Should the GnosisDAO approve the “Gnosis Assets Holding I Foundation” for onboarding into Centrifuge Prime?

- In Favour

- Against

GIP: 94

title: Should the GnosisDAO approve the “Gnosis Assets Holding I Foundation” for onboarding into Centrifuge Prime?

author: @graysonalto

type: Meta

created: 2024-04-03

This Proposal is an Update to GIP-91

Centrifuge is pleased to announce the successful snapshot vote on GIP-91 which brings GnosisDAO a large step closer in its ability to diversify the treasury into real-word assets (RWAs). Centrifuge received an overwhelming 96.99% of the governance vote in the snapshot that closed on January 29th. The proposal targeted initial allocations of $10m USD into Centrifuge Prime, through pools such as Anemoy LTF, New Silver, and other available pools.

Since then, the Centrifuge team has been progressing with the operational and legal next steps to ensure a smooth onboarding process. The legal docs, both the MoA and AoA (attached to this post) define the critical processes and structure of a Cayman Foundation Company, which will serve as the RWA Legal Conduit we describe in GIP-91. A summary of such processes and structural matters are set out in this post below, but please refer to the legal docs for more detailed information.

Legal documents are linked right below and at the bottom of this post:

The Memorandum of Association Here

The Articles of Association Here

We are sharing the summary here for the rest of the community with a view to a final proposal being voted on for implementation.

Bringing Anemoy Liquid Treasury Fund to GnosisDAO

Centrifuge is pleased to bring U.S t-bill access to the GnosisDAO treasury via the Anemoy Liquid Treasury Fund. This will provide the DAO access to stable yield uncorrelated to that of DeFi, and importantly, not denominated in volatile assets like Eth/stEth as the treasury mainly utilizes today to earn yield.

Some benefits of the fund structure include:

- Daily Liquidity: The fund offers daily redemptions in USDC.

- Direct Ownership: The token serves as evidence of ownership, allowing cost-efficient redemptions and providing legal claims on assets.

- Investor Protection: Prospective investors must adhere to the Know Your Customer (KYC) and anti-money laundering requirements of a BVI-regulated fund, ensuring a secure and transparent investment environment.

- Transparency: Centrifuge provides near real-time onchain visibility of holdings, returns, and tokenized U.S. Treasury Bills.

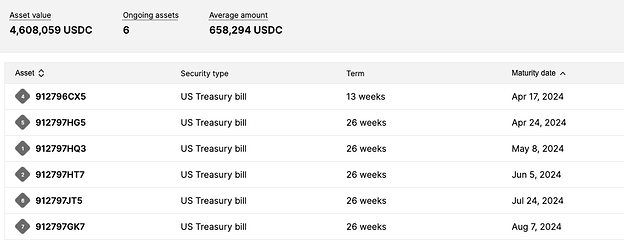

The Anemoy Liquid Treasury Fund purchases US Treasury bills at different periods with varying durations, ensuring a revolving set of maturities. The Fund’s investments are T-Bills with 1 month, 3 month and 6 month maturities.

Legal Overview

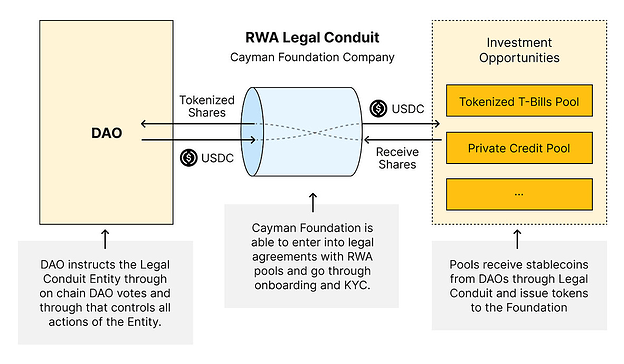

The legal structure will be integrated with Karpatkey, who was mandated by governance to make treasury investment decisions on behalf of the DAO. The principle idea behind the structure is to establish an entity that is capable of signing and fulfilling legal agreements for the benefit of GnosisDAO, ultimately enabling GnosisDAO’s path to legal recourse. This provides a high degree of reliability and security for RWA investments, without compromising the principles and position of the DAO. This framework is based on our extensive experience in MakerDAO setting up similar structures. There, the same structure supports a >$1B in deployed capital.

The structure is enabled by the Cayman Islands Foundation Companies act 2017 (the Foundation Act). Under this framework, Centrifuge as part of its services, will set up a foundation company titled the “Gnosis Assets Holding I Foundation.”

The Articles of Association defines the critical processes and structure of the company such as:

- The company is assigned one nominee director who is responsible for executing and adhering to the mandate of a DAO Resolution or a Delegated Committee Instruction

- The company may form a Delegated Committee that has a mandate from the DAO to manage its treasury

- A Delegated Committee Instruction is a written set of instructions as scheduled to the Articles of Association and from there established as a legal obligation of the Foundation company.

- A supervisor, responsible for ensuring directors fulfill their duties, and a secretary, responsible for administering the company, are also required roles

- Specific obligations and procedures for assigning beneficiaries and distributing assets during events such as winding up the company or similar

A foundation director will be recommended by Centrifuge solely for the purpose to execute orders from the DAO, and acts as a legal signature in the Cayman Islands. The foundation director will implement DAO votes and Delegated Committee Instructions as detailed in the Articles. The DAO has full authority to remove/replace the foundation director at full discretion in a timely manner. As part of Centrifuge’s service offering, the legal conduit/foundation can be repurposed for any of GnosisDAO’s future needs, including for other RWA projects and issuers. Under the current proposal, the target max allocation is $10M to be focused mainly in U.S t-bills, but also diversified in other credit strategies Centrifuge offers if desired.

The Initial foundation company secretary shall be Leeward Management Limited

Leeward Management Limited is a leading fiduciary and governance services provider in the Cayman Islands. The service company is well positioned to fulfill work on behalf of a DAO as it is specialized in dealing with Digital Assets, specifically RWA structured products.

“With the rapid institutionalization of digital assets, having independent, non-executive directors who provide investors and stakeholders with an added layer of transparency, accountability and expertise is often a critical element to ensuring a project’s success.”

Glenn Kennedy will be appointed foundation director as approved by both Centrifuge and GnosisDAO.

Due to our relationship with Leeward in using them in several other similar projects, Centrifuge is able to provide a cost effective deal. Ongoing per annum governance and corporate expenses of USD 40k consist of fees for the independent foundation director and foundation supervisor.

Next Steps in order:

- Leave posted legal docs to the community forum(in this post) for seven days as a period for feedback

- Open a snapshot vote to ratify the docs

- Setting up the foundation takes ~10 days

- Begin the KYC process between the foundation director and Anemoy that will take a week or less

- Investments can then take place immediately

*Once the DAO has voted and reached the necessary quorum, the Foundation can be set-up immediately.

The Memorandum of Association is a document that contains all the conditions which are required for the registration of the company. Articles Here

The Articles of Association is a document that contains the rules and regulations for the administration of the company. Articles Here

Lastly, I wanted to introduce myself @GraysonAlto. I recently joined Centrifuge as a BD Analyst working with DeFi protocols. I work closely with @akhan.eth as whom most are familiar with. I look forward to working with the DAO in supporting the path towards diversifying into RWAs.