Introduction

The first major use case of blockchain is tokenizing real-world assets (RWAs). Although this idea has been discussed for the last 6–8 years, there are still only a handful of RWAs on-chain. Many projects have tried blockchain in various domains, and the most natural fit has been finance. Yet while DeFi—initially a niche use case—has grown rapidly in TVL and innovation, RWAs have struggled to gain adoption.

The primary reason is that launching a DeFi protocol requires minimal funds to build an MVP, get user feedback, and iterate quickly. In contrast, bringing RWAs on-chain involves:

- Establishing legal entities and corporate structures

- Opening bank accounts and crypto-friendly accounts

- Drafting and executing legal documents

- Forming partnerships for custody, on-ramps, off-ramps, and trading

Each of these steps can cost between USD 100,000 and 250,000 and take 6–9 months. Every project repeats this costly process from scratch.

Our goal is to templatize this setup, reducing cost and effort by 20×. We will create standardized fund structures with flexible underlying assets, so teams can launch new RWA products more quickly and affordably.

Why DoDAO

KoalaGains is an initiative by DoDAO, a team with deep expertise across all required areas:

- Corporate and fund-vehicle law in multiple jurisdictions

- Real-world financial assets and their management

- Ethereum ecosystem and smart-contract development

- DeFi growth strategies and integrations

At DoDAO we have conducted extensive RWA research, mapped here: https://research.chainedassets.com/

We’ve also catalogued the main projects and service providers in the RWA space:

- Projects: chainedassets.com/landscape-projects

- Service Providers:

https://chainedassets.com/landscape-service-providers

Our team has published detailed blogs on vehicle structures and compliance:

https://koalagains.com/blogs/2025-06-10-bvi-spc-incubator-setuphttps://koalagains.com/blogs/2025-06-10-bvi-umbrella-structureshttps://koalagains.com/blogs/2025-06-10-bvi-vehicles-breakdownhttps://koalagains.com/blogs/2025-05-31-dst-series-llc-compliance-automation

On the DeFi side, DoDAO has delivered tools and integrations for Compound Finance, giving us a deep understanding of how to bridge RWA tokens into DeFi protocols.

Problem Statement

Launching an on-chain RWA product is expensive, time-consuming, and requires expertise across many verticals. High fixed costs (USD 150–250 K per iteration) leave little room for experimentation, preventing new teams from bringing different assets on-chain.

Many protocols offer token-creation tools, but that is only the simplest part. The real burden lies in regulation, compliance, banking, custody, and partnership setups.

Burden of Regulation and Compliance

RWA products face similar or greater regulatory complexity than traditional finance:

- Negotiating custody agreements for digital asset safekeeping

- Finding crypto-friendly banks for on-ramps and off-ramps

- Complying with securities laws when structuring offerings

By templatizing these processes, we remove redundant work. RWA teams can then focus on asset selection, growth strategies, and DeFi integrations.

Solution

We will build a ready-to-use framework that anyone can plug into for launching real-world assets on-chain. First, we create a set of legal and technical templates for common fund structures. These templates include entity formation, bank and custody agreements, and smart-contract code. Teams only need to choose their asset and fill in a few details. This approach cuts setup time from months to weeks and reduces cost by over 90%.

Next, we provide a one-stop dashboard for managing all steps in one place. From document signing to token issuance and DeFi integrations, everything happens in a single interface. We also offer guided support for compliance and growth strategy, so teams can focus on their asset instead of recreating the wheel.

Key benefits:

- Fast launch: Go from idea to live token in weeks, not months.

- Lower cost: Standardized templates save >90% of upfront fees.

- Easy growth: Built-in DeFi hooks and partner network to help you reach investors.

- Full compliance: Pre-approved legal and banking modules for major jurisdictions.

With this solution, any asset manager or developer can bring new RWAs on-chain quickly, affordably, and securely.

Growth Challenges

Because most RWAs are treated as securities, their investor audience is limited compared to DeFi tokens, which flow freely. Every team must build bespoke structures compliant with securities laws while still offering innovation and flexibility.

Opportunities

On-Chain RWA Yield

Even with high interest rates, the average USDC rate on Aave is only 5.47%, and Aave holds nearly 50 % of on-chain DeFi TVL. Many RWA products offer double-digit yields or dividends over 5 %. Bringing these on-chain would attract strong demand, boost overall DeFi yields, and draw external capital into the ecosystem.

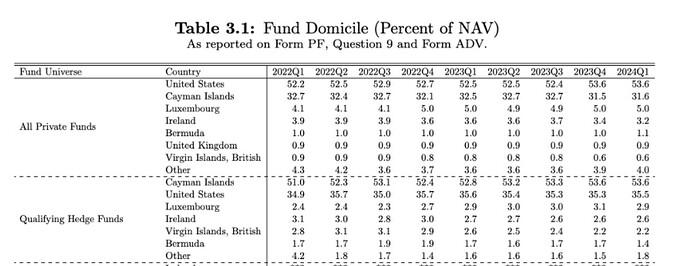

TradFi Shift into Alternatives

Assets under management in non-public markets surged ~67 % from USD 10 T to USD 16.7 T over the past five years, driven by high equity valuations (S&P 500 at 28× P/E) and low bond yields. By tokenizing RWAs on-chain, KoalaGains will unlock on-demand liquidity, deliver real-time, auditable reporting, and slash operational costs—activating idle capital and meeting traditional investors’ hunger for yield.

Role of Gnosis

Layer-2 solutions like Arbitrum Orbit and Optimism’s Superchain enable custom blockchains. Many other L2s subsidize gas, making transactions free or low-cost. As a core layer of financial infrastructure, Gnosis can provide more than technology:

- Collaborate on standardized, scalable fund blueprints

- Pilot the first 5–10 on-chain RWA assets as templates for future builders

Together, DoDAO and Gnosis will accelerate RWA adoption, enabling projects to launch securely, affordably, and at scale.