kpk March 2025 Report for GnosisDAO

This report provides an update on kpk’s contributions and impact on GnosisDAO in March 2025, focusing on treasury overview, operations, including liquidity and diversification, ecosystem development, technology and governance.

Big Picture

Following the $1.5 billion Bybit hack in February, which has become the largest hack in crypto history, one of our main focuses in March has been security and asset segregation.

We have implemented a range of updates to our proactive security strategy for the treasury, with a focus on segregating assets and operations. This approach reduces the overall attack surface by limiting exposure and isolating critical assets, thereby minimising the risk associated with any single store of assets. Our existing permissions technology prevents any single point of failure in our managed transactions by requiring a specific, prior permission to be granted before a transaction can succeed. This further segregation of funds takes things further, ensuring that even a multi-point exploit of any managed Safe would not provide access to more than a small fraction of the total treasury. By distributing sensitive resources, we enhance our ability to contain potential breaches and maintain tighter control over access permissions.

Our second key focus has been the continued growth of the Gnosis ecosystem, with a particular emphasis on expanding the presence and adoption of real-world assets (RWAs). By supporting innovative RWA integrations and strategic partnerships, we aim to position Gnosis as a leading hub for bridging traditional finance with decentralised infrastructure.

Following the approval of GIP-117, which introduced incentives for tokenised RWAs, significant progress has been made in strengthening our partnership with Backed and expanding RWA adoption within the Gnosis ecosystem. In January, the bCSPX pool was launched as part of this initiative, with $100k of the allocated $250k incentives already distributed, and $6.5m in current liquidity—reflecting strong initial traction.

In March, incentives for Backed’s wbTSLA RWA were rolled out on the wbTSLA/sDAI pool on UniswapV3 via Okutrade, further diversifying RWA exposure and broadening access to traditional asset classes through DeFi-native mechanisms. Rewards can be tracked on Merkl.xyz.

These efforts underscore our commitment to supporting high-quality RWAs integrations on Gnosis and highlight Backed as a key partner in bridging traditional finance with on-chain infrastructure. Incentivising these pools is a critical step toward deepening liquidity, fostering adoption, and positioning Gnosis as a leading hub for real-world asset innovation.

Headline Figures

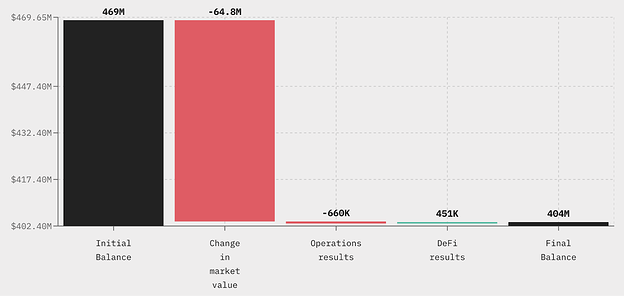

The headline figures for the month of March were:

- Treasury Value: The treasury value has decreased by $65 million from $469 million to $404 million over the last month. This decrease is largely driven by declines in the market prices of GNO and ETH, accounting for approximately $38 million and $25 million of the loss, respectively.

- Performance by Category:

- DeFi Results: $450,909. The majority of our yield is generated through strategic ETH deployments across established protocols, along with staking auraBAL within the Aura ecosystem. A significant portion of the results was impacted by the decline in market prices.

- Operations Results: -$660,000. This includes the DAO’s ongoing monthly expenses.

- Change in Market Value: -$64.8 million. This is reflective of the decline in market prices from large holdings as mentioned above.

- Gnosis Chain Metrics:

- DeFi TVL: $263.02 million. This is a $12.92 million decrease from last month’s TVL, which equates to 4.68%. In context, Gnosis Chain outperformed the 5.33% decrease in the Global Cryptocurrency Market Cap.

- DeFi Volume: $262.96 million. This is a 14.26% ($43.74 million) decline from last month. Ethereum DeFi volume alone saw a sharper decline of 21.33%, likely due to reduced trading activity, lower on-chain incentives, and general market caution following recent price volatility.

This report derives all of the published details of the performance of GnosisDAO’s portfolio from kpk’s monthly reports, which are published on our website. Information regarding the aggregate performance of Gnosis Chain is sourced from DefiLlama’s website.

Treasury Operations

Liquidity and Diversification

- Executed a withdrawal of 1.2M wxDAI from Aave, converted these funds to sDAI, and allocated the resulting sDAI to the wstETH/sDAI liquidity pool on Uniswap v3 to optimise capital efficiency and yield.

- Rebalanced the stkGHO/GHO pool on Maverick and claimed rewards on Merkl.xyz.

- Initiated a position on Enzyme via Stader by depositing 10 ETHx to begin yield generation exposure and evaluate performance for potential scaling.

