karpatkey 2024 Review for GnosisDAO

This report reviews and summarises karpatkey’s key activities and achievements in supporting GnosisDAO throughout 2024, highlighting our ongoing efforts to strengthen the Gnosis ecosystem and support Gnosis-related products.

In this third full year of our engagement as treasury managers for GnosisDAO, karpatkey has added value in many different areas across Gnosis’ ecosystem, including managing treasury assets and liquidity, performing ongoing risk management and monitoring, driving growth, partnerships and new initiatives and building and operating the technology needed to deliver these actions safely and efficiently.

Ultimately, all of our activities aim to promote growth, sustainability and utility for GnosisDAO, Gnosis Chain, other Gnosis products and other projects in the Gnosis ecosystem. It is our honour to serve Gnosis in this capacity and to summarise the details of a remarkable year for the Gnosis ecosystem.

Headline Figures

In 2024, the GnosisDAO treasury grew substantially and generated significant earnings while continuing to support and deliver the strategic initiatives of the DAO and its various associated organisations.

The headline figures for the full year are:

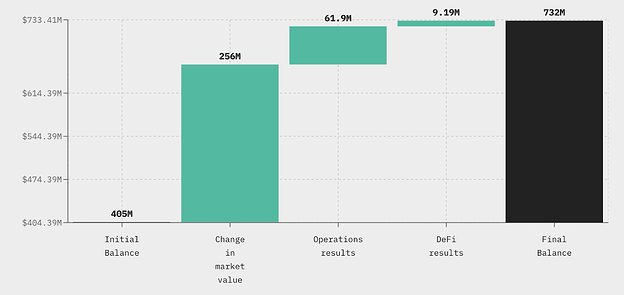

- Treasury Value: the GnosisDAO treasury has grown in value from $405 million at the start of 2024 to $732 million by the end of the year.

- Performance by Category: this amounts to an increase in value of $327 million, which in turn may be broken down into the following categories:

- DeFi Results: $9.2 million earned from active management of financial assets, deploying funds into DeFi protocols, real-world assets (RWAs) and other onchain yield sources;

- Operations Results: $61.9 million earned from GnosisDAO’s ongoing operations including additions to the treasury seen in the special additions section of the report; and

- Change in Market Value: $256 million in value added due to changes in the market value of curated assets included in the treasury.

- DeFi TVL: the “total value locked” (TVL) of Gnosis Chain increased from $223 million at the start of the year to $342 million. This best represents the amount of ongoing activity on the chain.

- DeFi Volume: the monthly volume of DeFi activities on Gnosis Chain increased by 281% over the year, from $100 million in December 2023 to $381 million in December 2024. In November 2024, the chain achieved a record high of $533 million in monthly volume.

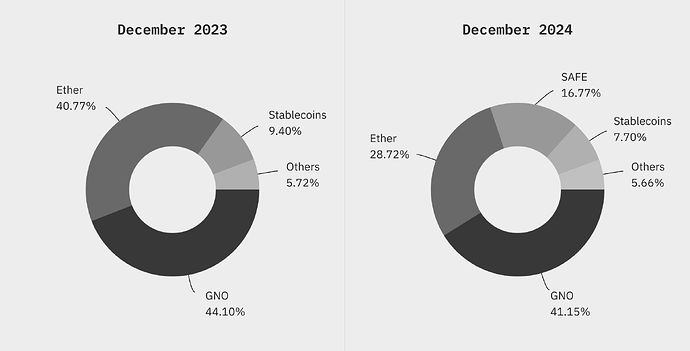

We continue to gradually diversify the GnosisDAO treasury and ensure a sustainable footing for the DAO’s finances. Figures for the end of 2024 (in USD) show divestments of ETH holdings and the addition of SAFE holdings following the token transferability event in March. That notwithstanding, the significant increase in market values for digital assets in the course of 2024 has led to a significant increase in nominal asset values and treasury runway.

In this report, all details of the performance of GnosisDAO’s portfolio are taken from karpatkey’s monthly reports as published on karpatkey’s website. All information about the aggregate performance of Gnosis Chain is sourced from DefiLlama’s website.

