GIP-120: Should GnosisDAO acquire Headquarters (HQ.xyz) to Accelerate Gnosis 3.0

- In Favour

- Against

GIP: GIP-120

title: Should GnosisDAO acquire Headquarters (HQ.xyz) to Accelerate Gnosis 3.0

author: Co-founders of HQ.xyz: Sharon Paul @0xRoney & Sunny Singh @Sunny-HQ

status: Phase 2

type: Funding

created: 2024-12-24

duration: Effective starting from the date of GnosisDAO approval

funding: Upfront: 11,422 GNO + 926,263 SAFE

Deferred over 2 years: 18,769 GNO + 1,457,505 + USD 6M reserved as working capital

Deferred over 4 years: 5,040 GNO + 380,000 SAFE

Deferred based on Performance: 20,160 GNO + 1,520,000 SAFE

Update

Please note that this proposal has been revised. Kindly refer to the following link for the latest proposal: GIP-120 (revised): Should GnosisDAO acquire Headquarters (HQ.xyz) to Accelerate Gnosis 3.0

1. Abstract

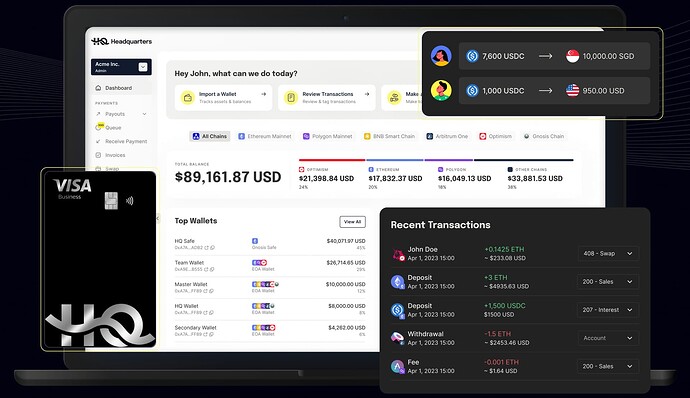

Gnosis 3.0’s vision (recap here) to revolutionize payments takes a leap forward with the proposed acquisition of Headquarters (HQ.xyz), an onchain business account. Established in 2022, HQ.xyz has emerged as the leading Onchain Business Account, seamlessly bridging digital assets and traditional finance while maintaining complete self-custody of funds.

Through this acquisition, HQ.xyz will be rebranded as Gnosis HQ, joining the ecosystem alongside Gnosis Chain, Gnosis Pay, Safe, CoW Swap, and Karpatkey. This move signals Gnosis’ expansion into business applications whilst solidifying Gnosis Chain as the leading decentralized payments network. This union represents more than an integration; it is a merger of shared vision and complementary expertise. By aligning resources, roadmaps, and expanding into key markets, this partnership positions the combined entity as the Financial OS for the Open Money Generation. Together, we will accelerate Gnosis’ ambitious vision to pioneer a payments network that is truly open, global, and autonomous.

2. Specification

This proposal seeks a full acquisition of HQ.xyz by Gnosis, with an equity to token swap structure, using both $GNO and $SAFE from Gnosis DAO’s treasury, with working capital injection for the new post-acquisition entity. The total budget and funding milestones are elaborated under 4. Budget and 5. Milestones.

3. Rationale

To all fellow token holders of Gnosis, as a believer in Gnosis and Gnosis 3.0, you are part of a generation that believes money should be open, it should be self-sovereign and it should be autonomous - i.e. For money to be easily moved to anywhere in the world, without unwarranted control by others. Money, like water, should exist in multiple forms and be easily accessible.

