of the programme, a total of 1,816 GNO has been distributed (valued at $242,648.81 at the time of the relevant transfers).

- For bTSLA, 1,034.28 GNO ($123,355.69 at time of transfer) has been distributed since commencement on the 27th March 2025. In June, 341.63 GNO ($38,843.58 at time of transfers) was distributed.

- Gnosis Pay Cashback Programme (GIP-110):

- A total of 7,256.70 GNO has been awarded to date (72.56% of the total) among 4,021 users. 1,649.20 GNO was distributed in June alone.

- See the Dune Dashboard, which shows the weekly and total number of GNO rewarded, USD equivalent and users rewarded.

- Aave EURe:

- A total of 59,000 EURe incentives were supplied to Aave to stimulate demand for EURe borrowing.

- Gnosis’ Curve liquidity pool:

Technology

Gnosis Pay

In support of Gnosis Pay’s technical development, several key enhancements were implemented to improve system functionality, data accuracy, and user experience.

- The Gnosis Pay Rewards Indexer was upgraded with a new subgraph integration, historical price tracking, and fixes for missing GNO snapshot data, ensuring more accurate and reliable reward calculations.

- The user dashboard was also improved, now offering the ability to export airdrop data as CSV files for greater transparency and user control. To support liquidity and user access, a bridged USDC claimer was launched, allowing seamless retrieval of USDC on Gnosis Chain.

- Additionally, a new rewards distribution feature was introduced, enabling transactions to be queued directly to the rewards Safe, which has streamlined internal workflows and improved the overall efficiency of the cashback rewards process.

kpk Dashboards and Alerts

Significant progress has been made in strengthening monitoring, visibility, and analytics across key infrastructure components supporting Gnosis Chain. These tools aim to enhance transparency and support informed decision-making.

- Development continued on three new kpk dashboards:

- One offering real-time insights into the Gnosis Bridges Network, which helps track liquidity availability, bridging costs, and route-level details.

- The second one is tracking key performance metrics for strategic CoW AMM pools on Gnosis Chain.

- The third, showing market activity data to be able to track market liquidity and price efficiency across Gnosis markets.

- Implemented real-time alerts across major bridges for Gnosis Chain, enabling the team to quickly identify and respond to unusual activity or performance issues and maintain consistent infrastructure reliability.

Across Relayer

- The Across bridge relayer is now fully active and continues to receive funding to support seamless cross-chain activity on Gnosis Chain. The relayer plays a key role in enabling efficient low-latency bridging and has begun generating small but consistent revenue, contributing to the long-term sustainability of the cross-chain infrastructure. We worked closely with the Across team to debug and resolve issues to ensure stable and reliable functionality.

Governance

Delegate Programme

In order to facilitate GIP-101, certain on-chain transactions had to be executed through GIP-116. This included claiming, transferring and withdrawing assets, including claiming and burning 3.15 million GNO from the vesting contract, which supported GIP-35. In addition, the subdomain for the snapshot space to select the delegates was created. This resulted in the selection of 10 delegates who have assisted GnosisDAO in reaching quorum and increasing decentralisation.

ShutterDAO

Actively participate in Shutter DAO’s governance proposals where we support the development of privacy-preserving, MEV-resistant infrastructure, and ensure Gnosis-aligned perspectives are represented in shaping Shutter Network’s future. GnosisDAO originally supported Shutter network through GIP-38 and later on the development of the Shutterized Gnosis Chain (GIP-104).

Completion of Buyback Programme

The buyback programme outlined in GIP-100 was successfully completed in January, comprising a total of $30 million split between $15 million TWAPs executed over 6 months and an additional $15 million executed at kpk’s discretion. See the Dune Dashboard and forum update for more information.

Fees

For the period of six months, the management fee charged was $1,000,002 (6/12 of $2 million per annum). The performance fee is 20% of DeFi results from assets on Mainnet, which resulted in 196.54 ETH.

| Management Fee | Performance Fee (ETH) | |

|---|---|---|

| January | $166,667 | 33.72 |

| February | $166,667 | 25.07 |

| March | $166,667 | 36.04 |

| April | $166,667 | 42.20 |

| May | $166,667 | 26.07 |

| June | $166,667 | 33.44 |

| Total | $1,000,002 | 196.54 |

This corresponds to a total fee of c. $1,457,900 from January to June 2025 (calculated by substituting 20% of the USD value of DeFi results for the ETH fee charged). Relative to the $3,112,413 in DeFi results, kpk’s fees represent 46.84% of the total. Therefore, the majority of earnings generated by our work remain with GnosisDAO. However, this analysis only accounts for the basic yield generated and does not factor in kpk’s additional activities or value-added contribution.