Treasury Operations

Throughout the year, we have continued to deliver and expand upon our core mandate to manage the GnosisDAO treasury (under GIP-20, and extended by GIP-58 and GIP-95). This includes diversifying and investing the idle treasury, facilitating operating activities and expenses, providing and maintaining liquidity, investigating and enacting opportunities for real-world assets, and developing and operating key technologies that the DAO treasury relies on.

Our work encompasses thousands of transactions per year spread across all of our initiatives. For 2024, we are proud to confirm the continuation of our record for zero funds lost across all of our work.

Set against that background, the key highlights of this year’s treasury operations include:

- Investment of $1.5 million and 500 GNO into HOPR under GIP-98 to support the project and fund the production of GnosisVPN (a decentralised virtual private network service built on HOPR Mixnet).

- Further diversification of the GnosisDAO liquid-staking portfolio, adding new products produced by Chorus One, Diva, Origin, Rocketpool and Stader and increasing the total quantity of equivalent assets in the portfolio from 1000 ETH to 9000 ETH.

- Supported lending markets on Gnosis Chain such as Aave and Spark by providing large amounts of liquidity from the GnosisDAO treasury.

- Optimised the distribution and reach of GNO rewards across various decentralised exchanges in the Gnosis Chain ecosystem, by gradually reducing direct incentives and leveraging voting power in veBAL and vlAURA.

- Commenced delivery of the GNO buyback program mandated under GIP-100, purchased $26.4 million in 2024 using a mixture of time-weighted average price (TWAP) sales, spot sales and over-the-counter deals.

- Negotiated and agreed an extension arrangement with GnosisDAO’s professional market maker, Efficient Frontier.

- Expanded Gnosis Chain’s network of bridging solutions and providers to deploy new services like deBridge and Relay, optimise existing services like Hop and Connext, prepare new services for onboarding like Stargate, and introduce new bridge aggregation services like Bungee.

- Stewarded through governance a comprehensive onboarding package to bridge Uniswap’s market-leading exchange technology to Gnosis Chain, through the Oku Trade frontend and Merkl reward distribution platform. The integration of Uniswap promises to significantly enhance liquidity on Gnosis Chain, by reducing slippage and driving higher trading volumes.

In the remainder of this section, we expand upon the particular activities and accomplishments of several key areas.

Liquidity

Liquidity is the lifeblood of financial markets, connecting interested users with vital utilities and interesting applications, allowing ecosystems to emerge and thrive. Building and maintaining effective liquidity is at the heart of karpatkey’s work, and provides a platform for most of our other activities.

Throughout 2024, we have continued to expand the considerable liquidity portfolios of Gnosis Chain and the GNO token, across the following activities:

- Launched a selection of different Uniswap V3 pools on Gnosis Chain, including wstETH/sDAI and wstETH/GNO, resulting in over $10 million of new Uniswap V3 TVL on Gnosis Chain by the end of 2024.

- Continued to build and utilise strategic liquidity on Balancer and Aura to boost relevant liquidity incentives for DAO treasury assets and to support new products and initiatives to help grow the Gnosis ecosystem.

- Worked closely with Balancer and CoW Swap to deploy new CoW AMM pools on Gnosis Chain and Ethereum, including wETH/GNO, wstETH/sDAI, and GNO/COW, OLAS/GNO.

- Deposited $2 million of DAO treasury liquidity into Arrakis’ managed automated liquidity management vaults.

- Deployed 15,000 ETH from the DAO treasury into the new Aave V3 Lido markets, to maximise yield on the treasury’s ETH reserves.

- Engaged in a structured liquidity provision under Aave DAO’s Fast Pass programme, as part of the Merit programme. This involved staking borrowed GHO into stkGHO and actively market-making stkGHO and GHO in CoW Swap and Maverick Protocol ensuring immediate exit liquidity for stkGHO holders.

- Managed liquidity for Monerium products, such as EURe and GBPe, which are utilised by Gnosis Pay. Deployed liquidity through CoW Swap, Balancer, Uniswap and Curve and provided EURe incentives to accelerate liquidity formation.

