karpatkey February 2025 Report for GnosisDAO

This report provides an update on karpatkey’s contributions and impact to GnosisDAO in February 2025, focusing on treasury overview, operations, including liquidity and diversification, ecosystem development, technology and governance.

Big Picture

Starting this month, we will aim to highlight individual topics of interest in each monthly report, to provide the community with a sense of the strategic value that we’re seeking to deliver over and above our typical reporting statistics.

For February, a key focus has been the growing adoption of real world assets (RWAs) on Gnosis Chain. RWAs have been a central theme for karpatkey since we first introduced Savings xDAI on Gnosis Chain, which taps into yield generated by MakerDAO (now Sky) from RWAs (e.g. treasury bills) to offer a stable interest rate to holders. This month, GnosisDAO voted to extend that initiative by migrating the backing for Savings xDAI from the old MakerDAO DAI Savings Rate to the new Sky Savings Rate. We’re proud to see the community’s continued support for native RWA yield on Gnosis Chain.

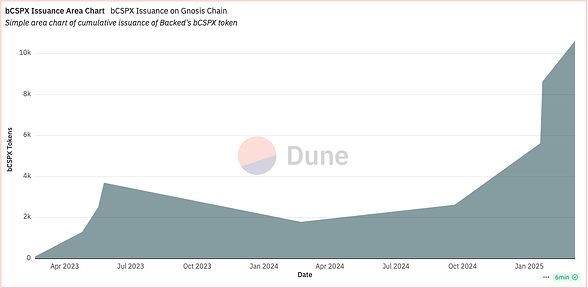

In 2025, Gnosis Chain has also emerged as a leader in new RWA innovation, as we were among the first EVM blockchains to adopt tokenised equity securities. At the end of 2024, GnosisDAO approved a strategic partnership with BackedFi which involved $1 million of GNO incentives to cultivate adoption on the chain. After a new Balancer liquidity pool was created at the end of January, February saw rapid uptake of Backed’s S&P 500 token ($bCSPX), with over 10,000 tokens (or $6.4 million) issued on the chain.

Liquidity is far from the only value proposition we see for tokenised equities. The vision is that onchain exposure to a diversified basket of RWAs can provide systemic stability for the Gnosis Chain ecosystem. bCSPX adoption can therefore benefit and progress all manner of DeFi protocols and onchain infrastructure. A key example is how we worked together with PWN DAO to rapidly deploy a lending market for bCSPX, which allows users to go short or leverage the token, and can therefore be used to arbitrage yields and optimise market efficiency. Another example is the ongoing effort of adding bCSPX to the Aave V3 instance on Gnosis Chain, to extend the range of collateral on the chain and diversify Aave’s exposure to crypto-native asset pricing.

There is still a long way to go in the adoption of RWAs on Gnosis Chain. Support for new Backed assets will follow soon, and karpatkey will continue working to support additional integrations and ecosystem projects. Taking a step back, we believe that Gnosis Chain is the perfect ecosystem to spearhead RWA innovation. Our unique combination of sophisticated technology, low-cost-high-throughput infrastructure, substantial support from the DAO’s treasury, and an experienced and loyal community allows us to invest long term and conduct bold, large experiments across our ecosystem.

While our progress so far in 2025 has been exciting, there is a long road still ahead for RWA adoption. We appreciate the ongoing support of the community in pushing the boundaries of what’s possible on Gnosis Chain.

Headline Figures

The figures for the month of February:

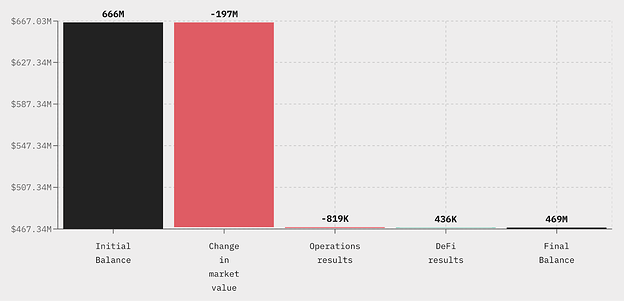

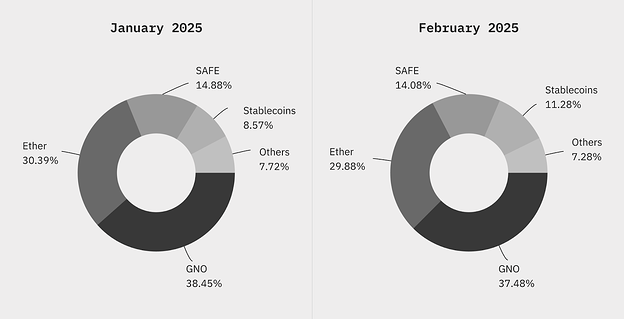

- Treasury Value: The total treasury has decreased from $666 million to $469 million. The vast majority of this decrease is attributable to decreases in the market price of crypto-native assets, which make up the majority of the GnosisDAO treasury. The decrease aligns broadly with the wider collapse of the Global Cryptocurrency Market Cap, which sank ~22% in February.

- Performance by Category:

- DeFi Results: $435,927. Where a significant proportion of yield is derived from staking of crypto-native assets like ETH, the significant downturn in the market price of these assets has also decreased the treasury’s DeFi results in February.

- Operations Results: -$818,876. This is reflective of routine monthly expenditures for the DAO only.

- Change in Market Value: -$197 million. This aligns with the broader collapse in the market described above.

