[TEMP CHECK/DISCUSSION]

0xLaJota, 1st topic, 20/06/2024.

Context :

With the deployment of RealT, which allows exposure to real estate by offering the first tokenization of real-world assets (RWA), it is now possible to invest in Web2 from Web3. With a TVL of $100M that continues to grow, this Dapp has taken a major place in the Gnosis ecosystem.

Additionally, Maker’s savings product, sDai is also available on Gnosis, enabling yield generation on a stablecoin. This adds a Web2 aspect since simply holding sDai allows generating a return, similar to the Livret A savings account in France.

The recent launch of Gnosis Pay, an off-chain payment method via a Visa card while using EURe from one’s wallet, has boosted Gnosis’s reputation, offering a real alternative to centralized CEX cards (Binance, Crypto.com, etc.).

To summarize, Gnosis Chain has become “the Web3 bank” where users can invest their money in real estate, generate passive income, or even use their cryptocurrencies as a means of payment in Web2.

To grow and develop this “bank” aspect that Gnosis is working on, it is necessary to attract the giants of RWA:

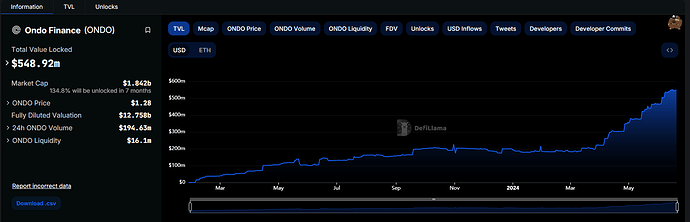

A leader in tokenized assets, with a TVL growing from $500k on February 1, 2024, to $550M on June 20, 2024, Ondo Finance has become the major player in RWA.

What Ondo Finance offers :

The USDY token is a tokenized financial note, backed by short-term US Treasury bills. This token aims to offer the accessibility, utility, and privacy of stablecoins while providing an attractive yield and protections for institutional-level investors. In other words, USDY is a secure tokenized debt, over-collateralized by short-term US Treasury bills (in addition to high-quality bank deposits).

The OUSG Fund is another financial product offered by the Ondo Finance protocol. Specifically, it is a tokenized representation of ownership in the “BlackRock iShares Short Treasury Bond ETF” (an exchange-traded fund or “ETF” managed by BlackRock).

More recently, Ondo Finance has introduced an alternative stablecoin called OMMF. This stablecoin is backed by US money market funds (MMF) and offers a daily yield in the form of new OMMF tokens.

What would Ondo Finance bring to Gnosis Chain ?

To begin with, Ondo Finance is deployed on 9 blockchains, both EVM and non-EVM, so it will not be a problem for them to build on Gnosis Chain. Their assets are of high quality, notably stored by the giant BlackRock. They are regulated, and their Smart Contracts are audited. The team has experience, including former members from MakerDAO, Goldman Sachs, and more.

The Dapp continues to grow, backed by giants like Coinbase Venture and Pantera Capital. The $ONDO token is in excellent shape despite the capricious market.

What can Gnosis Chain gain from this ?

- New users attracted by Ondo Finance’s services

- More liquidity and volume for the blockchain

- Developing DeFi within Gnosis Chain:

- A badge of trust for users seeing the giant Ondo arrive on the Owl Chain

- Another RWA service besides RealT or Angle Protocol to provide diversification

- Exposure to RWA without leaving Gnosis Chain

Realization :

- Directly mint $USDY, $OUSG, $OMMF from Gnosis Chain

- $USDY, $OUSG, $OMMF available for lending/borrowing on Spark Finance

How to solicit them ?

- By showing them that Gnosis Chain is the future hub of RWAs, thanks to RealT, Angle Protocol, and Gnosis Pay.

- The Gnosis Chain is very secure, especially with the future integration of an MEV Blocker by Shutter Protocol.

- By a grant to developper and early user of Ondo Finance on Gnosis Chain.

To conclude :

The integration of Ondo Finance can only be beneficial, both for Ondo, which will reach a broader audience, and for Gnosis Chain, which will see its metrics/stats increase, as well as for the end user who will have access to these products.

Thank you for reading my first topic, and we can discuss it in the comments!