Added KPK airdrop details to the proposal:

Update: GIP-92 karpatkey spin-off and KPK token launch

karpatkey Investment Memo

Summary

This memo highlights karpatkey’s progress since February 2024, when GIP-92 was introduced, while reaffirming our firm commitment to GnosisDAO. Over the past six months, we have achieved significant revenue growth, expanded our team, and strengthened our treasury management services for DAOs. As we continue to build the leading on-chain investment banking solutions for DAOs, our focus remains on delivering exceptional value to GnosisDAO and the broader DeFi ecosystem.

We are committed to increasing transparency, aligning our future success with GnosisDAO’s long-term vision, and deepening our contributions to the Gnosis ecosystem.

Key Achievements

- Significant revenue growth

- Expansion of our pipeline, including new DAOs onboarded

- Extended solution offerings and expanded total addressable market (TAM)

Commitment to GnosisDAO

To reaffirm our alignment with GnosisDAO and GNO token holders, karpatkey commits to allocating 10% of our monthly revenues over the next year to purchasing GNO tokens. This move reflects our belief in the significant undervaluation of GNO and presents a strong investment opportunity for both investors and DAO treasuries. We are fully aligned with the strategic goals and long-term vision of GnosisDAO.

Modifications to GIP-92 phase-2

The initial proposal called for GnosisDAO to invest $5M in karpatkey through a $2.5M stablecoin investment and a $2.5M GNO-KPK token swap.

However, given the current market conditions and the undervaluation of GNO, we propose replacing the token swap with a $2.5M USDC investment. To reinforce our commitment to GNO, karpatkey will allocate 10% of its total revenue over the next 12 months to purchasing GNO in the open market, which we estimate will add +$2M GNO to our treasury. Purchases will be made at our discretion and included in monthly reports to maintain transparency.

The final GIP-92 structure consists of a $5M investment for 2.5% ownership at a $200M valuation, with an additional 5% ownership through an airdrop, totalling 7.5%. The total ownership of the Gnosisdao will amount to 10%.

karpatkey’s Financial Growth

Since February 2024, when GIP-92 was introduced, the total value of our DAO treasuries grew by 133%, from $900M to $2.1B. This growth was primarily driven by the onboarding of SafeDAO’s treasury in Q2 and the general market uptrend in crypto assets.

We continue to explore opportunities with leading DAOs such as Arbitrum and dYdX and are confident in expanding our revenue partnerships before year-end.

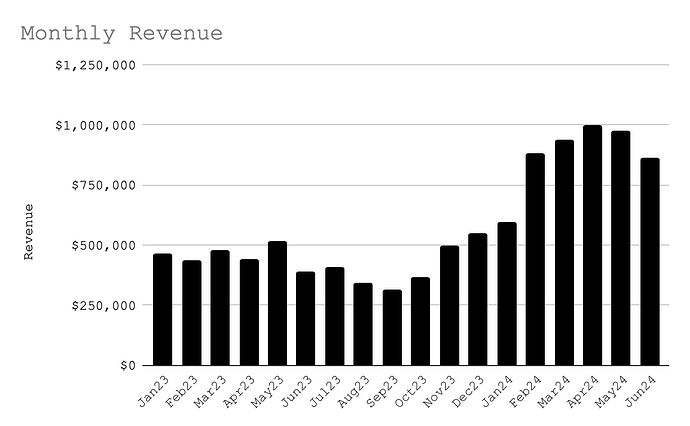

From the beginning of 2024, our non-custodial Assets Under Management (ncAUM) grew by 53%, from $654M to over $1B. In the first half of 2024, we recorded $5.26M in revenue and are on track to achieve $12.5M in total revenue for 2024, more than double our revenue from 2023.

The chart below shows a solid uptrend in revenue over the past 18 months. We remain focused on sustainable growth and see benefits from improved operational efficiency and the overall scaling of our business.

karpatkey’s Operational Milestones

In 2024, karpatkey expanded from 29 to 50 full-time contributors. This growth was driven by reorganising our treasury teams to better serve clients, improving our risk management infrastructure, and expanding our services.

Key growth drivers in 2024 include:

- Team expansion to 50 contributors

- Reorganisation of treasury teams to improve service delivery

- Execution of 9,000+ DeFi transactions with zero security incidents

We remain committed to improving our risk management infrastructure to support our partners.

karpatkey’s DAO Expansion

- Safe–Gnosis Joint Treasury. With the passing of both GIP-97 and SEP-24, karpatkey was chosen to manage the joint treasury owned by SafeDAO and GnosisDAO.

- AAVE Financial Services - Phase II. karpatkey extended their agreement with the AAVE DAO for an additional six months. This joint service agreement provides financial services to the Aave DAO focused on treasury management, GHO adoption, and the Aave DeFi product stack.

