GIP-6: Deploy Gnosis Auction

- Let’s do this!

- Make no changes

0 voters

GIP: 6

title: Deploy Gnosis Auction

author: auction_master

status: Phase 3

type: Meta

created: 2021-02-11

Update (19/02/2021)

According to GnosisDAO’s governance process I promote this proposal to the consensus phase (Phase 3).

Voting is available here

A link to the audit report for Gnosis Auction smart contracts was added to the Implementation section of this proposal.

Simple Summary

This GIP intends to answer the question: Should GnosisDAO deploy GnosisAuction?

Abstract

This is the phase-II continuation to Should GnosisDAO build an IDO specific Dapp?

GnosisAuction would build on the proven success with token sales that Gnosis Protocol (GP) v1 (Mesa) had. It will provide a sturdy mechanism that supports fair price finding in token sales. It will also aim to be modular enough to work in other scenarios where auctions are needed.

Motivation

Gnosis Protocol v1 was successful with multiple token sales, including some high profile ones such as mStable and API3. Nonetheless, the protocol was not developed with this specific use-case in mind. Additionally, after hitting the market, many users suggested multiple improvements.

Some of the suggested improvements included:

- Making the UX more simple

- Reducing the number of transactions required to trade

- Improve gas efficiency

- Reduce attack vectors

Though these improvements are being addressed in the development of Gnosis Protocol v2 (GPv2), it still plans to be a DEX that is not aimed at token sales and other kinds of auctions. Thus, it is important to address this segment of the market that has proven demand.

GnosisAuction still takes some of the most important benefits from GPv1, out of which the following two stand out:

- Single closing price per auction, which is the fairest price-finding mechanism

- MEV resistance, which prevents miners and frontrunners from extracting value

Finally, it is important to note that there is no general auction smart contract ready to use in the market. Some of the use-cases that the contract could also be used for include:

- Auctions to repay debt on shortfall events of lending protocols like AAVE

- Liquidations

- Token buy backs

- Price discovery for all sorts of assets

Specification

GnosisAuction may be used as a tool by anyone hoping to auction off a predefined amount of tokens. Anyone can bid to buy these tokens by placing a buy-order with a specified limit price during the whole bidding time, subject to any potential customisations/restrictions placed by the auctioneer. At the end of the predefined auction time, the final price is calculated by the following method: The buy volumes from the highest bids are getting added up until this sum reaches the initial sell volume. The limit price of the bid that increases the overall buy volume to the initial sell volume is setting the uniform clearing price. All bids with a higher price will be settled and traded against the initial sell volume with the clearing price. All bids with a lower price will not be considered for the settlement and users will be able to withdraw their committed funds.

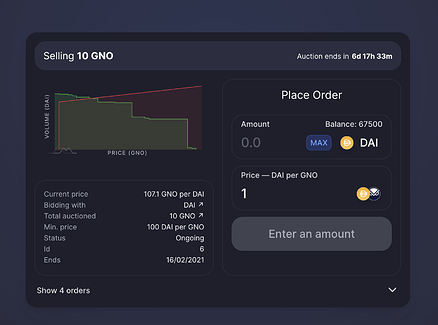

Gnosis auction will initially have a simple UI so buyers can place their bids. A draft of the interface can be seen below, which will aim to use the gnosis-auction.eth domain.

At first, auctioneers (sellers) will have to interact directly with the code in order to run an auction. Nonetheless, simple, yet comprehensive documentation will be written to make this easy for sellers to set up. Subject to legal considerations, eventually an auctioneer interface may be built.

Rationale

As stated above, GnosisAuction is a software tool to cater primarily to those hoping to conduct IDOs, which are currently an underserved market. GPv1 was not aimed at fulfilling this market, and GPv2 is geared towards being a DEX-aggregator/general purpose DEX.

Regarding other models considered, batch auctions were preferred over Dutch Auctions mainly because:

- Dutch Auctions have high activity near the end, high gas prices or other infrastructure issues could be fatal on a critical event as a token sale or shortfall event

- DutchAuctions calculate their price based on blocktime, which makes it hard to predict

- Dutch Auctions cause a gas war near the end of the auction, causing competition based on gas bidding instead of the limit price set buy buyers of the auction

- On Dutch Auctions, bidders need to wait until the auction price reaches the maximum amount that they are willing to pay, or else they risk paying more than they wanted. With this implementation, users can set their limit price (maximum amount they are willing to pay) from the start, and never pay more than what they determine.

Implementation

The specific information on the contract can be followed up in this repository.

The audit report can be found here