I like the discussed ideas on how to decentralize the validators to Gnosis Chain, i.e. using cloud solution, incentivizing minority GNO holders with higher rewards. I also agree that we shall also keep in mind he geographical allocation of validators. Maybe it would be worthwhile giving out hardware for free (100% subsidy) in some jurisdictions for a commitment to stake for at least x years (lock period).

In this context I think we should also discuss the decentralization of GNO. If GNO is not sufficient decentralized, it may harm the Gnosis Chain ecosystem in the medium to long-run, either through legal actions and / or price impacts.

Current Situation

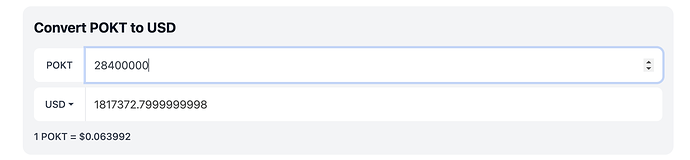

Most (> 50%) for voting eligible circulating GNO supply of 1.60M GNO (2.58M circulating supply, less Gnosis DAO treasury holdings (614k GNO), less major bridging funds (0x88ad09518695c6c3712ac10a214be5109a655671) (369k GNO)) is held by 10-15 addresses on Mainnet (ignoring Gnosis Chain here, as most of the GNO there is held by Gnosis DAO). As per my analysis, the main holders are

- Gnosis Builders (Gnosis VC arm),

- Consensys Inc.,

- former xDAI Team,

- Gnosis Ltd Management,

holding one or more of these addresses (“GNO Whales”).

Quorum threshold for passing a proposal is 75k. As per my analysis, each of these GNO Whales own more than quorum, essentially giving them power over Gnosis DAO and hence most of GNO’s current value.

In addition, signers to the Gnosis multi-sigs (e.g. Gnosis DAO Parent Safe [0x0da0c3e52c977ed3cbc641ff02dd271c3ed55afe]) are not made public, i.e. are untransparent, and may also move effective control to one ore multiple of these GNO Whales. Signers have been designated upon creation of these Safes by Gnosis Ltd’s Management, which let’s assume that control may still be with these parties.

Starting Point for Analyses (mainnet):

Messari

Deep DAO

Thoughts

First, I’d like to start with acknowledging that sufficient decentralization of the native chain token is not a Gnosis only issue. I think Gnosis has done a better job than most of other DAOs / blockchains so far. Further, Gnosis Ltd’s Management has done an incredible job in developing state of the art Web3 infrastructure thus far, and therefore shall be credited with some trust from the community.

However, on the other side, having four parties essentially determining the future of GNO may harm the ecosystem in the medium to long run. In theory, there is no point for a minority GNO holder (<10k GNO) to see GNO as a governance token, i.e. vote on proposals, as their vote won’t determine the outcome of a proposal. Further, with effectively no power over Gnosis DAO’s treasury, GNO is considered a high risk investment, as GNO Whales would be able to withdraw funds from Gnosis DAO within a short period of time, making staking less attractive to the average minority GNO holder.

Proposal

To further decentralize GNO’s value (respectively Gnosis DAO as major part of GNO’s value as of today), I propose to the community to work towards the following high-level mid-term goals. This obviously means that the existing GNO Whales give up power to some extent.

- open multi-sig signers on all Gnosis (DAO) Safes. Signers shall be assigned by the community in a transparent process.

- Limit GNO voting power by party by giving more voting power to minority GNO holders. Happy to discuss the implementation. Two ideas that come to my mind:

(a) create a voting GNO token that increases the voting power for minority GNO holders,

(b) limit GNO voting to X GNO by address and ask Gnosis DAO to engage a team that reviews the voting activity to avoid misuse.

Thoughts?