Summary

Under GIP-20, the GnosisDAO Treasury has been managed by karpatkey since its inception in January 2022. The GnosisDAO agreed to pay fees based on the yield farming results, i.e. Performance Fees, calculated as follows:

Yield farming fee = ( Weekly liquidity mining rewards + arbitrages - trades slippage - deposit/withdrawal fees - impermanent loss - gas fees) * percentage fee

However, given the swiftly changing crypto market, tracking impermanent loss on a weekly basis is impractical and inefficient for overall fee calculation. It was thus agreed to address this variable periodically, so it has been left out of all fees charged so far. This post suggests a compensation effort to the GnosisDAO for the losses incurred due to impermanent loss under karpatkey’s treasury management until June of 2023.

Abstract

Impermanent loss is the potential loss of value that liquidity providers in DEXs and AMMs may experience when the relative price of the tokens they provide liquidity for changes, as the value of providing liquidity becomes smaller relative to simply holding the assets. It occurs due to market fluctuations and arbitrage opportunities and can be partially mitigated by the trading fees collected.

It is important to understand that impermanent loss is an inherent risk that cannot be avoided entirely. In the case of GnosisDAO, it is worth noting that several positions are part of the larger plan of building the GNO value proposition as well as developing the Gnosis ecosystem.

This post aims to address the impact of impermanent loss in the GnosisDAO Treasury and compensate for the unaccounted losses by adjusting the treasury management fees.

Methodology

In simpler terms, impermanent loss can be seen as the difference between holding a pair of assets and providing the pair of assets as liquidity for a pool. The approach used to calculate impermanent loss involved analysing the variations in token balances for the three semesters from the 1st of January 2022 to the 30th of June 2023 separately, to account for the different pricing agreed upon GIP-20 and GIP-58. The results were then adjusted based on the relevant prices.

- Final Balance = amount of tokens after providing liquidity for the pool

- Initial Balance = amount of tokens before providing liquidity for the pool

→ ∆ Balance = Final Balance - Initial Balance

- IL Result = ∑ ( ∆ BalanceAsset1 * priceAsset1 + ∆ BalanceAsset2 * priceAsset2 )

→ Performance Fee = IL Result * Percentage fee

(Note: Asset1 and Asset2 represent the two assets in the liquidity pool)

The calculations exclude earned rewards, which often offset the impermanent loss outcome. As karpatkey has already collected their portion of these earnings, the current focus is on deducting the losses to determine net income accurately.

It is also worth noting that the Performance Fee is different for each semester.

- GIP-20: Period Jan-2022 to Jun-2022 (1st semester) | Percentage fee → 3%

- GIP-58: Period Jul-2022 to Jun-2023 (2nd and 3rd semesters) | Percentage fee → 20%

Results

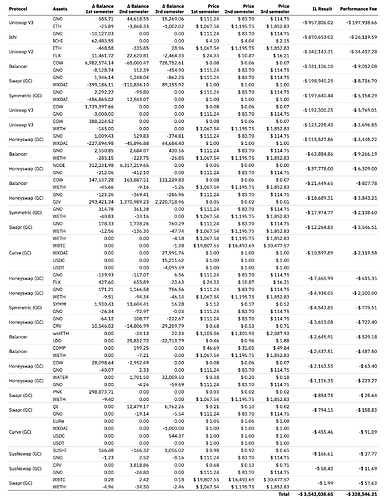

The following table presents a comprehensive overview of the impermanent loss calculations for the GnosisDAO Treasury from the 1st of January 2022 to the 30th of June 2023.

Despite experiencing unrealized losses of $3.5 million due to impermanent loss, the GnosisDAO Treasury was able to generate revenues of approximately $16 million in 2022 and $6 million in 2023 so far, effectively compensating for the losses incurred.

We present below the rationale for participating in the pools:

- Uniswap v3: the GNO/ETH pool is the one mainly supporting GNO’s price and is critical for building the GnosisDAO ecosystem.

- Ichi: bring the project to Gnosis Chain while increasing GNO liquidity and providing different use cases. The loss came from a price manipulation attack (post-mortem analysis).

- Reflexer: the project is supported by the community and aligned with GnosisDAO’s principles regarding decentralisation. The pool has become unbalanced and the yield returns are no longer attractive enough.

- COW pools: supporting the project is within the objectives of GnosisDAO. The high rewards provided in COW, BAL, and AURA incentives outperformed the effects of impermanent loss.

- Honeyswap, Swapr, and Symmetric: provide GNO use cases and market liquidity to support and help with the growth of the Gnosis Chain.

Next steps

Following the launch of our new report, no further reimbursements like this will be needed in the future as the impact of impermanent loss will be addressed on a monthly basis and directly accounted for in the charges, which will now match the same calculation cycle for increased transparency. We’ll also improve the way we calculate results as well as present the variations’ breakdown that occurs each month.

Through this post, we aim to demonstrate our commitment to the GnosisDAO by rectifying the charged expenses related to impermanent loss. According to the calculations presented above:

- Yield farming fees Jan-2022 to Jun-2023 = $2,823,753.97

- Yield farming fees Jan-2022 to Jun-2023 (IL adjusted) = $2,495,207.76

→ Compensation result = $328,546.21

We propose to waive all treasury management fees until the total amount is fully refunded.