kpk April 2025 Report for GnosisDAO

This report provides an update on kpk’s contributions and impact for GnosisDAO in March 2025, focusing on treasury overview, operations, including liquidity and diversification, ecosystem development, technology and governance.

Big Picture

This month, we reflect on the growing role of stablecoins in accelerating the adoption and usage of DeFi on Gnosis Chain and beyond.

In recent weeks, the news has been awash with various legislative proposals, new product entrants, and awe-inspiring financial results, all demonstrating how stablecoins are reaching a critical mass of adoption. The world, it seems, is finally starting to catch up with GnosisDAO…

For years, Gnosis has been building core utilities on top of stablecoins, like gas payments for Gnosis Chain and debit payment rails through Gnosis Pay. Ours is one of the few ecosystems delivering support for a variety of alternative fiat-backed tokens, with significant usage of EUR, GBP and now BRL-denominated tokens (as well as USD). And, with the launch of sexyDAI in 2023, Gnosis Chain became the first to offer a stable savings rate on our native gas token.

As part of our mandate, kpk pursues innovative projects that help to expand Gnosis’ lead in this area. Those projects encompass a range of interesting behind-the-scenes opportunities that are quietly driving value back to Gnosis. Our ongoing efforts include:

-

Supporting the Sky migration for sDAI. Our team developed and maintains the interest relay mechanism that earns interest on Mainnet DAI in the Gnosis Bridge and distributes this to holders on Gnosis Chain. Recently, we upgraded the system to address the divergence between DSR (Dai Savings Rate) and Sky’s SSR (sUSDS Savings Rate). To ensure users on Gnosis Chain benefit from the higher yield offered by Sky, DAO treasury funds are being deployed to top up the relay balance to match the sUSDS rate. This upgrade ensures xDAI users continue to receive optimal returns.

-

Maintaining liquidity and pricing for alternative fiat-backed tokens. We deploy GnosisDAO treasury assets as liquidity for EUR, GBP and, soon, BRL-denominated tokens, and help protect the peg through strategic arbitrage. Our development team has built and deployed automated agents tasked with monitoring live pricing on Gnosis Chain. This ensures the prices users receive on the chain never deviate too far from current foreign exchange values.

-

Integrating Aave’s GHO and building an sGHO vault. Our team is always on the lookout for opportunities to expand the range of products and yield sources deployed on Gnosis Chain. Over the last few months, we’ve stewarded the deployment of Aave’s GHO stablecoin on Gnosis Chain, developed designs for a Savings GHO vault (similar to sDAI) to deliver native yield, and proposed Aave treasury to accompany the launch of GHO with liquidity.

Individually, each of these efforts is helping to maintain a competitive and effective space for deploying capital and making payments with stablecoins. But putting the pieces together, Gnosis is building a new monetary system that’s credibly neutral and end-to-end decentralised. In doing so, we’re helping pave the way for billions of users to seamlessly transact across borders and keep their hard-earned savings safe from overreach or inflation. The vision is an open internet that empowers individuals all over the world.

And there’s still a lot more work to do…

Headline Figures

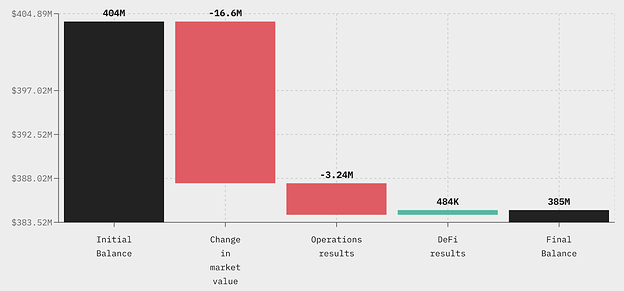

The figures for the month of April:

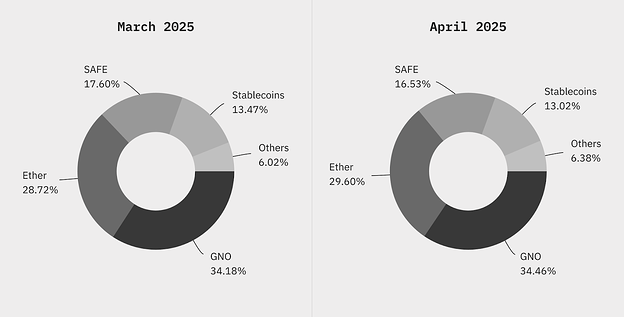

- Treasury Value: $385 million, which reflects a decrease of $19 million from last month. This is mainly due to the ongoing declines in market prices from cryptoassets (save for Bitcoin), correlating with increasing global macroeconomic uncertainty…

- Performance by Category:

- DeFi Results: $483,586. This is an increase of $33k from last month’s DeFi results. The increase was primarily driven by ETH deployments across different protocols, and despite a 1.6% decline in ETH prices, the impact on DeFi performance was minimal. In contrast, as auraBAL is staked within the aura ecosystem, the price decrease of 21.84% led to lower results.

