@Rafa can we make a tracking in case of this proposal passes and see its influence on a 1-2-3 months period?

Sure, the idea is to see what happens after it is live for 1 month, and decide what goes on based on trading activity around the pair.

But can we react after 1 month. E.g. if we need to create a new proposal to stop this incentive in case it doesn’t produce the expected result, this would take some time. So should we define clearly the expected results and what to do when they are not met.

I think it is important to let the proposal run for a full month or else we don’t see the effects of doing so (it is a very small time sample if we do it for shorter time).

I am also comfortable with having an on-forum discussion of published results to discuss the impact and if we should followup with similar programs.

the reward will be reduced to 700 GNO paid out throughout one month

Ahh I missed that in the update post. I think it would make sense to somehow add the updated proposal details to the initial post (e.g. as an edit).

and yes I agree that 1 month is a reasonable time and there is no need to cut this shorter (I was still thinking about the 60 days originally proposed)

I can see that this is looking like it may go through, but it might be worth noting that the sushi farming is already well underway (around month already) meaning that the combined incentive may not overlap much if this isn’t moved into the final voting stage soon. Of course, its probably fine to have the GNO incentive occur later, but we may want to consider that users might leave the pool after the sushi farming is over if this hasn’t already come into effect.

I am currently waiting on an update from the Sushi team, which is building a script to help external projects track the addresses that staked the LP tokens to receive Sushi rewards.

This will in turn make a Merkele airdrop easier to execute for Gnosis, given that depositing the tokens directly to the LP contract can have some negative repercussions on the price of the pair and can also be gamed.

Once we have that, it should be ready to move to the next phase. Regarding the overlap, in case this proposal hasn’t gone through, we can still chat with the team on possible extensions to make sure there is a double reward.

I am happy to share a new update on this proposal!

Thanks to the help of @bh2smith, we now have a DuneQuery that can let the DAO effectively track the addresses that staked GNO<>ETH LP tokens on the MasterChefSushi contact.

This will enable the DAO to distribute the GNO reward via the SafeAirdrop app, and avoid using the suggested “deposit directly to LP contract” method. This will avoid:

- Price depreciation for GNO on the LP pair

- Eliminate people that only deposit to frontrun before the reward is distributed (not real LPs)

Details of the reward

- 700 GNO will be distributed to GNO<>SUSHI LP providers that stake their token on the MasterChef LP Staking Pool (0xc2edad668740f1aa35e4d8f227fb8e17dca888cd) for one month

- The elegible period for the reward will start on 0:00 (GMT) of the following day in which the proposal has passed phase III, and will end 30 days later

- After the period has concluded, the Gnosis DAO will use the SafeAirdropApp to distribute the tokens to all eleigible addresses

- A post-factual post on forum will show the impacts of this proposal and start a discussion regarding possible repetitions in the future

A final side note, I will hold on moving this to Phase III until the current active proposal is passed to a) have more attention from voters and b) possibly have a simpler phase III for future DAO proposals

This proposal is now on phase-III and live for voting.

Please vote! https://snapshot.page/#/gnosis.eth/proposal/QmdbLM9oRMZcKeK7AXR2xkLvSwV6mvCy9y5xP5BDYKEcEW

I’m on the fence for this one. On one hand, definitely will bring more attention to GNO and will attract more GNO holders (in the short term at least). On the other hand, I still have doubts about the long term effects even though 700 GNO might not be as significant to the DAO. I think in order to develop longer term cooperation, I would rather have 700 GNO being sold to the Sushi community/DAO at a discount with 1-2 year vesting as that way Sushi community can be a participant in the Gnosis DAO while also solve some of the distribution issue (I feel other projects can be considered as well). The GNO can be sold for SUSHI as well that we can stake as part of the Gnosis DAO as to formalize this relationship. Just my 2cent, leaning towards a NO vote for this proposal but will sit this one out to see how others vote.

An additional question for me is who do we want to be holders of GNO tokens that are given out in the future. Do we want to increase the amount the current token holders hold or do we want to disctribute tokens to new token holders.

If we want to distribute tokens to new token holders who do we want to target here.

I am in favor of distributing tokens to holders that will benefit the Gnosis ecosystem. E.g. provide liquidity for the Gnosis based exchange solutions or contribute to the popularity/ wellbeing of the Gnosis products.

In that regard I do not see why we reward that someone puts tokens into a Sushi LP.