- Uniswap Treasury Working Group. We were selected as a Uniswap Treasury Working Group member to provide subject matter expertise and treasury management research for the Uniswap DAO.

- Nexus Mutual DAO: karpatkey was appointed as the Treasury Manager.

- Arbitrum Stable Treasury Endowment Program : Appointed as a member of the STEP Committee evaluating, vetting, and selecting candidates for the program, as well as recommending specific allocations toward successful applicant’s RWA products.

- Balancer Expanded Scope: We increased our scope to offer Balance Statements, Fund Flow Analysis, Expenses Breakdown, and Cash Flow Forecasting.

Investment Opportunity

KPK Token Value Accrual: All value generated from karpatkey’s business operations accrues to KPK holders, providing direct exposure to our financial success.

Governance Influence: With 10% ownership of KPK tokens, GnosisDAO will retain significant influence over karpatkey’s strategic direction.

Financial Returns: Our recent seed round, closed in Q1 2024 at a $200M valuation, represents a 5x increase from GnosisDAO’s initial investment via GIP-20, demonstrating karpatkey’s strong return potential for investors.

GNO Exposure: karpatkey’s commitment to add +$2M in GNO to its treasury over the next 12 months, combined with existing GNO holdings, highlights our focus on creating long-term value for GNO holders.

Strategic Alignment: karpatkey’s success contributes directly to the growth of the Gnosis ecosystem, reinforcing GnosisDAO’s position in DeFi. The spin-off allows karpatkey to create an interconnected network of DeFi treasuries, with GnosisDAO at its core, driving value and activity to Gnosis Chain.

Further Notes:

- Vesting Period: KPK tokens from GnosisDAO’s $5M investment will vest linearly over two years.

- OTC Deals: KPK tokens will be non-transferable at TGE until governance approves transferability. Still, karpatkey will facilitate OTC deals for Gnosis using our investor network, which can accrue value directly to GNO through buybacks.

- Upcoming Funding Round: karpatkey will initiate a new funding round at a higher valuation, reflecting our strong growth. This round presents an opportunity for existing investors to see an increase in their initial investment value.

Thank you for the detailed post. It’s great to see Karpatkey further strengthen its dominant position in the DAO treasury management market, and we’re excited to witness more onboardings and expansion into contingent markets.

We fully support the proposed changes to the deal—we believe it’s in the best interest of both parties. The commitment to accumulating tokens on the open market with revenues, instead of through a swap, will complement the GIP-100 buyback program and provide Karpatkey with cash on hand to focus on growth, without the need for the potentially difficult decision of selling any GNO in the short to medium term.

Very happy to see this and personally support the change though I am a bit biased for Karpatkey ![]()

Fernando from Balancer here: just wanted to say I’m a big fan of Karpatkey and the team and support this GIP. We at Balancer have been long term partners and fully trust their ability to deliver.

Disclosure: I’m an angel investor in Karpatkey.

My personal feeling is that GnosisDAO is receiving a very small percentage of the KPK tokens.

If I understand correctly, GnosisDAO, through Gnosis Ltd, incubated Karpatkey, provided them with an investment, gave them their first job, and lent them credibility, which allowed them to expand into other DAOs.

So we took on all the risk from the beginning and have very little upside.

This is an excellent deal for Karpatkey, while GnosisDAO seems to be acting more like a non-profit entity here.

Looking at the KPK token distribution from an investor’s perspective, this is what I see:

Team: 25%

M&A: 20% = Team

Investing Contributors: 11.6% = People from the team who could invest under the best conditions.

GnosisDAO: 10%

Future Fundraising: 10% = Team

Airdrops: 10% = The team finds a best way to distribute this portion among themselves and their friends.

Partners: 5% = Team

Treasury Core Unit: 5% = Team

Treasury Reserve: 3.4% = Team

It’s completely understandable that the team wants to secure the largest share for themselves, but why does GnosisDAO only have 10%?

Am I missing something fundamental?

We appreciate this update memo and the modifications put forward. karpatkey has had an exceptional year with more and more wins coming each month, and we believe it’s fantastic for GnosisDAO that another incubated project is thriving and delivering value back to this community.

Critical Feedback

Further to @gno-investor 's critical feedback above, our feeling is that the basic 10% allocated to karpatkey is reasonable, in view of (i) the amount invested in karpatkey to date; (ii) the success that karpatkey’s had from its engagements both with Gnosis, Gnosis ecosystem projects and other large DAOs across the industry; and (iii) karpatkey’s rapidly improving financial position.

