GIP-58: Karpatkey DAO Service Extension

- Let’s do this!

- Make no changes

0 voters

GIP: 58

title: Karpatkey DAO Service Extension

author: Karpatkey

type: Meta

created: 2022-06-30

replaces (*optional): GIP-20

Simple Summary

After the GIP-20 approval, the development and sustainable growth of the Gnosis Chain became a top priority for GnosisDAO. Even though efficient treasury management is still a must for GnosisDAO’s evolution, the scope of our work has to encompass more in order to take the Gnosis Chain to the next level, co-creating a safe, trustworthy ecosystem.

We increased our headcount and went beyond the scope of GIP-20 to be able to adequately cater to Gnosis’ current needs.

This proposal focuses on the Gnosis Chain and treasury development, seeking to reduce risk exposure, develop anti-liquidation bots to increase capital efficiency, update our security protocol, run security audits, further improve our reporting, execute and manage a sustainable rewards plan for new and existing protocols in the GC, and scout attractive new ones to make them part of the GC.

Abstract

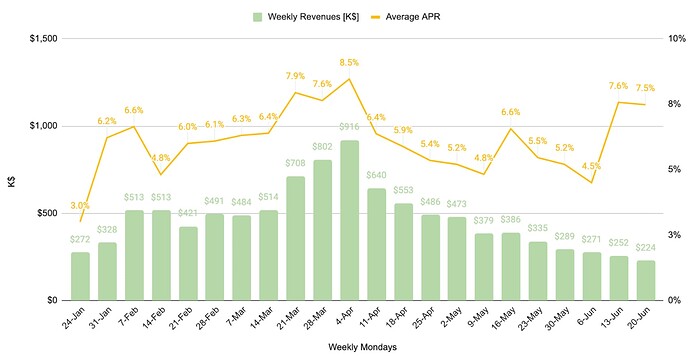

GnosisDAO’s treasury has been growing consistently since its management was delegated to Karpatkey DAO.

However, with the continuous growth of the Gnosis Chain, the number and complexity of the challenges faced by GnosisDAO have increased substantially. Our goals, detailed below, are aligned with the successful overcoming of those challenges:

Karpatkey’s goals for 2022/2023

- Steward a healthy DeFi ecosystem to act as the backbone of the Gnosis Chain for mass adoption applications

- Improve the value proposition of GNO and the GnosisDAO treasury

- Actively support the portfolio projects of the GnosisDAO

Structural Upgrade

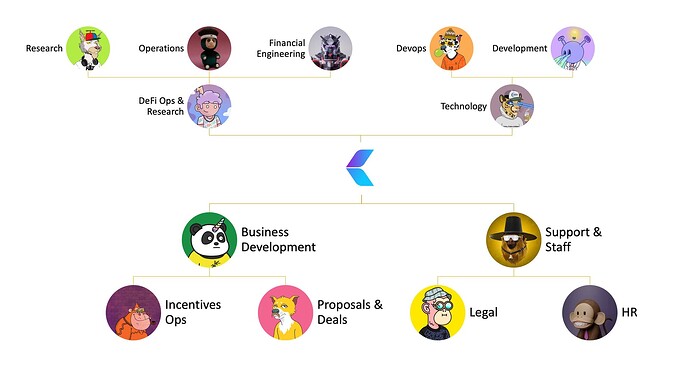

To achieve the goals mentioned above, we have created a technology team and expanded our Business Development team to develop the Gnosis Chain.

Motivation

Professional treasury management carried out by Karpatkey has yielded positive results, eliminating significant workload on GnosisDAO’s side, but a series of additional needs have arisen as GnosisDAO has grown and the DeFi ecosystem matured. Carrying out the tasks required to meet those needs entailed a substantial amount of workload that is unrelated with GnosisDAO’s core business and would reduce its focus and hinder its growth. Karpatkey DAO has been proactively meeting such needs, enlarging its scope of work, and consequently allocating more resources to meet them.

Specification

In order to better assist GnosisDAO in its current phase of growth, Karpatkey DAO carried out the following services:

Currently Provided Services

Treasury Management

- DeFi strategies research / Alpha research

- Treasury execution:

- Non self-executable GnosisDAO proposals

- Gnosis Chain new protocols liquidity bootstrapping

- Position optimisations and creation of new ones

- Security protocol design and security audit for the tx execution process. Emergency protocol design and maintenance

- Continuous loans evaluation and management to prevent liquidation

- GNO liquidity provision and maintenance: Monitoring the liquidity provision on mainnet and GC, checking the price impact for swaps

- DeFi user experience improvement on Gnosis Chain: Bug reporting and integrations

- Reporting:

- Periodic reporting

- Dashboard creation and maintenance to monitor the yield of investments, rewards distribution and overall treasury growth trend, health and diversification

- Gnosis Chain ecosystem health monitoring

- Performance analysis of the different bridges from and to the GC

- Bridge GNO and market make it on other networks

- Research on assets in need of improved liquidity in terms of bridges to GC

Business Development

- Gnosis Chain Incentives Program design and implementation:

- Business Development, rewards management and execution

- Technical execution/rewards transfer

- DeFi investment research related to proposals

- Cross-DAO Governance Participation delegated by GnosisDAO including

- Research on the governance processes of other DAOs

- Partnerships with protocols & DAOs: strategic token swaps with other protocols, negotiation and proposal presentation

- Social media and micro-targeted news spreading.