- Withdrew 50k USDC from Spark for future reallocation in potential yield-generating strategies.

- Received 600k DAI from the Hop Bridge Bonder as part of a liquidity withdrawal strategy.

- Increased liquidity in the Brazilian Real BRLA pool by $35k, to support Gnosis Pay’s ongoing integration into the Brazilian market. This brings the TVL to $50k, and will be increased by a further 50k in the next month, resulting in a $100k TVL.

- Deposited 35k USDC and 26.3 WETH to Symbiosis for enhanced bridging and cross-chain functionality.

- Reallocated $100k from the WETH/WBTC pool on Balancer to a newly launched wstETH/WBTC pool on Balancer. This will support Circles, providing a route to maintain price stability for CRCs.

- Withdrew 200k EURe and 800k wxDAI from Aave to enable strategic reallocation. The funds were repurposed for upcoming payment obligations and to support new Uniswap v3 positions.

Ecosystem Development

Integrations & Partnerships

- A second tranche of funding for investments, amounting to $6.7 million, was sent to GnosisVC, bringing the total sent to $13.4 million out of $20 million.

- Supported Circles by providing 100k sDAI to the Circles liquidity Safes to support price stability and bolster the emerging Circles ecosystem as the rollout of V2 gathers pace.

- Added proposer roles to Circles’ Safes, allowing trusted parties to initiate transactions without compromising security.

- As part of our ongoing partnership with Backed and GIP-117, we deployed incentives for the wbTSLA pool on Uniswap v3. This initiative supports the growth of tokenised RWAs on Gnosis Chain and reinforces our shared goal of bringing traditional financial exposure into the DeFi ecosystem.

Initiatives & Incentives

- Executed weekly distributions of incentives and rewards for:

- Gnosis’ Curve liquidity pool:

- The March incentives totalled 4.8 wstETH. Cumulative total incentives now sit at 23,431.90 GNO and 99.32 wstETH.

- CoW Solvers:

- In March, a total of 33,540.03 xDAI was awarded to CoW solvers, which brings the total solver rewards to 284,234.40 xDAI.

- Backed:

- For bCSPX, 371 GNO ($48,267.02 at the time of transfers) has been distributed in March. Since the start of the programme, a total of 662 GNO has been distributed (valued at $106,502.99 at the time of the relevant transfers).

- For wbTSLA, 10 GNO ($1,276.04 at the time of transfers)has been distributed since commencement on the 27th March 2025.

- Gnosis Pay Cashback Programme (GIP-110):

- A total of 3,025.65 GNO has been awarded to date (30.26% of total) among 2,723 users. 1,000 GNO was distributed in March alone, which is double last month’s figures.

- See the Dune Dashboard, which shows the weekly and total number of GNO rewarded, USD equivalent and users rewarded.

- Gnosis’ Curve liquidity pool:

- Continuously claim and lock rewards on Aura Finance to maximise yield through compounding while ensuring long-term participation in the ecosystem.

Technology

- Implemented new real-time alerts for major bridges servicing Gnosis Chain to enhance situational awareness and responsiveness to key performance changes. This ensures that any irregular activity, performance issues, or critical updates are immediately visible to the team, allowing for faster incident detection and better operational oversight.

Governance

GIP-101: Should karpatkey and StableLab Establish a Delegate Program v0 for the GnosisDAO?

- In early March, the proposal took place on the new Snapshot space, resulting in the selection of the following 10 delegates:

- ACI (Aave Chan Initiative)

- mrtdlgc

- Lefteris Karapetsas

- Gnosis Guild

- Viszla

- Staworth (jackgale.eth)

- Stake Capital (Louk)

- Breadchain Cooperative

- Gardens (paul2)

- Areta

- A total of 50,000 GNO was delegated, with each delegate receiving 5,000 GNO.

- This initiative aims to help GnosisDAO meet quorum and maximise participation. In turn, it will also further decentralisation, increase community engagement and strengthen governance processes as our new delegates help the community to make informed and effective decisions.

Fees

For this month, the management fee charged was $166,667 (1/12 of $2 million per annum). The performance fee is 20% of DeFi results from assets on the mainnet, which resulted in 36.04 ETH.

| Management Fee | Performance Fee (ETH) | |

|---|---|---|

| January | $166,667 | 33.72 |

| February | $166,667 | 25.07 |

| March | $166,667 | 36.04 |

This corresponds to a total fee of c. $732,741 in the first quarter of 2025 (calculated by substituting 20% of the USD value of DeFi results for the ETH fee charged). Relative to the $1,684,039 in DeFi results, kpk’s fees represent around 43.51% of the total. Therefore, the majority of earnings generated by our work remain with GnosisDAO. However, this analysis only accounts for the basic yield generated and does not factor in kpk’s additional activities or value-added contribution.