So we took on all the risk from the beginning and have very little upside

With respect, it’s hard to agree that the karpatkey team didn’t take on any risk here. They threw their entire livelihood at supporting GnosisDAO at a time where it was not clear how that would turn out. Now that they’ve had enormous success, it’s easy to say that the risk profile was obvious in hindsight. In reality, we believe the vast majority of karpatkey’s success comes from the work of its teams.

This critical feedback also seems to ignore a few of the other benefits that can be gleaned from karpatkey’s update here:

- The token swap element is good for GNO and increases karpatkey’s “skin in the game” in GnosisDAO, meaning more alignment between the two;

- karpatkey have amended the proposal to adjust for GNO price decreases, ensuring that the same USD value is reflected in the investment, avoiding a decrease in the value of their investment that would have occurred otherwise;

- karpatkey have committed to devoting 10% of revenue to purchasing GNO tokens, again increasing alignment between the two;

- the new $200m valuation announced in this post reflects a significant increase on the original value of Gnosis’ investment in GIP-20 of $50m. That’s a 3x return, or >63% CAGR on the initial investment. Clearly GnosisDAO has done well out of this investment.

For us, the real point of this proposal is that GnosisDAO has an opportunity to expand its share of karpatkey’s success at a decent valuation. If karpatkey’s trajectory continues as it has, the addition $5m investment may prove even more successful than the initial $1m has done to date. We strongly support these plans and look forward to further updates.

Hi gno-Investor,

I want to provide some critical context around the inception of karpatkey and the timeline of GnosisDAO investments that your response has not considered. Unlike Safe and COW, GNO token-holders took no risk or financial burden to bootstrap karpatkey.

At its beginnings, karpatkey was entirely self-bootstrapped by its members, and I was the largest angel investor. Because we believed in GnosisDAO, we willingly assumed large financial risk by hiring contributors even before we had revenue. During the early stages of GnosisDAO’s creation, karpatkey operated without income for several months. GIP-20 (3% performance fee) didn’t cover costs for many months, and we endured losses during the last 2022 bear market.

GnosisDAO’s investment came only after karpatkey had already become profitable with a team of six. It’s important to note that Gnosis didn’t contribute to our hiring, provide technical resources, or offer financial expertise—our core business. Additionally, karpatkey assumed regulatory risks that Gnosis was not prepared to take.

That said, we remain deeply grateful to Martin, Stefan, and Friederike for their early endorsement and guidance, which were instrumental in helping karpatkey build relationships with other DAOs and grow into the largest treasury manager in the DeFi space. I believe karpatkey owes much to them. However, since they won’t personally receive an airdrop or team KPK tokens, we’ve extended highly favourable conditions to GnosisDAO to honour their contributions.

Lastly, the team will not control the allocations. I assure you that only 25% of the total allocation will go to the team. This is a public commitment we take seriously. If any additional tokens are to be considered for the team, they will be subject to a DAO proposal for approval.

Gnosis Guild is in full support of this proposal and the recent updates. We look forward to this exciting milestone and the continued growth of karpatkey!

What Karpatkey has done from the outset, in his individual career but also with his strong links with Gnosis and its ecosysteme, is remarkable and must be underlined.

This proposal update is a strong testimony to this, I support this approach and look forward to hearing more about it.

Thank you all. This is Majed from Forteus Asset Management, a holder of GNO tokens.

Just so that everyone is on the same page, GnosisDAO owns 10% of Karpatkey at an average valuation of X. This was obtained by :

- $1m investment in KPK at 20% discount of $50m FDV, i.e. $40m. This is now worth $5m at latest seed valuation of $200m. = 2.5%

- $5m investment at $200m FDV. =2.5%

- 5% airdrop to GNO = 5%.

Thus we own 10% of the KPK for $6m implying a cost base of $60m FDV. This seems reasonably generous.

Some questions I have include:

-

What is the divestment approach for GNO if any? I believe SAFE has set a precedent here ensuring that GNO should only control <7% circulating supply of any incubated project.

-

It is great to see monthly revenue numbers clearly trending upwards, what does the expense/cost base side of the equation look like? This is important given the 10% commitment will clearly occur after operation expenses (overheads /salaries etc). Or should this actually be thought of as monthly profits?

-

What does traction look like for the new funding round? And where do you think it’ll price at?

Overall, think this is a very well structured proposal. The DAO receives:

- A front-seat in the private rounds for their capital at a $60m FDV

- As a token of good faith GNO will also receive 10% of monthly revenues which the team implies at $1.6m / month in the form of buybacks

This proposal has undergone ten revisions before being abruptly pushed to Snapshot. Which of these eleven versions aligns with the forum poll?

The structural changes appear significant, yet the last meaningful discussion took place in October 2024 – nearly six months ago.

Will the token be listed on any centralized exchange upon deployment? Additionally, will there be liquidity provisioned on Gnosis Chain?