Technology

- Early alerts messaging system

- Processes automation for increased reliability, efficiency and scalability

- Security review and risk analysis of new protocols

- Bridge infrastructure and routers maintenance, liquidity balancing

- Development of money market liquidation keepers for Gnosis Chain’s money markets.

Services in the pipeline for 2022

Treasury Management

- Secure funding for the development of GC. Evaluation and Management of new collateralized and uncollateralized loans, ie Makerdao, Aave, Element, Yield, Porter Maple, Truefi, etc.

- GnosisDAO’s portfolio data analytics, dashboards and reports

- Positioning GNO on other networks, adding exchanges, money markets

- GNO valuation model.

Technology

- Trust minimisation of treasury execution: elimination of GnosisDAO trusted signers through the use of guard-scope modules, a joint effort with the Zodiac team

- Development of money market liquidation keepers for Gnosis Chain’s money markets

- Reports automation and frontend development

- Technical audits: Hiring, management and follow up of audits for new small projects in the GnosisDAO’s portfolio

- Keeper infrastructure setup and maintenance for additional capital efficiency. The anti-liquidation bots will allow us to minimise collateral without increasing liquidation risk, which will allow us to invest assets that would otherwise be locked, further increasing the treasury’s growth by $30-50MM a year.

Redesigned Fee Structure

Management fee

The provision of new services during the last quarter has decoupled Karpatkey’s cost structure from investments’ yield. Therefore, a yearly management fee (in monthly instalments) of 1% of the AUM would be charged to finance the services detailed above. This fee will be paid in stablecoins.

Performance fee

We will charge 20% of the yield obtained as a performance fee each month. This fee will be paid in ETH or stETH.

Past Work

- $645k would be charged for the Gnosis Chain related work (additional to GIP-20) which was carried out during 2022.

Duration & Termination

This agreement has an indeterminate time duration since it is approved by way of the GnosisDAO governance mechanism unless any renegotiation and/or termination of this agreement occurs, always through the governance mechanisms of GnosisDAO.

The GnosisDAO may terminate Karpatkey DAO’s engagement under this agreement for any reason by way of Governance Mechanism.

Kapatkey DAO may terminate this agreement upon four week’s’ notice posted by …. as a new discussion thread in the GnosisDAO forum.

Regular fees will be collected until the day of termination independently which party made the decision.

Either GnosisDAO or Karpatkey DAO may at any time terminate this engagement with immediate effect, without previous notification, in any of the following circumstances:

a. If the other party incurs a material breach of any of their obligations under this proposal

b. If the other party commits any act of fraud or dishonesty, or acts in a manner which brings or is likely to bring the other party into disrepute or materially affect its interests

c. If the other party becomes unable to pay its debts, admits its inability to pay its debts, enters into administration, becomes insolvent, or enters into a similar arrangement

d. A competent regulator considers the services rendered under this agreement in breach of the law.

Karpatkey DAO will be entitled to terminate this agreement, without previous notification, if GnosisDAO fails to make payments for more than 3 consecutive months.

Custody of Funds

Karpatkey DAO is not a custodian of funds. The funds will be in possession of the GnosisDAO at all times.

Likewise, Karpatkey DAO is not responsible for loss of funds caused by the existence, identification and/or exploitation of vulnerabilities through hacks, mining attacks (including double-spend attacks, majority mining power attacks and “selfish-mining” attacks), sophisticated cyber-attacks, distributed denials of service or other security breaches, attacks or deficiencies with smart contracts or protocols which are not owned by GnosisDAO or Karpatkey DAO.

GnosisDAO is fully aware of, understands and agrees to assume all the risks associated with the Treasury Management.

Karpatkey DAO assumes the risks associated with contractors.

Both parties have to take their own security measures for the addresses used to make the DeFi transactions to avoid a loss of access.

Entire Agreement

a. This Agreement constitutes the entire and exclusive agreement between the Parties regarding its subject matter and supersedes and replaces any previous or contemporaneous written or oral contract, promises, assurances, warranty, representation or understanding regarding its subject matter, whether written, coded or oral.

b. Each Party acknowledges that in entering into this Agreement they do not rely on, and shall have no remedy in respect of, any statement, representation, assurance or warranty (whether made innocently or negligently) that is not set out in this Agreement.

The plans outlined in this proposal are subject to discussion by the GnosisDAO and may need to be (re)structured to take account of legal, regulatory, or technical developments as well as governance considerations. This document should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in any transactions.

Edit July 13th 2022:

- Removed GNO grants

- Management fee will be paid in stablecoins, performance fee will be paid in ETH or stETH

This proposal is now on Snapshot !

Edit July 20th 2022:

Removed cancellation penalty clause