Hi Folks – This is my first forum discussion and potential GIP, so happy to take feedback from any of the Gnosis team on style/substance.

As of last notice, the Gnosis Treasury (managed by Karpatkey) holds 64,124 wstETH (~$130mm) and 5,725 stETH (~$10mm), 712 rETH (~$1.4mm), and 18,622 ETH. Full report here: 20230424 - karpatkey's Weekly Report on GnosisDAO Farms.pdf - Google Drive

I should note that the majority of the wstETH is being used as collateral in the Gnosis Maker vault, where we have loan drawings of ~$22mm. 550 of the ETH are in Agave for loans as well.

This leaves sizeable unused ETH, stETH, and wstETH. Given that Gnosis Chain is all about decentralization, I am wondering if it makes sense to move some of our LSDs or ETH into RocketPool. Looking at the RocketPool validator Queue, the protocol has room for a deposit of up to ~60k ETH, so more than enough room for our supplied ETH to immediately be staked with hundreds of decentralized validators. Current minipool queue here: Rocket Pool Explorer.

I think there are two ways here to show support for Rocketpool’s mission to decentralize the validator set while also benefiting the Gnosis DAO Treasury. (Find RocketPool’s mission statement here: Rocket Pool - Decentralised Ethereum Staking Protocol)

1 (easiest) – supply ETH for rETH to RocketPool Protocol

2 (more meaningful, harder) – once Lido enables withdrawals, unstake some stETH and deposit ETH to RocketPool. This would reduce Lido’s dominance in the LSD market, spread ETH to a large validator set, and increase the decentralization of Ethereum’s validator set

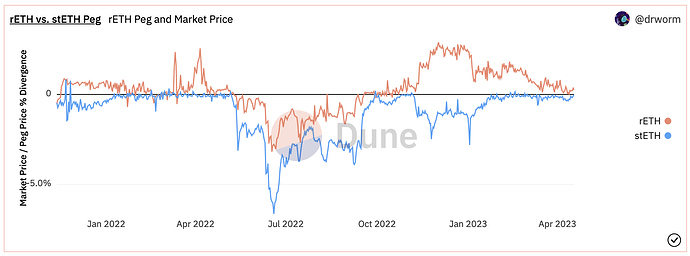

1 is the easiest for Gnosis DAO as it requires only one transaction (depositing ETH to RocketPool) but i do think that withdrawing stETH for ETH and depositing to Rocketpool sends a stronger message that we vote with our dollars for decentralization. I dont recommend we sell stETH to deposit in Rocketpool as the slight stETH discount pre-unlock would be a waste of Treasury funds. Better we wait for withdrawals.

Im hoping to get guidance/help from the Karpatkey team on this one as I dont have a perfect handle on where/how all of our LSDs and ETH is being used. Would love an opinion on what amount we can move without breaking loan positions etc.

Any/all feedback welcome!! Hoping to move this to Phase 2 at some point once this proposal is in good form.

Disclaimer: I hold GNO, RPL, ETH