GIP-34: Should Gnosis DAO support in a reimbursement plan to the Agave Community.

- Let’s do this!

- Make no changes

0 voters

GIP: 34

title: Reimburse agave users in exchange for AGVE

author: Agave DAO

status: Draft

type: Meta

created: 2022-04-02

Simple Summary

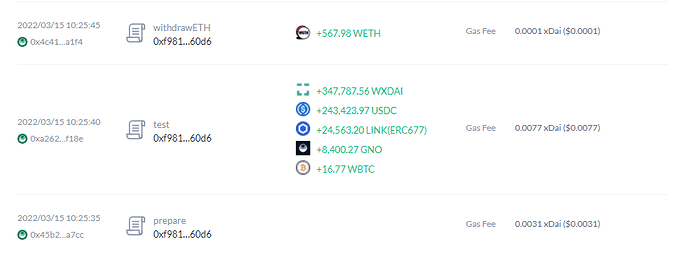

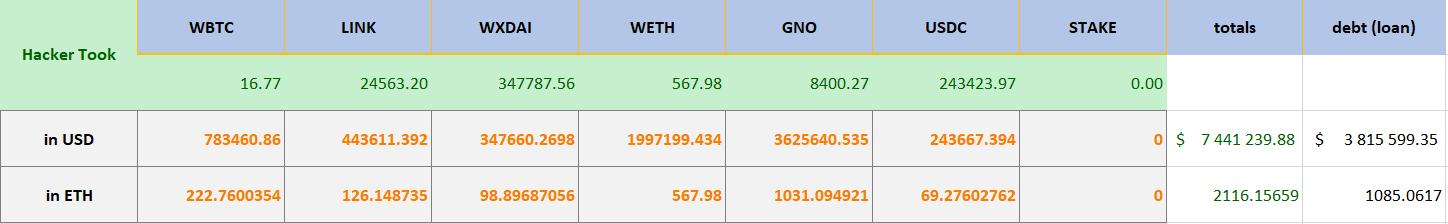

Funds Stolen from Agave during the hack:

| WBTC | LINK | WXDAI | WETH | GNO | USDC |

|---|---|---|---|---|---|

| 16.77 | 24563.20 | 347787.56 | 567.98 | 8400.27 | 243423.97 |

Reimbursement strategy:

- GnosisDAO covers the full amount of GNO lost in the hack 8400.27 GNO (roughly 50% of lost funds)

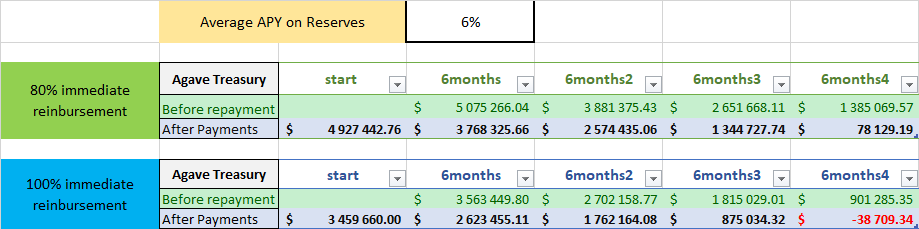

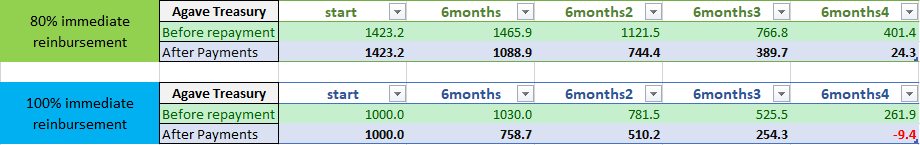

- GnosisDAO loans the remaining amount of lost funds to Agave specified above which currently ammounts to approx 3.5M USDC, in Two years, 4 biannual payments.

- Agave will use 80% of all assets to compensate users immediately and the remaining 20% will be repaid in the same timeframes as the GnosisDAO loans, in biannual installments over 2 years (4 installments). This buffer will be used to accrue interest and fees in the protocol.

- Agave DAO does a 12.5k token swap with GnosisDAO and an Open Auction of 12.5k Tokens each for the purpose of raising enough funding to repay the loan and increase TVL allocated to the protocol.

- Kapartkey DAO will be responsible for managing the acquisition of assets loaned to Agave and the co-management of the funds that are acquired by Agave during the Token Swap.