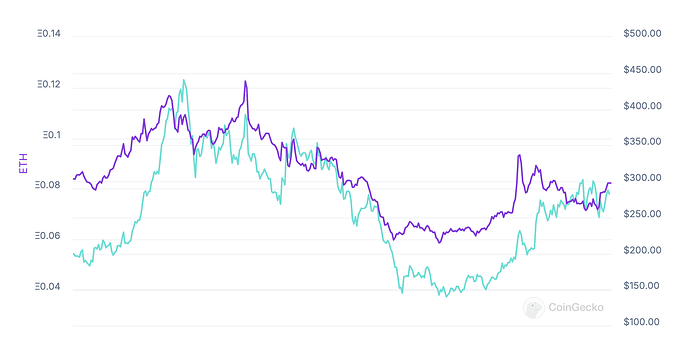

We are living in the Open Money Generation, and at Headquarters, we have been deeply committed to this and remain so. This year marked a turning point for stablecoins, as they transitioned from crypto experiments to mainstream financial tools. Landmark deals like the following happened all within this year:

- VISA reports that stablecoins have now surpassed USD 3 trillion in global transaction volumes (source: Transactions | Visa Onchain Analytics Dashboard)

- Major FinTech players making needle moving moves: PayPal launching $PYUSD & Stripe reportedly acquiring stablecoin orchestrator, Bridge, for $1 billion

- Regulatory clarity is also emerging in key jurisdictions, including Singapore’s Payment Services Act and Europe’s MiCA framework.

3.1. Gnosis HQ: Pioneering Decentralized Business Banking

Despite the rapid progress of stablecoins in recent years, a glaring gap remains. Most innovations in stablecoins and self-custodial wallets are designed primarily for consumers or large institutions, leaving businesses—the very builders of the onchain economy—underserved. Web3 teams often encounter:

- Banking chokepoints: Traditional banks and FinTech platforms frequently impose barriers, making it difficult for businesses to access seamless financial services. Read more.

- Compromised solutions: Businesses are forced to rely on personal accounts or custodial services, undermining the core Web3 principle of financial self-sovereignty.

Gnosis HQ aims to bridge this gap, empowering businesses with decentralized, self-custodial financial solutions that align with the ethos of Web3 and support the builders of the onchain economy.

Over the past two years, HQ.xyz has been relentlessly creating a Business Account that operates on self-custodial rails without compromising user experience. With its intuitive interface and unwavering commitment to self-custody, HQ.xyz enables businesses to operate with efficiency while retaining full control of their funds—securely held until the moment one makes payment. From using stablecoins for payroll deposits directly into employees’ bank accounts, to paying bills with a VISA debit card linked to their Safe Account, HQ.xyz has made true on-chain, self-custodial finance a reality for businesses.

This vision extends beyond Web3-native builders, aiming to serve the wider business community with decentralized finance tools. By joining the Gnosis ecosystem, HQ.xyz will bolster Gnosis 3.0’s focus on payments, creating a self-sovereign banking solution that supports money in all forms—on-chain, online, and offline. This synergy will enable businesses to adopt decentralized financial tools that are accessible, efficient, and most importantly, community-owned.

3.2. Gnosis & HQ.xyz’s shared conviction on self-custodial banking

Since day one, we have embraced technologies from the Gnosis family, including Safe as our preferred wallet for teams and CoW Swap as our go-to DEX for swaps. This shared foundation of products, coupled with our deeply aligned visions, gives us unwavering confidence that the HQ.xyz and Gnosis teams will collaborate seamlessly and hit the ground running with speed.

With HQ.xyz being part of Gnosis, we look forward to working closely with Gnosis’ ecosystem to create the best possible business banking experience. Imagine a future where businesses use Gnosis HQ to:

- Collect payments directly into their Safe accounts

- Payroll paid using stablecoins, on Gnosis Chain, and effortlessly deposited as fiat into employees’ bank accounts

- Treasury assets swapped seamlessly on CoWSwap.

- AI agents assigned and managing spend with Gnosis HQ Cards

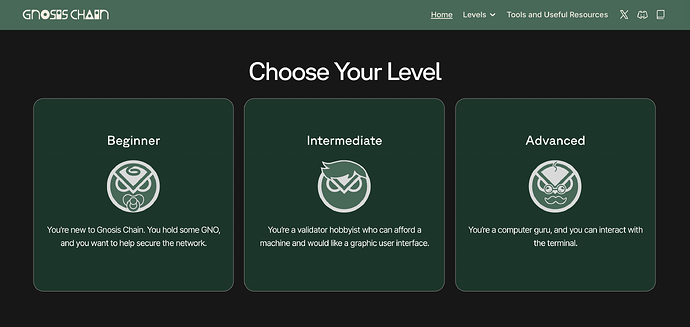

3.3. Expanding Beyond Business Banking to Accelerate Gnosis Chain as the Decentralized Payments Network

The proposed Gnosis HQ unit represents a bold leap forward, extending beyond business banking to champion the adoption of Gnosis Chain as the decentralized payments network for our generation. Gnosis already has all the critical components to lead this transformation, creating a payments network that is:

