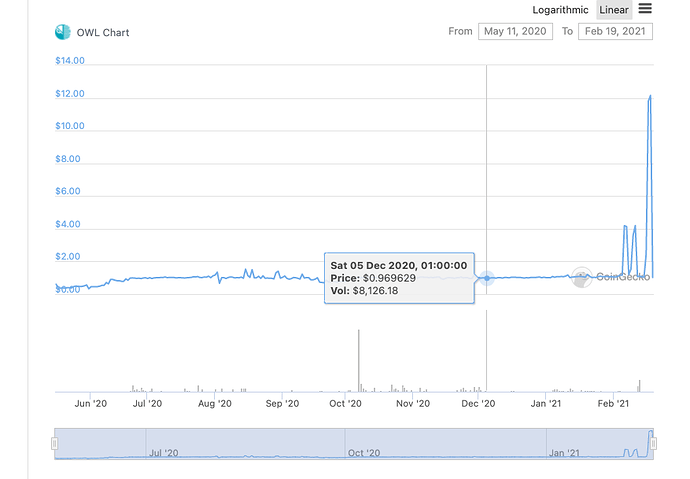

IMO OWL is one of the most undervalued assets Gnosis has. Currently its role seems fuzzy and the potential of OWL is not used at all.

This proposal suggests to morph OWL into an asset backed stable coin - similar to DAI.

Compared to DAI there would be key differences:

- Holding OWL should accrue interest. (similar to DSR - but in contrast to DAI all OWL should benefit from this interest) OWL == CHAI

- Minting of OWL is (at least in the beginning) primarily done by GnosisDAO

- All assets controlled by GnosisDAO are essentially collateral for OWL

- In contrast to Maker - GnosisDAO could freely use the assets to do e.g. yield farming

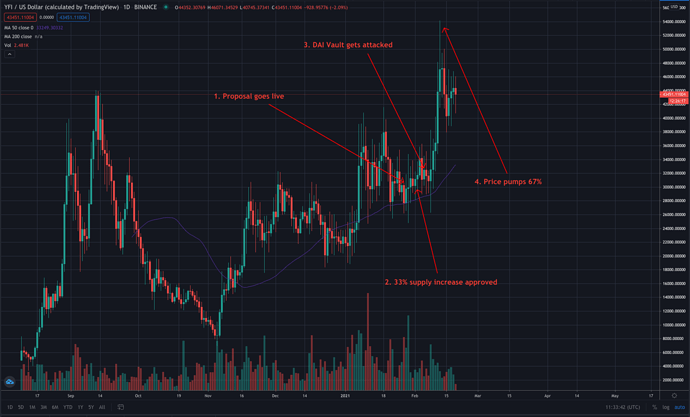

Conceptually this would be a mix out of Maker and Yearn.finance. Similar to Maker an important byproduct would be the stable coin (DAI/OWL) - similar to Yearn essentially people will but in other stable coin (USDC/DAI/…) and hand those over to a mechanism to do yield farming for them.

Yearn is supposed to do this trustless/ noncustodial for you. This though comes with significant downsides: the strategies that can be used are more limited and the smart contract risk is significantly higher. GnosisDAO in contrast can use its reputation and huge asset base.

A primitive implementation can be done without the need for any smart contracts.

Steps:

- Vote on a interest rate for OWL (e.g. I’d suggest to start with 10% APY/ there should be rules for how it can be adjusted)

- Mint e.g. 10 Million OWL

(Note - as long as the DAO holds the OWL it does not pay any interest) - Create a yield curve with buy/sell orders on Gnosis Protocol

On day 1 one OWL == one $ (e.g USDC)

10% APY means ~ 1.00026 return per day. So on day one you can buy and sell OWL for 1.0000 on day 2 for 1.00026, day 3 1.0005200676 and so on - till on day 365 it would reach 1.1

With GP v.2. it should be possible to pre-sign those orders with a validity for this day. Potentially a small spread (e.g. 1-5 BIPs) can be taken between buying and selling.

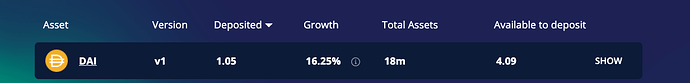

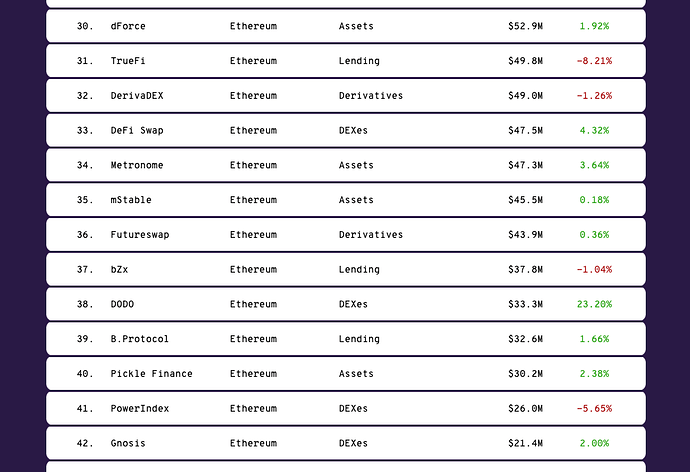

In our example this account would start with 10M OWL and 0 USDC. As soon as people would start buying OWL (you could argue this is actually minting OWL) - the account (and thus the GnosisDAO) would essentially receive USDC and have OWL dept. Now some USDC should always be left in this account to keep OWL always liquid - but most of it should be used in some yield-farming/ investing activity since GnosisDAO needs to beat the 10% it is essentially paying on the 10%. With todays DEFI opportunities 10% seems very doable. In fact - Gnosis is today using its ETH to borrow DAI and e.g. participate in ETH/DAI pools. This can be done tremendously more efficient the DAO gets the stablecoin for issuing OWL.

For all use-cases that need stablecoin OWL should be an attractive alternative - simply because it is earning interest and only add very limited risk (assuming GnosisDAO acts responsible).

The primary 2 use-cases could be

a) liquidity pools (use OWL/ETH instead of stablecoin/ETH)

When GPv2 launches Gnosis could start a big liquidity mining program for GPv2 specific OWL/Token AMMs

b) Prediction markets

Gnosis could start a big liquidity mining program to incentivise OWL funded prediction markets.