- Gnosis Chain Metrics:

- DeFi TVL: $275.94 million. This reflects a ~20% decrease in TVL, slightly below the ~22% collapse in Global Cryptocurrency Market Cap.

- DeFi Volume: $306.7 million. At less than 5% deviation from January figures, this suggests relative stability and lack of panic on Gnosis Chain despite the wider collapse in market values.

This report derives all details on GnosisDAO’s portfolio performance from Karpatkey’s monthly reports, which are published on the website. Information regarding the aggregate performance of Gnosis Chain is sourced from DefiLlama’s website.

Treasury Operations

Liquidity and Diversification

- Deposited $2 million USDC.e and 770 WETH ($2 million at time of transfer) into Stargate on Gnosis Chain to provide liquidity for bridging, thereby facilitating cross-chain transactions. This has generated $3.18 million in volume through the Stargate instance on Gnosis Chain over the past month.

- Actively rebalanced Monerium’s GBPe CoW Swap liquidity pool on Gnosis Chain to maintain efficient user transactions and pool pricing.

- Withdrew $2 million of liquidity from Arrakis HOT AMM to optimise capital allocation and enhance liquidity management.

- Optimised the treasury’s existing stGHO strategy while continuing to receive incentives, improving capital efficiency.

- Migrated ETH liquid-staking token positions from Sommelier vault products to stake on Aura Finance instead.

- Doubled the treasury’s deposit in the PrzWxDAI reward pool on PoolTogether, from 200,000 to 400,000 xDAI. This was a strategic move to support the SafeBoost Programme, ensuring more incentives for participants while also attracting more liquidity and engagement within the PoolTogether community.

Special Additions

- GnosisDAO received an additional allocation of 2 million SHU tokens (0.2% of total supply) from the Shutter community. Shutter Network was a project incubated by the Gnosis Builders programme under GIP-38, and the DAO supported Shutter in developing the Shutterized Gnosis Chain.

Ecosystem Development

Integrations & Partnerships

- Symbiosis, a cross-chain bridging and exchange protocol, deployed onto Gnosis Chain, increasing the range of bridging options open to users. karpatkey assisted Symbiosis with the deployment of a non-custodial Safe smart account to accommodate their bespoke UI and facilitate the integration.

- Integrated BackedFi’s bCSPX to the PWN lending protocol. This expands borrowing and collateralisation options, enabling users to borrow stablecoins against bCSPX as collateral and borrow bCSPX against sDAI as collateral.

- Supported efforts to integrate bCSPX into the Aave V3 instance on Gnosis Chain through an ongoing Request for Comment and a Temp Check proposal. Integration to Aave would simultaneously increase optionality for users, grow bCSPX’s exposure and further solidify and diversify Aave’s collateral on Gnosis Chain.

Initiatives & Incentives

- Executed weekly distributions of incentives and rewards for:

- CoW Solvers:

- In February a total of 27,149.50 xDAI was awarded to CoW solvers, which brings the total solver rewards to 250,694.38 xDAI.

- Backed

- 209 GNO ($38,880.19 at time of transfers) has been distributed in February. Since the start of the programme, a total of 291 GNO has been distributed (valued at $58,235.97 at the time of the relevant transfers).

- Gnosis Pay Cashback Programme (GIP-110)

- A total of 2,178.68 GNO has been awarded to date (21.7% of total) among 2,414 users. 500 GNO was distributed in February alone.

- See the Dune Dashboard which shows the weekly and total number of GNO rewarded, USD equivalent and users rewarded.

- CoW Solvers:

- Throughout February, we continued our systematic process of claiming, redepositing and locking rewards earned on Aura Finance into $auraBAL, which helps to maximise the quantity of rewards and scope of yield obtained on the treasury’s positions, while ensuring long-term participation and value-alignment for GnosisDAO in the Aura and Balancer ecosystems.

Technology

- Continued development of a new karpatkey dashboard to provide an overview of all inflows using the native Gnosis Bridge.

- Continued development of a new karpatkey dashboard for Gnosis CoW AMM, displaying key metrics for strategic CoW AMM pools on Gnosis Chain.

- The Across bridge relayer has begun generating small but consistent revenue from Gnosis Chain bridge activities, contributing to overall ecosystem sustainability.

Governance

Update on GIP-101: Should karpatkey and StableLab Establish a Delegate Program v0 for the GnosisDAO?

- A snapshot space has been created to facilitate the selection of 10 delegates.

- The selection process runs from the 3rd to the 11th of March 2025.

- Every GNO holder can vote to select the DAO’s delegates using their GNO in the new Snapshot space.

- GNO delegations are not carried over to new spaces by default, so holders with existing delegations will need to re-delegate to carry them over for the selection of the DAO’s delegates.

Fees

For this month, the management fee charged was $166,667 (1/12 of $2 million per annum). The performance fee is 20% of DeFi results from assets on the mainnet, which resulted in 25.07 ETH.

| Management Fee | Performance Fee (ETH) | |

|---|---|---|

| January | $166,667 | 33.72 |

| February | $166,667 | 25.07 |

This corresponds to a total fee of c. $500,266 for both January and February (calculated by substituting 20% of the USD value of DeFi results for the ETH fee charged). Relative to the $1,233,131 in DeFi results, karpatkey’s fees represent around 40.57% of the total. Therefore, the majority of earnings generated by our work remain with GnosisDAO. However, this analysis only accounts for the basic yield generated and does not factor in karpatkey’s additional activities or value-added contribution.