- Optimised liquidity across various decentralised exchanges to increase capital efficiency by re-routing through the wstETH/sDAI pair (and therefore increase the uptake of yield-bearing assets). This included ensuring that deposits and redemption routes were covered at all relevant times and had coverage across as many trading venues as possible.

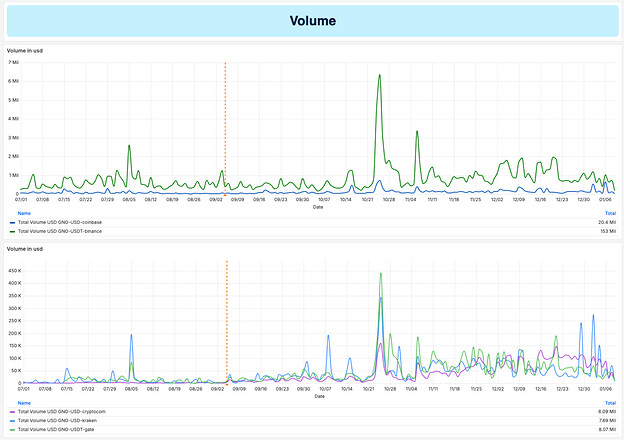

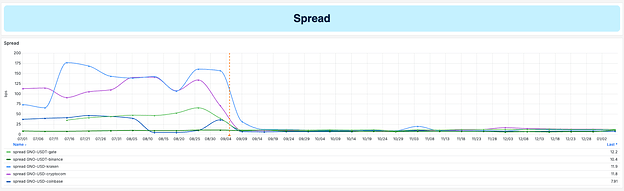

- Negotiated a 3-month renewal arrangement with Efficient Frontier - a professional market maker focused on building liquidity on key centralised exchanges and trading venues. Built liquidity on Coinbase, Binance, Crypto.com, Kraken and Gate.io, producing increasing volumes and tightened spreads throughout the second half of 2024.

- Facilitated the Gnosis Chain migration from USDC to USDC.e (a Circle Token Standard equivalent), including monitoring the allowance of the transmuter contract which handled the token migration workflow.

- Deployed $100,000 worth of wETH to the new lending market on PWN.xyz, and curated a strategy for GNO-collateralised loans for wETH and wstETH.

Market Making

In support of the commentary on improved liquidity for GNO on centralised exchanges, Efficient Frontier - the DAO’s professional market maker - has prepared graphical analyses of GNO’s volume and spread on all 5 of the exchanges which currently list GNO. These graphs display the visible improvement in liquidity for GNO since the commencement of the agreement which is indicated by the red dotted line below.

Diversification

Another core aspect of our treasury operations is the careful diversification of the treasury’s assets to manage risk and pursue sustainability, while also facilitating the DAO’s operating needs.

Across the year, the DAO sold approximately $38 million at an average sale price of $3,392 per ETH:

- in the first half, $19.3 million worth of ETH was sold across several transactions at an average sale price of $3,693 per ETH;

- in the second half, a further $12 million worth of ETH was sold across several transactions at an average sale price of $3,608 per ETH; and

- in the middle of the year, a further $6.7 million worth of ETH was sold at an average sale price of $2,527 per ETH for seeding the activities of GnosisVC, the DAO’s new venture fund, following the approval of GIP-102.

Buybacks

Beyond our core diversification function, the passage of GIP-100 in June 2024 added an additional mandate to execute a new GNO buyback programme, using up to $30 million of GnosisDAO treasury assets to repurchase GNO tokens.

In total, we conducted repurchases totalling $26.4 million throughout 2024. This includes:

- $15 million of mandatory CoW Swap TWAP orders.

- $11.4 million of the remaining amount, over which we were assigned full discretion.

From the discretionary allocation, we agreed a number of over-the-counter deals with one of the largest known sellers, which totalled around $820,000 of sales. For the remaining repurchases, we sold 7 million SAFE tokens and a combined 5,500 ETH or wstETH tokens. See Dune Dashboard here.

The year ended with a remaining $3.6 million of the buyback programme funding to be used at karpatkey’s discretion.

Separately, during the first half of the year (unrelated to GIP-100), the DAO repurchased GNO by selling approximately 1.35 million OLAS tokens through CoW Swap using TWAP orders.

