karpatkey January 2025 Report for GnosisDAO

This report outlines karpatkey’s key contributions to GnosisDAO in January 2025, detailing our ongoing efforts in treasury management, liquidity optimisation, risk assessment, and ecosystem expansion. Our focus remains on supporting the Gnosis ecosystem and Gnosis-related products, as well as ensuring financial sustainability, strategic growth, and operational efficiency. This month’s update highlights the latest developments and progress in our work with GnosisDAO.

Headline Figures

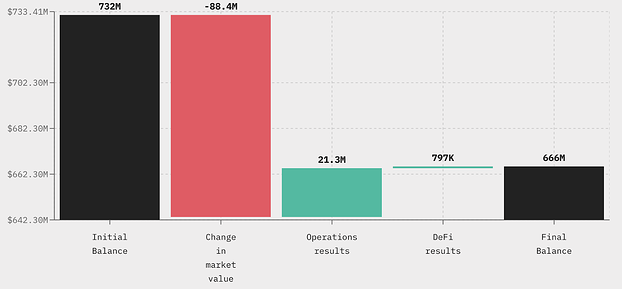

The figures for January:

- Treasury Value: The total treasury has decreased from $732 million to $666 million in the past month, primarily due to market value fluctuations of key assets and operational inflows, as outlined below.

- Performance by Category:

- DeFi Results: $797,204

- Operations Results: $21.3 million (This includes the reception of tokens from GIP-116 and CIP-60)

- Change in Market Value: -$88.4 million (Primarily driven by a 16.68% drop in GNO price, resulting in a $50 million decrease. Additionally, SAFE declined 19.36% reducing value by $24 million, while COW and OLAS collectively contributed an $11 million decrease).

- Gnosis Chain Metrics:

- DeFi TVL: $344.67 million

- DeFi Volume: $321.34 million

This report derives all details on GnosisDAO’s portfolio performance from karpatkey’s monthly reports, as published on the website. Information regarding the aggregate performance of Gnosis Chain is sourced from DefiLlama’s website.

Treasury Operations

Liquidity and Diversification

- Migrated USDC to USDC.e on Aave v3, aligning with Circle’s Bridged USDC Standard to enhance cross-chain compatibility, improve liquidity efficiency, and support future upgrades to native USDC issuance.

- Increased liquidity and rebalanced the EURe/EURC.e pool on Curve, ensuring greater stability, improved trading efficiency, and enhanced support for euro-pegged assets.

- Adjusted liquidity and rebalanced the GBPe/EURe pool on Balancer.

- Deposited 500 GNO into the SeedNodes StakeWise V3 vault, contributing to decentralised staking infrastructure and enhancing network security.

- Repositioned stkGHO/GHO holdings, restructured limit orders, and ensured SD and GHO were claimable.

- Withdrew from the GHO/stkGHO Maverick pool, restarted the stkGHO cooldown, and restructured the Maverick pool, optimising liquidity allocation and staking efficiency.

- Deposited 22.66 WETH into the PWN Loan platform, enhancing liquidity for decentralised lending and enabling secure trustless loan issuance.

- Claimed accumulated rewards and successfully withdrew ETH from Aave Prime ensuring efficient utilisation of assets.

- Continue to stake PNK balance in Kleros’ General Court, earning PNK rewards while contributing to decentralised dispute resolution.

Buybacks

The buyback programme (GIP-100) is now complete. The $30 million total ($15 million TWAP over 6 months and $15 million buyback at KPK discretion) was completed at the end of January. For more details see the Dune Dashboard and forum update.

Special Additions

CIP-60: Migrating the Gnosis bonding pool

The old bonding pool (created in this transaction) has been officially deprecated under CIP-60. The following assets have now been returned to the GnosisDAO treasury:

- 112.63 GNO

- 0.01098472 WBTC

- 529,456.35 aEthUSDC

- 19,787.19 SAFE

Re-do of: GIP 116: Should the DAO perform the following treasury operations?