- Globally accessible

- Capable of supporting money in any form, from on-chain to off-chain

- Fundamentally decentralized, rewarding individual validators instead of central entities

Imagine a world where every payment transaction benefits everyone involved:

- Customers and merchants earn transaction fees, not centralized payment gateways.

- Any device—from laptops and mobile phones to a shop’s POS terminal—acts as a validator, earning rewards for maintaining the payments network.

This is the promise of Gnosis HQ: To bring back the original vision of crypto as decentralized financial rails. Picture decentralized versions of today’s payment giants—Stripe, Shopify, and PayPal—where control is no longer concentrated in the hands of a few centralized entities. Payments are no longer monopolized; infrastructure, data, and earnings are distributed equitably. In this decentralized world, participants are rewarded for their contributions, creating a fair and open financial system for everyone.

3.4. HQ.xyz Brings New Capabilities and Global Expansion

In addition to technological synergies, the team of HQ.xyz brings unique strengths to Gnosis:

-

Stablecoin expertise: HQ.xyz’s CEO, Sharon, was a founding member of StraitsX.com - Singapore’s leading stablecoin issuer. During her time, she joined the team at the whitepaper stage for the Singapore-dollar stablecoin, $XSGD and led all go-to-market initiatives as well as discussions with regulators to ensure a strong launch back in 2019-2020. She was also heavily involved in expanding the team for growth phase as the stablecoin entered DeFi summer back in 2021. This gave her front row seats in growing the adoption of stablecoins, as well as first-hand experience in being in the driving seat to bridge both traditional financial markets with onchain finance.

-

Asia Market Entry: HQ.xyz’s leadership has over a decade of experience spanning across the tech startup, fintech, and Web3 ecosystems in Asia, especially in Southeast Asia. This expertise positions HQ.xyz to spearhead Gnosis’ expansion into Asia, a critical battleground for Web3 adoption. With HQ.xyz being their second and third startup respectively, both Sharon and Sunny have the experience of building 0 to 1 stage in Asia. as well as joining high-growth teams entering from seed to Series B growth stages. More on their profiles: linkedin.com/in/sharonlourdes/ and linkedin.com/in/sstrgh/

-

Navigating regulatory landscape: HQ.xyz operates under a temporary licensing exemption allowing it to provide certain digital payment token (DPT) services under Singapore’s Payment Services Act and has applied to the Monetary Authority of Singapore for a licence to provide DPT and fiat currency-related services. Operating within one of the world’s most stringent and respected financial jurisdictions, this licensing application underscores HQ.xyz’s commitment to operating in accordance with stringent regulatory requirements and illustrates its credibility as a trusted player in the onchain financial space. Under the leadership of Sharon, HQ.xyz’s CEO, leveraging off her former experience as founding member and Payments Lead at StraitsX, the company strikes a thoughtful balance between preserving the onchain ethos and navigating fast-evolving payment and finance regulations. This positioning not only instills confidence in HQ.xyz’s commitment to integrity but also creates a competitive moat, ensuring sustained growth in a highly regulated and competitive environment.

4. Budget

The proposed full acquisition of HQ.xyz by Gnosis will be structured as an equity-to-token swap, utilizing both $GNO and $SAFE tokens from the GnosisDAO treasury. The inclusion of $SAFE tokens reflects the strategic alignment of Gnosis HQ’s initiatives with Safe Account and the upcoming SafeNet ecosystem.

| Allocation | GNO | SAFE |

|---|---|---|

| Upfront: | 11,422 | 926,263 |

| HQ.xyz Founders | 9,599 | 785,334 |

| HQ.xyz Team | 1,564 | 121,393 |

| HQ.xyz Investors & Advisors* | 259 | 19,536 |

| Deferred: Over 2 years | ||

| HQ.xyz Investors & Advisors* | 18,769 | 1,457,505 |

| Deferred: Over 4 years | ||

| HQ.xyz Founders | 5,040 | 380,000 |

| Deferred: Performance-based | ||

| HQ.xyz Founders | 20,160 | 1,520,000 |

*For list of Investors, please read section 6.2 Investors.

