- In favor

- Against

GIP: 128

title: Should GnosisDAO fund Gnosis Ltd with $30m/ year?

author: Friederike Ernst (@ernst)

status: Phase-2

type: Funding

created: 2025-07-12

Summary

This proposal requests a grant with an annual budget of $30 million in stablecoins, disbursed quarterly, to fund the operations of Gnosis Ltd — now formally a quasi-foundation — as the primary builder of Gnosis infrastructure and ecosystem products.

Gnosis Ltd played a foundational role in the Gnosis ecosystem: it conducted the original GNO token sale in 2017, and in 2021, divested 150k ETH, 8 million GNO, and several third-party token positions into the newly formed GnosisDAO. Since then, it has operated without requesting funding, relying on its retained assets.

As of early 2025, Gnosis Ltd has successfully completed its legal transformation into a quasi foundation (a Company Ltd by guarantee without share capital), eliminating the dual equity-token structure and converting the entity into a purely purpose driven organization, with the objective to further the Gnosis ecosystem and decentralised technologies more generally. With the transition complete and reserves running low, this proposal marks its first funding request to the DAO.

While many entities contribute, Gnosis Ltd is still the primary development and operations entity in the Gnosis ecosystem. It builds and maintains the core infrastructure that powers Gnosis Chain, and develops and supports major products, onboarding, BD, and governance tooling for the community.

This proposal ensures continuity and momentum for critical initiatives, while maintaining full alignment with the DAO’s long-term interests.

Motivation

We’re proposing an important change in how we position Gnosis. Going forward, Gnosis would become a core consumer-facing brand, rooted in integrity, trusted execution, and user agency. The story we want to tell is no longer just about open infrastructure, but about building fair, user-owned financial systems.

We believe we can gain stronger traction by fully committing to our most compelling narrative, rather than trying to be everything at once. We now have all the key components in place, and bringing them together under one cohesive brand will not only clarify our message but also strengthen the platforms that power it.

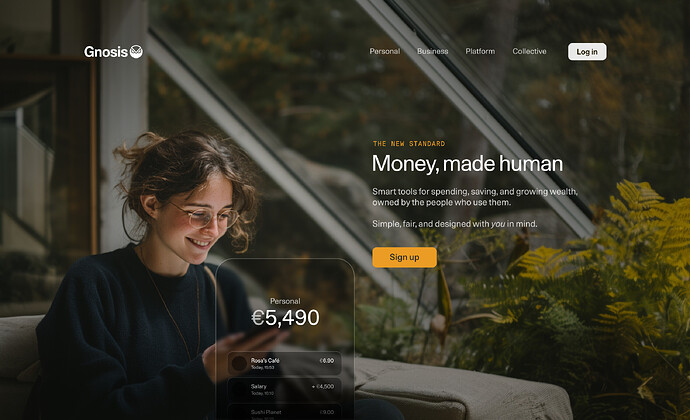

We propose renaming the Metri app to Gnosis. It would become the central retail interface to everything we build. All core offerings — Gnosis [i.e., the wallet], HQ, Gnosis Chain, and Gnosis Pay — would live under the Gnosis domain and share a unified brand identity. Only Circles retains its own branding and domain, while continuing to operate on Gnosis Chain as a core ecosystem project.

This structure is loosely reflected in the placeholder landing mockup we created to illustrate its potential appearance. In that concept:

Personal → Wallet (fka Metri)

Business → Gnosis HQ

Platform → A foldout menu linking to Gnosis Chain, Gnosis Pay, Circles

Collective → A foldout menu to Gnosis Labs, Gnosis VC, Treasury, Forum, Blog, Newsletter

Gnosis Chain remains the foundational platform: resilient, credibly neutral, and deeply integrated with local stablecoins and payment rails. Gnosis Pay enables on-chain assets in self-custody to be used in everyday payments. It operates B2B and powers apps like Gnosis, Zeal, and Picnic. GNO is the unifying asset across all these efforts — value creation accrues to GNO. There will be no further spinoffs.

Scope of Work & Budget Breakdown

The requested grant will cover Gnosis Ltd’s forecasted expenditure for a 12-month period, starting July 1, 2025. Disbursements will occur quarterly, with each installment totaling $7.5M in stablecoins. Funds will be sent to Gnosis Ltd’s Gnosis Safe.

Below is a high-level breakdown of Gnosis Ltd’s budget for the next 12 months. There are currently 127 team members and we’re expecting to onboard 25 more in the coming year.

| Product Development | $15.5m |

|---|---|

| Gnosis Pay | $8.0m |

| Circles | $1.5m |

| Gnosis (fka metri) | $3.1m |

| Gnosis Business (fka HQ) | $2.9m |

| Gnosis Chain and Core Infrastructure | $3.6m |

|---|---|

| Personnel (chain, bridges, devops, audits, analytics) | $1.95m |

| Hosting and cloud providers | $0.65m |

| Security audits and bug bounties | $0.3m |

| Gnosisscan | $0.4m |

| Safe network support | $0.18m |

| tenderly network support | $0.1m |

| dune network support | $0.02m |

| BD and DevRel | $3.85m |

|---|---|

| Personnel | $0.85m |

| Integrations (CEX, stablecoins, onramps) | $2.5m |

| Event sponsorships | $0.4m |

| Open internet clubs | $0.1m |

| Marketing and design | $2.035m |

|---|---|

| Personnel | $1.05m |

| Marketing spent | $0.835m |

| PR agency | $0.15m |

| Gnosis Labs | $0.4m |

|---|---|

| Personnel | $0.4m |

| HR & ops | $0.45m |

|---|---|

| Personnel | $0.45m |

| Legal | $1.625m |

|---|---|

| Personnel | $1.025m |

| External advisory | $0.6m |

| Finance | $0.59m |

|---|---|

| Personnel | $0.41m |

| External advisory | $0.11m |

| Software | $0.07m |

| Personnel overhead | $1.5m |

|---|---|

| Travel, equipment, software, offices |

| Management | $0.45m |

|---|---|

| M/S/F | $0.15m each |

Reporting and Accountability

-

Gnosis Ltd will publish quarterly reports detailing spend and progress across all budget categories.

-

No additional oversight structures are proposed; DAO token holders retain ultimate accountability through governance.

-

Future funding will depend on DAO review of outcomes and updated proposals.

Closing Note

Gnosis Ltd seeded the DAO. This proposal ensures the DAO can continue to rely on it. Onwards and upwards! ![]()