- Operations Results: -$3.24 million. Funds were allocated to cover market maker requirements, incentive programmes, payments to HOPR and Gateway and kpk fees. See below for more details.

- Change in Market Value: -$16.6 million. This mainly consists of the price decreases in SAFE and GNO, which decreased by 10.5% and 5%, respectively.

- Gnosis Chain Metrics:

- DeFi TVL: $258.15 million. This is a $4.87 million decrease from last month’s TVL, which amounts to a 1.85% decrease. By comparison, the total value locked in DeFi increased from ~$95 billion to ~$100 billion, largely driven by a ~15% rally in the price of Bitcoin.

- DeFi Volume: $253.13 million. This is a 3.74% ($9.83 million) decline from last month. This is comparable to far steeper declines of 12.91% in DeFi volumes on Ethereum Mainnet.

This report derives all details on GnosisDAO’s portfolio performance from kpk’s monthly reports, which are published on the website. Information regarding the aggregate performance of Gnosis Chain is sourced from DefiLlama’s website.

Treasury Operations

Liquidity and Diversification

- Continuously rebalanced the stkGHO/GHO pool on Maverick, which yields an APR of approximately 12-15%.

- Over $2 million was deposited into Uniswap V3 liquidity pools via Oku Trade. This deployment aims to enhance liquidity within the Gnosis-integrated Uniswap V3 environment. By providing liquidity, the strategy benefits from concentrated liquidity placement, enabling more effective capital usage and tighter price ranges for traders.

- Continued to fund the Across Relayer to support ongoing cross-chain bridging operations.

- Deployed an additional $100k to the BRLA liquidity pool, bringing the TVL to $200k. This increase in liquidity aims to strengthen Gnosis Pay’s rollout in the Brazilian market by enhancing the depth and stability of the BRLA pool. It supports more efficient fiat-to-crypto conversions, reduces slippage for users transacting in Brazilian Real, and contributes to a smoother payment experience as Gnosis Pay expands its real-world utility in the region.

- Executed a withdrawal of a further 2 million wxDAI from Aave, part of these funds were converted into sDAI for the wstETH/sDAI liquidity pool on Uniswap V3 improving capital efficiency, and the remainder was swapped into USDC.e and utilised for market making of GNO.

Ecosystem Development

Integrations & Partnerships

- Gateway.fm:

- As part of the execution of GIP-70, a total of 222k DAI was transferred to Gateway.fm in support of infrastructure development and operational services for the Gnosis Chain. As outlined in GIP-70, this initiative aims to strengthen the reliability, scalability, and resilience of core node services and related infrastructure. Gateway.fm was selected based on its proven technical expertise and track record in providing high-availability RPC services and validator support. This contribution aligns with the broader strategy of reinforcing key infrastructure partners to ensure long-term sustainability and decentralisation of the Gnosis ecosystem.

- HOPR:

- A total of $1.2 million USDC was transferred to HOPR as part of the execution of GIP-122. This allocation supports HOPR’s continued work on decentralised privacy infrastructure and metadata protection for the Gnosis ecosystem. As outlined in GIP-122, the funding enables HOPR to further develop, deploy, and maintain secure networking protocols that align with Gnosis Chain’s vision. This strategic funding reinforces the commitment to strengthening core components of the Gnosis tech stack.

- Bungee:

- A total of 100,000 USDC.e was deployed to Bungee to support cross-chain liquidity and routing infrastructure. This allocation was made to strengthen the Bungee bridge and routing protocol, which plays a key role in facilitating seamless cross-chain transfers to and from the Gnosis Chain. By supporting Bungee, the Gnosis ecosystem benefits from improved capital efficiency, faster onboarding, and enhanced user experience for both dApp developers and end users. Bungee’s routing technology helps users find optimal bridging paths with minimised slippage and fees, thereby making Gnosis Chain more accessible and interoperable within the broader multi-chain environment. This funding aligns with Gnosis’s strategy to reduce friction in cross-chain asset movement and expand liquidity accessibility.