Abstract

The exploit of the lending markets on Gnosis Chain left a significant amount of users affected. Over 500 users & communities lost significant amounts of their value in the chain. Roughly 770 total addresses were affected by this hack, which was possible due to a dangerous implementation of ERC667 in old bridged tokens. We believe Gnosis should help in this process.

There is a way to resolve this but there are no prizewinners.

From a technical standpoint:

Agave understands why the exploit happened, there were discussions with multiple security experts and we know hot we can fix the CollateralManager to be safe even in the case of asset reentrancy. However, the only way to truly be sure the protocol is as safe as it’s mainnet counterparts is with the hard fork in which the implementation of the tokens gets fixed.

Agave as protocol will be redeployed:

- The reason to do this is that the current state of the protocol is corrupted beyond what could be considered a safe recovery.

- There’s no significant infrastructure that is immutably dependent on the current protocol addresses right now, the first relevant integrations were being worked on the weeks before the pause.

- Reimbursed users will be “airdropped” agTokens at their net value before the hack took place,

- Agave DAO will deposit all the other reserve assets in the Protocol across all assets.

- Incentives will be skewed more into lending in order to get lending bootstrapped as fast as possible and boost Agave and Gnosis revenue.

- STAKE will be delisted from the new deployment, must also be recovered from the old currently paused deployment, converted into GNO, and dealt with in the same way as other assets.

- Stakewise liquid staking sGNO and FOX from Shapeshift is likely to be listed directly on the new deployment

- Other provided asset configs may be reviewed and adjusted in order to maximize efficiency within safety parameters.

Future of Agave:

- The future plans for agave are a lot about building on top of the lending protocol - a vertical growth strategy sounds like a better investment given the increased amount of lending protocols coming to market. If we successfully build a product with high demand for agTokens the requirement to subsidize interest rates at the Lending Market become mostly unnecessary. All products that integrate and increase demand for agTokens are a reduction in subsidies and a boost in the revenue for every stakeholder in the protocol. The Lending market is just the foundation, it’s not Agave.

- Proceed with the liquidity mining campaign in partnership with Gnosis, which will be supported with AGVE buybacks to maintain attractive borrowing rates.

- Ability to repay loans using agTokens is a priority when it comes to protocol improvements for a significant improvement in UX. If you have collateral in an asset, you should be able to pay debt in that asset with it. (This upgrade will require an audit).

- Ability to create partnerships with deeply aligned ecosystem participants for isolated lending markets with a deep focus on the tight community of Gnosis Chain. Example: WATER DAO lending market (WATER, AGVE, HNY, TEC, FOX, GIV…), DXdao lending market (ETH, DXD, SWPR, AGVE, OMEN), Gnosis lending market(ETH, GNO, COW, AGVE, SAFE).

- Let’s leave something for later…

Security:

- Agave would like to get access to the GnosisDAO’s smart contract auditing pipeline, which will oversee protocol upgrades and external integrations.

- Agave will improve the bug bounty program that was in collaboration with 1Hive into a better model. Scoping both Web and Smart Contract applications with more attractive bounties.

From a financial standpoint

Agave requires several assets to reimburse users, here’s a breakdown of lost assets:

We believe Gnosis should cover 50% of the funds depleted during this exploit which is also by coincidence the amount stolen in GNO.

Agave does not have the means to acquire the remaining funds to reimburse users. Attempting to raise funds without diluting completely the current Agave DAO holders is impossible without key support from the Gnosis DAO. The request is for Gnosis to make a loan to Agave under the supervision of Kapartkey.

80% of the assets allocated to reimbursements shall be used to reimburse users right away, the remainder 20% should be deposited in the protocol and contribute towards the reserve accumulation of Agave, in order to make enough for both users and Gnosis to be repaid in full.

Assuming a 6% average APY in the Agave protocol across the multiple assets for the next 2 years, without this 20% buffer the protocol won’t be able to build enough to cover the loan assuming no other sources of income.

In ETH:

This figure already takes into consideration a successful injection of capital into Agave via the token swap and the open auction. It also doesn’t take into account operational costs of the DAO which should however be incurred in AGVE tokens or incoming revenue from other sources. Worst case scenario Gnosis got a majority share in the most popular lending market in Gnosis Chain and reimbursed all users (which btw includes Gnosis itself) at the total cost of roughly 1600 ETH or 5M USD. The funds lost are still outstanding and the value is changing with the market until repaid, at today’s prices 2120 ETH or 7.4M USD.