I still have doubts about the long term effects

And I agree with @PYneer if we want to have a long term cooperation with Sushi Swap and the GIP is primarily about this there might be other/ better ways

Thanks for being active on the proposal. As stated before, this is an initial experiment to test what are the market dynamics around this type of proposal. I think it is a very good starting point, as it is low cost and will already benefit from an existing SUSHI reward. After the event happens (if the proposal is accepted), I’ll happily review what happened to see if we continue proposals of similar nature.

I see some people concerned about GNO distributed to Sushi LPs having a negative impact on price. I believe this is VERY UNLIKELY to be the case because:

- We are only adding 0.046% to the circulating supply (1,504,587 GNO)

- GnosisDAO will use the Safe airdrop app to distribute the rewards, instead of the suggested direct transfer to LP token address . This will not depress the price of the token in the pair itself, unless participants sell.

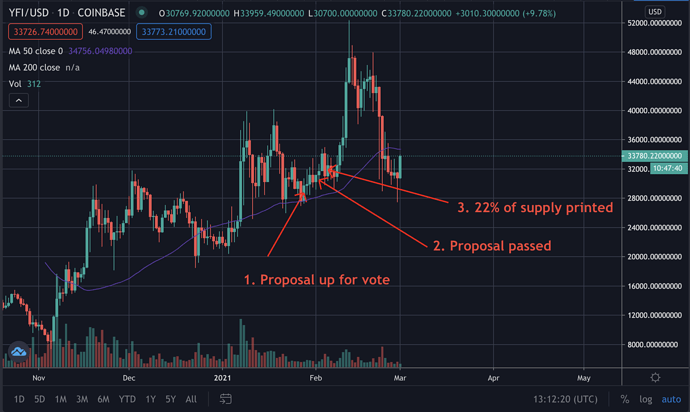

I want to add as an example what happened to YFI price once they recently decided to print 22.2% of the supply (vote started Jan 28, got passed on February 2) .

Price rose quite a lot after the supply increase, and, after a general market dump (all assets fell), it still has traded quite flat. The increase in supply has not had a negative impact on price.

If that was the price impact of a 22% increase in supply, I REALLY don’t think adding 0.046% into circulation will have a strong impact. (This is not financial advise)

I still advocate for the DAO to try out this proposal and VOTE YES, so we can test in reality how the market reacts to such an event.

Disclosure: Nothing in this post is to be interpreted as financial advise or a suggestion to make investments and/or transactions. You are solely responsible for any investment decisions and transactions.

Edit: had mistakenly stated that a Merkle airdrop would be used for the distribution, it will be the SafeAirdrop App. This again does not reduce the price of a pair.

I don’t think this comparison is reasonable. The purpose of Yearn’s minting (to finance internal development and build killer projects) and this particular minting goal (incentivise GNO/ETH liquidity) is very different.

To me it’s not clear what longtime value there is from short term increased GNO/ETH liquidity. Sure, people can sell/buy GNO at better rates but how does this create value in the long run?

So no matter by how little we are increasing the supply I’m not sure this is a good precedent for doing so at all. In my view the biggest reason GNO is trading under NAV is the fear of “pointless” increase in circulating supply, and this GIP is a step towards that direction.

Thanks for the reply Felix. That argument meant to showcase that increases in supply can happen without having a negative impact in price.

The purpose of this proposal is still the same:

- Pay out a reward to better distribute GNO tokens

- Take advantage of the existing SUSHI reward in order to have stakeholders for both communities

- Improve overall liquidity of GNO<>ETH

I am generally in favor of incentivizing liquidity providers (LP) because they provide a valuable service and they are natural long term holders (only if they are rational investors).

Very small liquidity providers are incentivized to keep their positions due to high gas cost and a whale like Gnosis treasury could increase its funds that are key for the development of Gnosis products.

I don’t think it is fair though to give rewards only to sushiswap LP and not to Balancer or Uniswap LP. Also it is not clear if 1 month is enough to create the required momentum to attract new investors or as Felix mentioned, how to measure the success of the proposal.

The rationale behind starting with Sushi is two fold:

-

Starting with a non existing pool in order to measure results from scratch

-

Take advantage of the reward that the other team is paying (this point is also valid for Balancer)

As stated in previous points of the discussion, I think it is good to start with an experimental phase that is contained in a shorter period, and discuss how to continue from there.

I would be worried of committing long term to an incentivisation campaign with out having tested for a shorter period of time.

If there is a notable spike in Sushiswap liquidity, which there has been so far just with the Sushi reward, I’d be happy to discuss a longer strategy covering multiple exchanges.

The added liquidity to Sushiswap was new, and does not belong to Gnosis, which I see as quite a positive event.