- Efficient Frontier:

- An 18-month contract was initiated with market makers Efficient Frontier, with $3 million deployed to support GNO liquidity and market efficiency. The objective of this engagement is to enhance GNO token liquidity across major exchanges, reduce price slippage, and ensure healthier order books for both retail and institutional participants. Partnering with professional market makers helps the trading environment, improves price discovery, and increases confidence among participants engaging with GNO. This strategic deployment supports long-term adoption by making GNO more accessible and tradable across various platforms. The 18-month horizon reflects a commitment to sustained support for liquidity on centralised exchanges, aligning with Gnosis’ broader ambitions to the maturity and sustainability of its ecosystem…

- Circles:

- sDAI from the DAO treasury was distributed across multiple Circles multi-sig accounts to provide strategic support for various components of the Circles ecosystem. The use of sDAI, a yield-bearing stablecoin, also allows the project to benefit from passive income generation while maintaining liquidity and supporting price stability, as well as operational viability. This funding model reinforces Circles’ commitment to decentralisation not only in technology but also in resource management.

- Headquarters:

- As part of the revised GIP-120, 150,000 USDC was transferred to Headquarters (HQ.xyz) as an advanced payment in connection with the full acquisition of the company by GnosisDAO. The rationale for fully acquiring Headquarters is to strategically align the platform’s infrastructure with Gnosis’ long-term objectives, particularly in the areas of business account management, payments, and global expansion. The acquisition enables Gnosis to establish a strong presence in Asia, integrate directly through existing regulatory licensing and investor relationships in the region, and integrate HQ’s capabilities into Gnosis Pay’s corporate card offering.

Initiatives & Incentives

- Executed weekly distributions of incentives and rewards for:

- Gnosis’ Curve liquidity pool:

- The April incentives amounted to a total of 4.8 wstETH. Cumulative total incentives now sit at 23,431.90 GNO and 104.12 wstETH.

- CoW Solvers:

- In April, a total of 34,056.40 xDAI was awarded to CoW solvers, which brings the total solver rewards to 318,290.80 xDAI.

- Backed:

- For bCSPX, 443 GNO ($48,658.58 at time of transfers) has been distributed in April. Since the start of the programme, a total of 1,105.03 GNO has been distributed (valued at $155,161.57 at the time of the relevant transfers).

- For bTSLA, 324 GNO ($35,856.76 at time of transfer)has been distributed since commencement on the 27th March 2025. In April, 314 GNO ($34,580.36 at time of transfers) was distributed.

- Gnosis Pay Cashback Programme (GIP-110)

- A total of 4,397.92 GNO has been awarded to date (43.98% of total) among 3,208 users. 1,372.27 GNO was distributed in April.

- See the Dune Dashboard, which shows the weekly and total number of GNO rewarded, USD equivalent and users rewarded.

- Aave EURe:

- 59k EURe worth of incentives were deposited into Aave to incentivise EURe borrowing.

- Gnosis’ Curve liquidity pool:

- Continuous claiming and locking of earned rewards through Aura Finance to maximise yield through reward compounding while ensuring long-term participation in the ecosystem.

Technology

Throughout April, our team has been continuing an ongoing development project to build a set of new custom dashboards for tracing bridging, liquidity and market activities across Gnosis Chain. This work aims to deliver a deeper level of live insights into these core functionalities, helping to ensure a seamless and efficient DeFi experience for the chain’s users. Ultimately, we aim to accelerate the process of issue detection and proactive management of core services. This work will continue over the coming months, and deliverables will be shared publicly (where appropriate) once completed.

Governance

Participated in Shutter DAO’s governance proposals on behalf of Gnosis as part of our ongoing work to support governance across other Gnosis-aligned projects. Engaging with Shutter DAO reflects a strategic commitment to supporting privacy-enhancing technologies and MEV-resistant infrastructure within the broader Ethereum and Gnosis ecosystem. This involvement ensures that stakeholder perspectives from the Gnosis community are represented in shaping the evolution of Shutter Network’s threshold encryption and governance tooling.

Fees

For this month, the management fee charged was $166,667 (1/12 of $2 million per annum). The performance fee is 20% of DeFi results from assets on Mainnet, which resulted in 42.20 ETH.

| Management Fee | Performance Fee (ETH) | |

|---|---|---|

| January | $166,667 | 33.72 |

| February | $166,667 | 25.07 |

| March | $166,667 | 36.04 |

| April | $166,667 | 42.20 |

This corresponds to a total fee of c. $975,242 from January to April 2025 (calculated by substituting 20% of the USD value of DeFi results for the ETH fee charged). Relative to the $2,167,625 in DeFi results, kpk’s fees represent around 45% of the total. Therefore, the majority of earnings generated by our work remain with GnosisDAO. However, this analysis only accounts for the basic yield generated and does not factor in kpk’s additional activities or value-added contribution.