Special Additions

Throughout 2024, the DAO treasury received a number of significant or unusual one-off additions arising from token vesting arrangements, earlier seed investments and special activities like the unwinding of programme-specific budgets.

In particular, the DAO received:

- Ongoing vesting from the DAO’s initial allocation of 150 million SAFE tokens, which began on 1 May 2022 for a 4-year vesting period. In March 2024, the SAFE token became transferable and a price variation of $168 million was recognised. By the end of the year, the DAO treasury accounted for 124.2 million SAFE tokens, including 52.9 million vesting tokens.

- 8.4 million OLAS tokens from Autonolas DAO, reflective of early seed investments made by GnosisDAO under the GIP-38 Gnosis Builders programme.

- 6,120 ETH and 71,841 GNO from the unwinding of the Gnosis Builders programme with the termination of GIP-38.

- 29.2 million HOPR tokens in relation to the investment into HOPR for the development of the Gnosis VPN, as part of GIP-98.

Ecosystem Development

Beyond the management of the GnosisDAO treasury, karpatkey’s mandate covers the development of the Gnosis ecosystem, including undertaking business development, facilitating new integrations, and devising and operating initiatives and incentive campaigns.

Integrations & Partnerships

A key component of the Gnosis ecosystem is the continued expansion and maintenance of integrations and partnerships, both to sustain activity on Gnosis Chain and to support the work of the various projects in the ecosystem to reach their aims. As experts in business development, karpatkey works actively to find, cultivate and maintain new relationships and integration opportunities to further this goal.

In the course of 2024, karpatkey led the following integrations and new partner relationships for Gnosis Chain:

- Arrakis Finance - an automated liquidity management solution for concentrated liquidity pools. By the end of 2024, Arrakis hosted 7 separate V2 vaults on Gnosis Chain, which held around $2 million of the DAO’s ETH positions.

- Backed Finance - an issuer of tokenised real-world assets, particularly traditional equity securities and funds. A strategic partnership bolstered by liquidity incentives on Gnosis Chain was approved by the DAO in GIP-117 during December, and will be executed in the course of 2025.

- Buenbit - a leading centralised exchange across Latin America, supplying digital assets and cross-border payments. The platform integrated Gnosis Chain for xDAI deposits and withdrawals in September 2024.

- Bungee Exchange - a bridging aggregation service built on SOCKET Protocol, allowing users to combine bridging and token swaps across many providers and routes to move onchain funds with ease. Bungee launched on Gnosis Chain in December 2024.

- Chronicle Protocol - a provider of onchain oracles and price feeds, specialising in real-world assets. In August 2024, Chronicle added support for GBP pricing on Gnosis Chain to facilitate Gnosis Pay’s pound-denominated accounts.

- deBridge Finance - a bridge service that provides fast and efficient crosschain transactions. deBridge integrated Gnosis Chain in May, at a monthly cost of $11k which is sponsored by karpatkey.

- Fireblocks - institutional-grade digital asset management and storage infrastructure that utilises multi-party computation for optimal security. Fireblocks integrated Gnosis Chain in the first half of 2024.

- Fjord Foundry - a community-focused platform for facilitating capital raising and early-stage participation through liquidity bootstrapping pools and token sale methods. Fjord opened up for participation in projects on Gnosis Chain in early 2024.

- Gyroscope - a stablecoin and automated market making protocol which uses novel concentrated liquidity designs to maximise capital efficiency. Gyroscope deployed on Gnosis Chain in November.

- Hidden Hand - is a governance incentive marketplace that allows users to engage with voters in particular governance issues and provide incentives to influence the outcome. Hidden Hand deployed on Gnosis Chain in early 2024.

- Hyperdrive - a novel automated market maker protocol that facilitates both fixed and variable rate liquidity positions to offer an improved trading experience. The protocol launched on Gnosis Chain in October.

- Merkl - an incentives distribution platform used to deliver complex incentive campaigns with offchain calculations across multiple protocol and blockchains. Merkl was deployed alongside Uniswap V3 as part of our onboarding proposal.

