TLDR:

Gnosis Impact calculation is currently based on Omen markets.

Those markets primarily ask the question whether or not the decision will be voted for. Through comparing the different prices of the same market with different collateral (e.g. GNO and DAI) the implied impact can be calculated. Also traders can through a combination of trades enter into a “conditional investment” position. More here and here.

The issue is that a liquidity provider (e.g. GnosisDAO) that keeps the liquidity in the market will lose all money since once it becomes clear how the vote will turn out traders will buy all the winning tokens.

For a project like Gnosis with a market cap of ~$50 - 100m a meaningful signal market signal should at the very least involve $100k+. To enable those trades the Omen market would need to be funded with a multiplier of that which would be totally unreasonable since it would mean that this amount (e.g. $500k) would be lost/paid for decision making by the DAO.

Luckily there is a solution to how the GnosisDAO (or really anyone) can provide meaningful liquidity (enabling $100k+ trades) without taking enormous market maker risks.

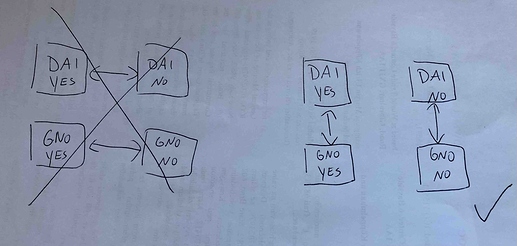

The solution is to not do the market making of GNOyes ↔ GNONo and DAIyes ↔ DAIno (where always one side will go towards 0 and thus the market maker facing permanent “impermanent loss”) but instead do: GNOyes ↔ DAIyes and GNOno ↔ DAIno. Here for one side, BOTH tokens will, in the end, be worth 0 and thus not suffer from any impermanent loss while the other side will turn into a DAI<->GNO market where you just face the much smaller regular market-making risk.

To offer those markets there are different technical paths to go forward.

a) use the AMM used by Omen.

This was created by Gnosis. It uses the same math as balancer (constant product market maker) but it supports natively ERC1155 tokens. This allows trading to be more gas efficient. Unfortunately, 1155 is not widely supported at all - so those markets have far less visibility.

We already have the infrastructure to wrap ERC1155 into ERC20. This allows to use all the standard AMMS.

b) Uniswap

Clearly the largest userbase. However - those tokens would get very little visibility on https://uniswap.exchange/ because by default they would not be listed anywhere. Since those tokens are only temporary in use (e.g. during a 1-2 week voting period) it might be an uphill battle to try to get them into all the lists used by Unsiwap.

c) Sushiswap

In principal Sushiswap has fewer organic users and a fee that goes to Sushiswap holders which are both arguments against Sushiwap compared to Uniswap. On the other hand, the community seems very interested in experiments around decentralized governance and token incentives. So potentially a collaboration is possible.

d) Mooniswap

If we those more specialized markets to move more (regularly price jumps of a few %) - Mooniswap slightly changed rules could be interesting since they protect/favor LPs.

e) Balancer

Balancer is currently the only platform with a liquidity mining program eligible for GNO. This is why balancer currently has the best ETH/GNO liquidity. Potentially there are also ways to leverage the ability to have more the 2 tokens per pool but for the concrete use-case I am describing here it is actually important to not have all tokens in the same pool. (would otherwise cause the permant IL problem again)

One bonus of balancer is the ability to chose a fee (and not use the fixed 0.3%)

f) dxSwap/ SwaprEth

Gnosis and dxDAO have already a history of successful collaborations. Swapr is another Uniswap fork developed by dxDAO. The primary argument would be to work with dxDAO again - potentially, however, the feature to set custom fees could also be useful.

Midterm Gnosis Protocol v.2 is meant to be a layer on top of all those solutions. Liquidity can be in all those market makers but traders could submit orders as a GP order and it would be matched against whatever liquidity is currently best. More about GP v.2 here.