Assets claimed and transferred into the GnosisDAO treasury include:

- 5,258,625 GEL

- 35,112,521.23 COW

- 0.01642 WBTC

- 1,692.90 FRAX

- 0.5494633326 stETH

Ecosystem Development

Integrations & Partnerships

- With Gnosis Pay expanding to Brazil, testing of routing for BRLA - a stablecoin pegged to the Brazilian Real and issued by BRLA Digital - is in progress. This will ensure efficient trade execution and liquidity flow, along with resolving issues in the BRLA/sDAI pair to enhance overall market functionality.

- Updated Zodiac module permissions within the Gnosis DAO on both Ethereum and Gnosis Chain to ensure proper access control, governance functionality, and security, allowing for more efficient execution of DAO operations while maintaining decentralisation and trustless management.

- Backed Finance’s real-world assets (RWAs) are now supported on Gnosis Chain with GNO incentives. This follows GIP-117 which was approved in December 2024. The first pool bCSPX/sDAI is now live on Balancer. bCSPX can also be traded across multiple venues on Gnosis Chain. See this tweet as an example of trading bCSPX using Bungee Exchange (one of our bridging partners). The TVL of the bCSPX/sDAI pool has surged to $3 million, driven by growing adoption and the impact of GNO incentives, which have significantly boosted liquidity and engagement.

Initiatives & Incentives

- Weekly distribution of Curve pool incentives, CoW solver incentives, Backed incentives and Gnosis Pay rewards (cashback programme under GIP-110).

- Assisting Gnosis Pay with USDC settlements on Ethereum at karpatkey.ai/gps.

- Actively claiming and locking rewards on Aura Finance, ensuring long-term participation in the ecosystem while optimising yield by compounding rewards.

Technology

- Conducted further improvements to our Gnosis Pay Rewards Indexer which included adding a subgraph, fixing missing GNO snapshots for Gnosis Pay safes and adding historical price tracking to help with missed rewards tickets.

- The Gnosis Pay user dashboard has been updated to enable users to download CSV files for airdrop records.

- The Gnosis Pay bridged USDC claimer is now live, enhancing the liquidity and usability of USDC on Gnosis Chain by enabling users to claim their bridged funds seamlessly.

- The ACX-Relayer is now active and receiving funding, with $2,000 USDC and 0.05 ETH recorded as of 30th January 2025. This relayer plays a crucial role in facilitating seamless cross-chain transactions through the Across Bridge, improving efficiency and reducing latency for users bridging assets. The system is currently undergoing debugging in collaboration with the Across team to ensure smooth functionality.

Governance

Re-do of: GIP 116: Should the DAO perform the following treasury operations?

A re-do of GIP-116 allowed us to execute the transactions onchain through snapshot. GIP-116 included:

- Claiming GEL and COW tokens

- Transferring FRAX, COW, WBTC and stETH to the treasury

- Withdrawing wETH from Aave

- Creation of subdomain delegates.gnosis.eth

- Claiming and burning 3.15 million GNO from vesting contract

- This supports the long-standing GIP-35 mandate to reduce total supply to 3 million GNO. As of now, almost 4 million tokens have been burned.

Fees

For this month, the management fee charged was $166,667, which reflects a fixed annual management fee of $2 million. The performance fee charged was 33.72 ETH, which reflects 20% of the DeFi results generated from assets on Ethereum Mainnet in the month of January.

For context, this equates to a total fee of c. $277,599 (substituting 20% of the USD value of DeFi results for the ETH fee charged). When taken as a proportion of the $797,204 of DeFi results in January, karpatkey’s fees equate to c. 34.8% of the total. In other words, the vast majority of the earnings generated by our work is retained by GnosisDAO. That notwithstanding, this analysis does not take into account any of the other activities or value-adds that karpatkey delivers routinely and only reflects the basic yield generated.