- Paraswap - a swap aggregation service that selects the most efficient routes from exchanging one digital asset to another. Paraswap deployed on Gnosis Chain in October.

- PWN.xyz - a lending market that facilitates fixed yields over set durations and curated lending strategies. In October 2024, PWN launched on Gnosis Chain with a curated strategy for GNO-collateralised loans created by karpatkey.

- Stakewise v3 - a liquid-staking protocol that provides simple staking solutions across a network of node operators across the ecosystem. The Stakewise V3 protocol was launched on Gnosis Chain in July 2024, introducing the new osGNO liquid-staking token.

- Stargate Finance - a bridge service built on top of LayerZero protocol which delivers seamless and low-cost crosschain messaging. In December, Stargate DAO approved a proposal to deploy Stargate on Gnosis Chain.

- Uniswap / Oku Trade - DeFi’s leading decentralised exchange technology, delivered through the Oku Trade frontend with support and incentives from Uniswap DAO under our onboarding proposal. Oku went live on Gnosis Chain in September with UNI token incentives facilitated by Merkl.

Initiatives & Incentives

To bolster those relationships and stimulate activity across the Gnosis ecosystem, karpatkey also pursues and operates various initiatives and incentive campaigns for Gnosis. Over 2024, we worked on the following initiatives:

- CoW Solver Rewards - continued to facilitate and distribute incentives for CoW Protocol solvers to encourage decentralisation, participation and competition among CoW Swap’s network. By the end of the year, the program had disbursed over 130k xDAI, with full data available on the initiative’s Dune Dashboard.

- Gnosis Pay Cashback - stewarded the Gnosis Pay cashback rewards programme defined in GIP-110, which will distribute 10,000 GNO tokens to Gnosis Pay users who stake GNO to participate. For full details of the campaign’s ongoing progress, see this Dune Dashboard.

- Safe Boost Programme - stewarded a proposal for a 6-month campaign on Gnosis Chain through Gnosis and Safe governance processes. The campaign will take place in 2025, rewarding users of Safe on Gnosis Chain for a range of activities.

- Curve EURe Incentives - supported the expansion of Monerium’s EURe product, which is used by Gnosis Pay cards. Distributed incentives on Curve for EURe pools to accelerate liquidity formation.

- Merkl UNI Campaigns - as part of our onboarding proposal for Uniswap V3 on Gnosis Chain, Merkl managed the distribution of $250,000 of UNI tokens across four new liquidity pools, helping to achieve $10 million TVL in Uniswap V3 liquidity on Gnosis Chain by the end of the year.

Technology

Underlying all of our work is karpatkey’s non-custodial active management stack, which brings together a variety of technologies, expert treasury management input and novel development work to build robust and efficient systems capable of meeting the needs of GnosisDAO’s treasury.

As karpatkey’s first and largest treasury management engagement, GnosisDAO has been the largest single user of karpatkey’s stack, gaining access to new and developing features first and foremost. As we work to develop and improve the stack accelerated in 2024, we were pleased to deliver a selection of new initiatives over the course of the year:

- Security Monitoring - continued to develop and expand our suite of security monitoring operations in partnership with Hypernative, which assist in securing assets, monitoring for unusual activity and ultimately managing risks.

- Execution Portal - built out and delivered an application for agile execution of treasury transactions, which is now used regularly by GnosisDAO for effective, safe and clear execution of key portfolio changes.

- Zodiac Roles Modifier V2 - migrated to Roles V2 in the second half of 2024. The process included conducting internal audits and testing before transitioning existing operations to ensure an additional layer of review was conducted to prevent permissions configurations that could potentially lead to unauthorised access or the risk of losing funds within the safe.

- Automation - ongoing development of our repertoire of automated actions and initiating bots, as well as new “Guardians” that orchestrate the delivery of automated actions. Though this work is a permanent ongoing item, 2024 saw dramatic steps forward in the automation of GnosisDAO’s treasury operations and safeguards behind the scenes.

Beyond our own core stack, karpatkey delivered a selection of specific work streams for GnosisDAO relating to development or technological operations. These include:

- Arbitrage Bots - created and deployed various bots on Gnosis Chain to conduct automated arbitrage transactions in order to enhance market stability, reduce trade slippage and rate discrepancies.