In addition, the proposal requests a working capital injection of USD 6 million, allocated for at least next two years. These funds will be disbursed in installments at regular intervals, with the specific schedule to be determined upon approval of the proposal. The working capital is intended largely for payroll of team spanning across GTM, Compliance and Legal, Product, and Engineering.

5. Milestones

If you have read this far, we thank you and hope that you are as excited as we are about what the future holds for the Gnosis Ecosystem! Below we have a series of tactical activities that Gnosis HQ will be conducting to unlock business use cases for Gnosis and its Ecosystem

This roadmap positions Gnosis HQ as the cornerstone of Gnosis’ ecosystem, integrating business banking with cutting-edge financial technologies and decentralized infrastructure. Together, these milestones will establish Gnosis as the Financial OS for the Open Money Generation, bridging traditional and onchain economies while fostering innovation and adoption on a global scale.

Phase 1: Launch and Establish Gnosis HQ (Q1 2025)

1. Launch Gnosis HQ

- Rebrand HQ.xyz to Gnosis HQ, establishing it as the essential business platform for the onchain economy.

- Gnosis HQ Visa Corporate Cards: Meet the business version of our favourite. Simply tap, swipe or key in your card details - to spend your funds, kept safely with you at all times in your self-custodial Safe accounts, with over 300 million merchants worldwide.

2. Core Business Neobank features

- End-to-end on-chain Invoicing - Enabling teams to issue and get paid easily on-chain and off-ramp if needed

- Gnosis HQ Collect - Enabling teams to collect digital revenue via payment links i.e. Stripe for Crypto

- HQ Crypto Accounting Suite - The team is working hard at launching the world’s first accrual based crypto accounting system.

Phase 2: Growth Phase for Gnosis HQ (Q2-Q3 2025)

1. Robust regulatory standing

- Seek and complete the full licensing application with the Monetary Authority of Singapore

- Integration of Gnosis and Gnosis Pay’s regulatory presence in Europe and LATAM for Gnosis HQ

- Strengthen the compliance framework to meet regulatory requirements

- Expand regulatory presence across key jurisdictions to create a competitive moat for sustained growth.

- Enhance compliance features within Gnosis HQ’s application with license-compliant infrastructure and regulatory-aligned updates

2. Drive Gnosis Expansion in Asia

- Leverage the Singapore-based team to lead market penetration in Asia

- Support regional expansion of Gnosis products, including Safe and CoW Swap

- Forge strategic partnerships with local players and establish developer communities across key Asian markets

3. Expanding into DeFi & Privacy

- Bridging Support : Allowing teams to seamlessly bridge assets across chains

- Defi Integrations: Allowing teams to participate in Defi yield opportunities with idle capital

- Support for Confidential Transfers: Experimenting with upcoming technologies like FHE & KYB Compliant Privacy Pools that would allow us to support confidential transactions.

4. Launch of Gnosis Enterprise Suite

- Gnosis’s technology stack is composable enough to be used even by enterprise customers for their own internal infrastructure. We’ll be working with the Gnosis portfolio team to identify key enterprise clients and work towards winning them as clients of solutions like Safe, Gelato, CoWSwap and services like Karpatkey

- Debit card protocol - So that Web2 card issuers would be able offer debit card facilities by bootstrapping its services on top of self-custody wallets

- Gnosis HQ Mobile Platform - Launch a Mobile app for teams to use HQ whilst they are on the go

Phase 3: Driving adoption of Gnosis Chain (Q3 2025 onwards)

1. Stablecoin coverage on Gnosis Chain

- Wide stablecoin coverage and deep liquidity of stablecoins on Gnosis Chain is critical to realise the vision of Gnosis Chain being the decentralised payments network

- After the launch of Gnosis HQ and expansion listed above, we will embark on the journey to get more stablecoins, both USD and non-USD denominated, natively issued on Gnosis Chain and with liquidity pools that are deep and easily accessible

- On/off-ramps connected to Gnosis Chain. To enable quick onboarding to Gnosis chain ecosystem from offchain ecosystems; integration with payment networks from Cards, local banking networks including out of the U.S. as well as alternative payment methods such as localised e-Wallets.