The Token Swap and Auction are then absolutely key for the success of this plan. We fixed the price at 0.04 ETH per AGVE in our Excel model, due to making the target amount raised exactly 1000 ETH. If we lower the swap price, then either the Average APY has to go up significantly, especially in the first semester which will be the most important, or we will possibly fall down into a debt trap. Lowering the share of the user reimbursement is out of the discussion. If we can’t make it right in the community, Agave has lost its way.

Agave has been contacted about interested parties in bidding on the open auction… it’s impossible to tell how much is the effective commitment to any price. However, there’s definitely demand from groups with the funding capacity to both cover the full extent of the auction or to negotiate an exit of Gnosis DAO from their position in Agave in the future. The price may seem like a high premium on market price but it only takes just a few eth to slip $AGVE price several %. In regards to the otc swap rate, the market depth is too shallow to buy a significant share of Agave in the open market when 35% of supply is currently staked, 15% is owned by 1Hive as seed, 15% scattered around in LP positions. After the auction all of these holdings will get diluted by 50%. There’s no real arbitrage to be made by AGAVE holders since both the OTC and the Auction are segregated markets and large investors are not going to buy a large position to dump days later.

Motivation

The motivation for this proposal is to make sure the Agave community and affected GC users are reimbursed at the end of this operation and that the community and protocol can continue the journey that started one year ago. We believe it is critical for the chain to make sure a significant amount of the long-term builders, supporters, and communities in the chain are restored on their losses as much as possible.

For example, 1hive lost all of the rewards accumulated as a long-standing validator of the xDAI chain, multiple 1hive and DAO builders lost a significant amount of their piggy bank, and Kapartkey lost a sizeable amount in varied assets.

A large percentage of the lost funds is from users that either has been users from Gnosis Chain for a long time or came specifically to use Agave in the last 3-4 months period. There’s long-standing ties with 1Hive, DXdao, Symmetric, DaoHaus, Shapeshift, Giveth, TEC, and so many other grassroots communities that make Gnosis Chain the only genuine DAO chain. We don’t think Gnosis should invest in communities seeking to extract value from the chain, rather than in the people building which made this chain investable in the first place. If the community is to be seen as expendable we should ask why didn’t Gnosis start a new chain?

Specification

-

AGAVE will execute an OTC token swap with Gnosis DAO of 12500 AGVE at 0.31GNO per AGVE. Which may be executed in GNO or ETH at the discretion of Kapartkey DAO.

-

AGAVE will initiate the Gnosis Auction with 12500 AGVE at the minimum bidding price of 0.036 ETH. Kapartkey executes a minimum bid on all tokens.

-

Timeframe for the execution: Q2 2022 - before hard-fork.

-

After AGAVE is ready to operate we will work with Kapartkey to make the deposits in the protocol and distribute the agTokens to the users.

Specific amounts per token:

| WBTC | LINK | WXDAI | WETH | GNO | USDC |

|---|---|---|---|---|---|

| 16.77 | 24563.20 | 347787.56 | 567.98 | 8400.27 | 243423.97 |

- 8400.27 GNO is the portion of the reimbursement from Gnosis DAO.

- The remaining assets are a loan to Agave DAO at the USDC value of those assets in the moment of the tx to Agave.

- AGVE token buybacks: Gnosis DAO Treasury does AGVE buybacks in the open market to target attractive borrowing rates on Agave.

Rationale

The rationale is pretty straightforward. Agave and Gnosis should do all they can to keep this tight community excited to work together and excited to speed run adoption with the help of Gnosis and new investors. Agave as a team will be laser-focused on increasing network effects and integrations of Agave across the GC Defi space beyond what we have already been. Agave will effectively be safer after this event and an entrust of Gnosis in the Agave Platform will be seen positively across the space.

Agave does not see an explicit conflict of interest for Gnosis with other lending platforms, Gnosis wins by bridging as much liquidity to Gnosis Chain as possible, so does Agave. Competition between lending markets should make the fight for better rates more fierce and to an extent, the plan of Agave to achieve that with the least subsidies as possible is a challenge even more interesting of undertaking. In case this isn’t clear enough… Agave loves Aave, that’s why we forked it rather than other options when literally nothing was out here.

Implementation

The implementation will be handled and executed in close collaboration with Kapartkey and the Gnosis DAO contributors.