The proposed $2 million in GNO buybacks represents less than one-third of the fees you charge GnosisDAO. Would it not be more prudent to simply forgo these fees and allow the DAO to determine the optimal allocation of its resources? Moreover, given that you are also conducting GNO buybacks, how do you reconcile purchasing GNO for yourselves while simultaneously executing buybacks on behalf of the DAO? This presents a clear conflict of interest IMO.

The token will not be transferrable at TGE, therefore not immediately listed on centralized exchanges.

Liquidity provisioning will be a topic discussed by the karpatkey DAO nearer to the time of token transferability. It’s worth noting that the token will be deployed on mainnet, but we expect that our long-standing relationship and commitment to Gnosis Chain be reflected in decisions where the chain would benefit.

It’s important to clarify that the specification of this proposal does not mandate a buyback program. The “historical updates” were included for continuity and record. The September update mentioning investments and buybacks in relation to this proposal should be considered superceded, removed from the main body and are no longer terms of this proposal.

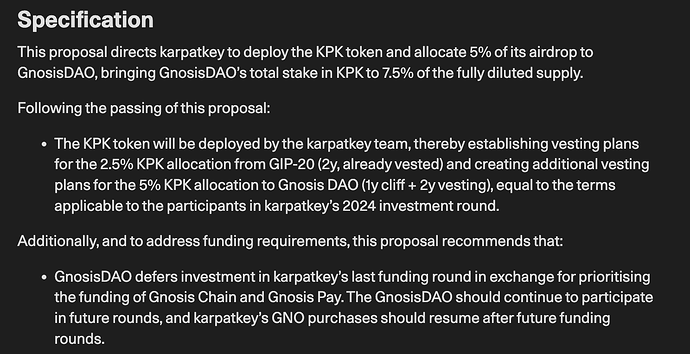

We want to draw attention to the specification of this proposal, which signals that GnosisDAO should receive a combined total of 7.5% ownership of karpatkey DAO. Voting in favour of this proposal helps ensure that Gnosis is allocated an additional 5% on top of the 2.5% ownership specified in GIP-20.

Anything outside of that specification, previously discussed or otherwise, is not a part of this proposal.

I am not voting on this proposal. Not even abstaining as it merely fails to follow the typical governance structure.

Can we, in general, not just for this proposal, agree that proposals, when revised, should be subject to the proposal guidelines and properly discussed before moving them to the snapshot?

People voted on the forum voted based on previous iterations of the same issue. Hence, the current version does not warrant sufficient approval necessary to move it to snapshot for token voting.

Or we can just go on and treat Gnosis governance as a joke like most of the recent proposals.

I have to say, this entire process is quite confusing. You haven’t clarified which version of the proposal the forum poll is based on—I assume it’s the first, before undergoing ten revisions?

More importantly, what is the actual purpose of this proposal if GnosisDAO isn’t investing, conducting a token swap, or taking any other action? You’re unilaterally deploying the token on mainnet and establishing vesting plans. So why does this require a GIP?

If the GIP fails, does that mean the token deployment won’t proceed? Or is this just a symbolic step with no real impact?

Just to be clear, I believe 7.5% for a DAO that has likely represented over 90% of your lifetime revenue is absurd.

hey mert - agree with your feedback that there should be more discussion after a GIP is revised this many times but republishing revised proposals as new Phase 2 GIPs is not a requirement. The governance tutorial actually describes making edits to the original post as the standard process.

Instead of letting the proposal fail and revising it once again, GIP-92 was moderated from Snapshot. We invite the proposer to re-issue a GIP that more clearly defines the outcome of the proposal. The governance process requires including version history and proposal changes in the original post and discussion of the GIP. The Snapshot proposal was published with a link to GIP-92 on the forum.

I think this makes sense, to avoid noise, but the issue seems to be what happens with the forum poll. Proposals cannot pass to phase-3 without a majority forum poll support (this disagrees, but I assume it’s superseded by this). But the processes don’t seem to cover the case where proposals are edited after the forum poll closes with support.

Intuitively, it seems like edited proposals are new proposals from an approval standpoint. Therefore any edits after that time should occur in the same forum thread but a new poll should be created each time. But currently that’s not specified.

Of course the simplest and most robust (from a governance perspective) process is that edits can only be made during Phase 1. What passes to Phases 2 and 3 is then voted on without further edits. But I appreciate reality requires something more dynamic than that.

yes, totally agree. after GIP-92, the HQ proposal and many other ‘redo’ GIPs, proposals that are revised need a fresh new GIP # and post so that we can address the point you’ve brought up.

to that end, a revision to GIP-92 was just published as GIP-121. Please check it out and cast your vote in the poll!