Amidst the bear market, Karpatkey’s team is looking for ways to respond to new GIP’s solicitation of funds while looking after the treasury’s health.

Here’s our post on Medium

Amidst the bear market, Karpatkey’s team is looking for ways to respond to new GIP’s solicitation of funds while looking after the treasury’s health.

Here’s our post on Medium

Your first listed objective is:

"Steward a healthy DeFi ecosystem to act as the backbone of the Gnosis Chain for mass adoption applications”

With that in mind I don’t get the logic for GnosisDAO to scoop up the very same GNO rewards that are supposed to incentivize adoption for itself.

So I don’t see anything wrong with Option 1:

Provide stablecoins by removing liquidity from the Gnosis Chain.

Curve for example is a time tested protocol that will always attract capital organically until an equilibrium dictated by the market is found. GnosisDao’s $8m in Curve (10% of total) only reduces the number of accounts that might travel to Gnosischain for stablecoin APY glory and stay. Good riddance.

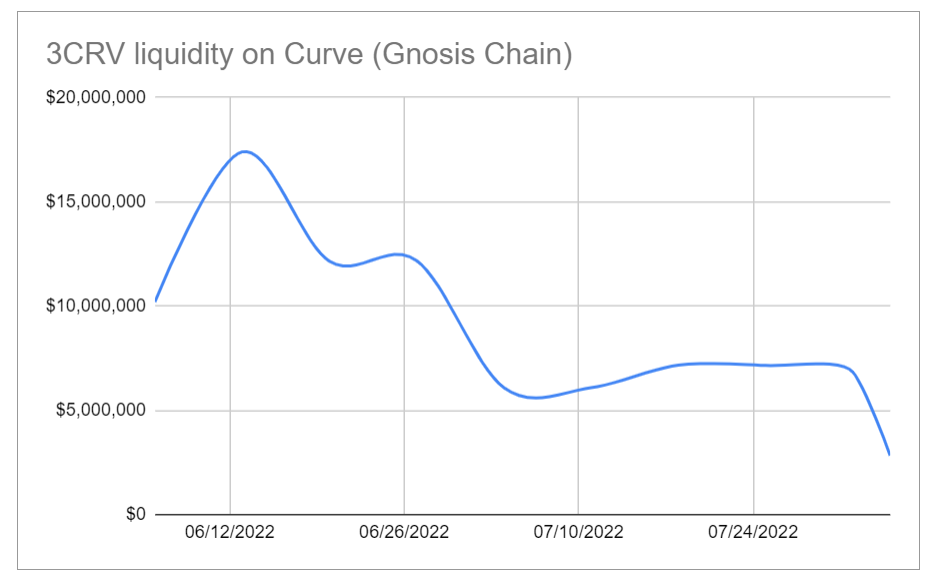

You have a point there, and actually we’ve been choosing option 1 to fund new GIPs since the date of the post’s numbers (July 11th 2022). However, 2 months ago, the GNO distribution process had issues on Curve during the changes in the contracts, so rewards and therefore liquidity went to almost zero. At that moment, the treasury added $17m in stablecoins.

This amount has been reduced to $2.8m by last Tuesday (less than 3.3% of the current pool’s TVL). The expected target is 0 stablecoins on Curve, but we’ll keep strategic stablecoins liquidity in the Gnosis Chain on other protocols.

Numbers in the post are a little bit outdated now. As we mentioned there, note that the treasury’s composition changes weekly.

Thanks for the post! Good to know what Karpatkey is trying to do

Some comments:

Is Karpatkey also considering staking more GNO, with own validators or in protocols like stakewise? This would help the Gnosis chain in decentralization and would get yield on the asset.

With the liquidation bots working, is the risk of liquidation down to 0? And so possible to borrow more stablecoins to fund GIPs? I would say the best way to fund proposals is stablecoins because they dont have to care for fluctuations in price. Bonuses could be given in GNO (paid in the staking rewards from point 1)

We could also choose for an option where projects that want to be funded get an amount of GNO they have to use for validating/staking. After certain time or when they meet certain criteria they can withdraw the amount and do whatever they want.

GnosisDAO supports projects like DappNode and Stakewise. It incentivizes the community to develop their own validators with GNO incentives.

In the case of Stakewise, GnosisDAO provided GNO and sGNO liquidity. However, we are not looking for generating yield or increasing processing capacity.

We are working together with the Zodiac team to rely on more robust technology to let the collateral ratio decrease while keeping funds secure.

However, anti-liquidation bots could never operate without available funds. This development will enable us to generate additional revenues, given a larger number of carry trade opportunities we could take advantage of, increasing capital efficiency. But taking a large amount of additional debt could be even riskier than today.

These are options that each team could suggest in their proposals.

Great idea. Yes, new GIPs should “Include a detailed expenditure plan showing a GANTT chart with milestones.”

Currently there is no accountability.

The GIP-38 grant was massive. No updates have been given to GnonsisDAO/GNO token holders on the progress of GIP-38.

I think GnosisDAO should request updates from every grant recipient to date. I don’t think it’s too much to ask.

Hi there, I am new on the forum, but have followed Gnosis since the ICO days. Recently Gnosis’ treasury and its successful management has come more to the spotlight.

Is Karpatkey a group that originated within the Gnosis community? And if not, could someone link me to how they started with being acknowledged as managers. As a DAOist, treasury management is high up my interest list.

@_Memo

Hi Zeb! Actually yes, Karpatkey started as a Gnosis spinoff and now it is an independent DAO.