Gnosis has a great visualiser for Gnosis impact (https://impact.gnosis.io/). However it is difficult to extract an accurate estimate of the Gnosis impact of a decision using Omen prediction markets because Omen markets facilitate trade in the wrong token pairs for this purpose. This makes them inefficient for liquidity providers looking to consult the market for the impact of a decision and difficult for users to trade on the impact of a decision. These issues mean that the data displayed by the visualiser is often of limited use.

These issues can be addressed by funding “conditional investment” markets in token pairs not supported by Omen - see this thread for details.

Using the Gnosis conditional token explorer (https://cte.gnosis.io/) and a DEX like Uniswap it is possible to create conditional investment markets. However, the user experience for traders is poor. Anyone looking to conditionally invest in a proposal would need to split collateral using the conditional token explorer and then find the appropriate token pair on the exchange to make the swap.

To address this, I am proposing a conditional investment trading interface that simplifies the process of making conditional investments. Like the current gnosis impact visualisation, I hope that it can be integrated with snapshot to enable trading on the impact of a proposal, rather than simply viewing it.

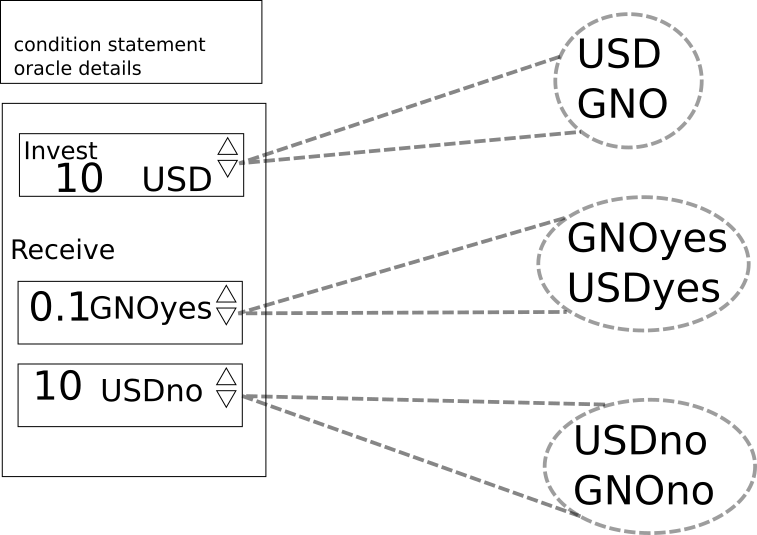

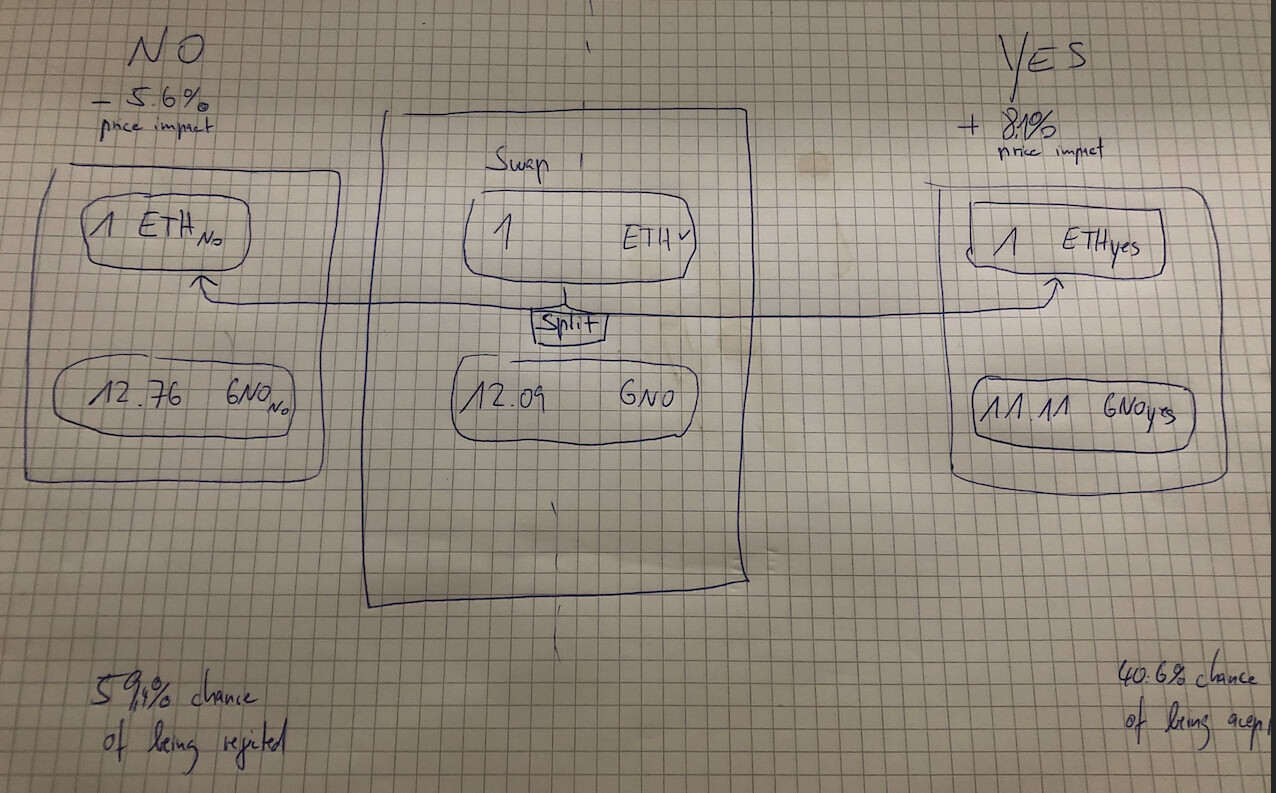

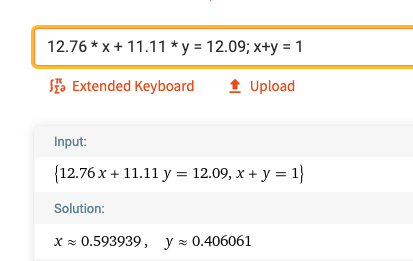

Similar to the way Gnosis Impact visualisations are created by providing the details of an event and associated Omen markets, a trading interface for a particular event would be created by providing an event link and a list of associated token addresses as parameters. For this event, the interface would look something like this:

Under the hood, the trade indicated would split the invested collateral and then trade the USDyes for GNOyes using a DEX like uniswap. Liquidity provision would still require someone to manually split and invest tokens using whatever tools already exist for this purpose. I think that as conditional investment is in an experimental phase, it is more important to make things simple for users than liquidity providers.

Also like Gnosis Impact, I think it would be good if event specific trading interfaces could be integrated with snapshot, as one of the major use cases will be to support DAO decision making.

I am planning to apply for a GECO grant to build this myself. It will be my first ethereum project so I am hoping to keep the scope limited.

I’m keen to hear feedback and to know if anyone is interested in collaborating.