Phase 4: Next-Generation Payments and Banking (2026 and Beyond)

1. Validator-embedded Payment Devices

- Launching the world’s first Point-of-Sale device with built-in validator to allow any merchant to earn while a customer makes a payment - to further the dream of a decentralised payments network

2. Agentic Payments

- Agentic Payments via Cards - Letting teams create AI Agents that could analyse card spend and provide input on how to optimise them to reduce spend

- AI powered Crypto Compliance Advisor - An AI agent that can sit in a customer’s infrastructure and provide immediate feedback on how to improve their compliance adherence based on their current place of business.

With this roadmap, Gnosis HQ will not only redefine business finance but also drive Gnosis Chain’s adoption as the decentralized payments network of the future, aligning with the shared vision of creating open, global, and autonomous financial systems.

6. Team

HQ.xyz is a team of 14pax strong, led by CEO Sharon Paul and CTO Sunny Singh.

6.1. Founders

Sharon Paul, CEO; linkedin.com/in/sharonlourdes

- Expertise in fintech & payments incl. Bank transfers, Cards, e-Wallets, Stablecoins, Neobanks

- Founding member of StraitsX.com, licensed stablecoin issuer ($XSGD) and leading Web3 payments infrastructure in Asia

- Former Head of Payments, Fazz.com (parent group of StraitsX)

- Member, SGBuilders - leading Web3 grassroots community in Singapore (sgbuidl.com)

- Web3 Sub-committee, Singapore Fintech Association - affiliated to MAS

- Former co-founder Digitalfolks, a software development studio; role focused on PM and UX

- Active in crypto since early 2017; proactive in both FinTech and Web3 ecosystems (Lemniscap Capital, Open Campus/Animoca, Spencer Ventures, Pudgy Penguins, ARC Community)

Sunny Singh, CTO; linkedin.com/in/sstrgh

- Blockchain Technical Advisor, Mission Plus

- Former Tech Lead roles, a strong focus on Data Eng (SensorFlow, Traveloka, Grasshopper HFT)

- Member, FinTech CTOs

- Entrepreneur First, batch ‘2017

- Proactive in Web3 developer relations (MadLads, Anonymice, Talent@Web3)

6.2. Investors

HQ.xyz is also supported by a strong pool of angel investors and funds. This include lead investors Mass Mutual Ventures, Analog Ventures and Crypto.com, and other leading Fintech & Web3 funds including Caladan, Ocular, Coinhako, Draper Startup House, DWF Labs, FEBE Ventures, FJ Labs, LongHash Ventures, Saison Capital, 500 Startups and industry veteran as angels including founders of Safe, Nansen, Coingecko and Etherscan.

Read more about our team and investors here: Headquarters (HQ.xyz) - About us

7. Next Steps

7.1. Decision Process

We’ve published the current proposal for discussion and voting by GNO holders, following the established Gnosis governance process. Both public discussions and Snapshot voting will serve as key signals in the decision-making process.

Here’s how the approval process works:

- Phase 2: Specification (12 days) – We’re currently in this phase, where the proposal is being refined and discussed.

- Phase 3: Consensus (5 days) – After the Specification phase, the community will vote to signal final approval.

7.2. Communications Plan

Once the Snapshot voting under Phase 3 is complete and the acquisition is officially approved by GnosisDAO, we’ll make an official announcement within one month. We’ll prepare a press release to share the news widely with interested parties, ensuring that the announcement effectively communicates this milestone to the broader community and stakeholders. For any press inquiries, please contact sharon@hq.xyz or @sharonlourdes via Telegram.