- Keepers - developed and implemented specialised “keeper” bots to optimise the yields for sDAI on Gnosis Chain by bridging the interest earned on Mainnet at routine intervals to realise the sDAI earnings as local yield.

- Gnosis Validators - Contributed to Gnosis Chain’s infrastructure and security by managing Gnosis Beacon Chain (GBC) nodes and, validators, as well as an Erigon node, to contribute to the security and strength of Gnosis Chain’s infrastructure, ensuring reliable and efficient operations on the chain.

- Bridge Validators - operated validators for the xDAI and AMB bridges for Gnosis Chain to support crosschain interoperability across the ecosystem.

- Bridge Routers - maintained the Hop Bonder and Connext Router infrastructure which is needed for each associated bridging service. In doing so, we helped to strengthen network connectivity and expand inflow channels, supporting the overall robustness and scalability of Gnosis Chain.

- Disassembler Audits - developed, audited and implemented new disassembling permissions for automated position management of the GnosisDAO treasury.

- Gnosis Pay Rewards Indexer - delivered, maintained and improved the infrastructure to track and distribute the Gnosis Pay rewards in line with our work to operate the execution of Gnosis Pay cashback rewards.

Governance

At the core of all of karpatkey’s work for GnosisDAO is our passion for the Gnosis ecosystem and our participation in the DAO and its governance. Since our earliest days, we have been actively working to develop GnosisDAO and ensure robust and transparent governance.

In 2024, we led a selection of initiatives to support our work, including:

- GIP-91: Should the GnosisDAO onboard into Centrifuge Prime?

- GIP-97: karpatkey SafeDAO <> GnosisDAO Joint Treasury Delegation

- GIP-100: Should Gnosis DAO conduct a $30 million buyback program?

- GIP-101: Should karpatkey and StableLab Establish a Delegate Program v0 for the GnosisDAO?

- GIP-110: Should the Gnosis DAO create and fund a Gnosis Pay rewards program with 10k GNO?

- GIP-112: Should the Gnosis Infrastructure team make changes to the GnosisDAO’s Snapshot configurations?

- GIP-115: SafeBoost on Gnosis Chain

- GIP-116: Should the DAO perform the following treasury operations?

- GIP-117: Strategic Partnership with Backed through Liquidity Incentives on Gnosis Chain

In particular, our initiative under GIP-101 to establish a Delegate Program was a key governance initiative aimed at strengthening and increasing participation in GnosisDAO. The preparations for that program remain ongoing, and we are excited to progress this work stream in 2025.

Fees

To conclude this report, we provide below the details of our monthly fees for 2024. Previously, karpatkey has charged a standard Management Fee of 2% of non-custodial assets under management (after several specific exclusions), as well as a Performance Fee which is a fixed 20% of the yield generated by our work.

| Management Fee | Performance Fee (ETH) | |

|---|---|---|

| January | $350,722 | 62.83 |

| February | $610,281 | 39.02 |

| March | $608,537 | 51.67 |

| April | $643,439 | 50.90 |

| May | $456,248 | 55.84 |

| June | $403,449 | 46.22 |

| July | $348,480 | 48.25 |

| August | $277,140 | 42.25 |

| September | $289,031 | 44.31 |

| October | $316,352 | 48.31 |

| November | $166,667 | 22.52 |

| December | $166,667 | 33.41 |

| Total | $4,637,013 | 545.53 |

From November 2024, karpatkey has agreed to amend its fees to a fixed annual Management Fee of $2 million per year. By contrast, the Performance Fee will remain at 20% of the yield generated from our work, however, this will now apply only to assets managed on Ethereum Mainnet, and not Gnosis Chain.

Conclusion

2024 was a year of significant progress for the Gnosis ecosystem, and the karpatkey team is proud to have contributed in so many different ways. As we bring this annual review to a close, we want to reiterate our appreciation for the trust and commitment that GnosisDAO has placed in us.

We look forward to maintaining our commitment and efforts in the upcoming year and beyond, as Gnosis continues to reshape the world before our eyes.

Thank you for reading.