Should Gnosis aim to establish a governance token for Gnosis Safe?

GIP: 2

title: Implement SAFE Token Model

author: Anna George, Lukas Schor

status: Pending

type: Meta

created: 2020-11-16

- Yes: Implement SAFE Token

- No: Make no change

Abstract

Gnosis Safe is a new account standard and open gateway to the Internet of Value. In order to establish the Safe as a community-owned public good, we plan to distribute the SAFE governance token. The SAFE Token will be used for voting, curation and rewards for ecosystem contributions.

Even though governance over parts of the Safe ecosystem and product offering will be community-driven, Gnosis Safe will always remain a fully self-custodial asset management solution, in which the user is in full control.

This proposal is about whether the Gnosis team should go ahead working out a Safe Token Model.

Motivation

Though we are building Gnosis Safe as an open system that can be re-used and extended by anyone, we recognize that Gnosis still holds a dominant position in the Safe ecosystem. The main reason for this is that Gnosis currently holds the “trust monopoly” for the curation and promotion of all core components of Gnosis Safe. Here are a few examples:

- Interfaces: Gnosis hosts the interfaces most commonly used to interact with Gnosis Safes.

- Smart contracts: Gnosis is the main contributor and publisher of smart contract updates.

- Safe Apps: Gnosis curates the list of Safe Apps displayed to the users through our interfaces.

SAFE Token

In order to enshrine Gnosis Safe as an end-to-end community project, we are proposing to launch the SAFE governance token. We consider the SAFE Token as an essential tool to decentralize the trust monopoly held by Gnosis. We believe this will firmly establish Gnosis Safe as a public good and community-owned infrastructure. SAFE Tokens are not an investment product. Instead, SAFE Token will be distributed to stakeholders of the Gnosis Safe ecosystem that are interested in shaping the future of Gnosis Safe.

SAFE Governance

We envision the SAFE Token will be used to govern and curate essential infrastructure components of the Gnosis Safe ecosystem, including:

Assets

- SAFE Treasury: SAFE holders will be able to reward important ecosystem developments via the SAFE Treasury.

- ENS domain “safe.eth”: The ENS domain “safe.eth” will be used in the future to point to a Safe Multisig interface deployed on IPFS, but it might be used for other purposes as well.

Curation

- Safe Apps: SAFE Token holders will curate the list of trusted Safe Apps that appear by default in the Gnosis Safe web interface and update existing ones to newer versions.

- Safe Contracts: After successful audits and bug bounty periods, the community should be vetting updates to the Safe Contracts and define which is the recommended contract version at any point in time.

- Safe Modules: Gnosis Safe smart contracts can be extended with modules to enable custom access/control schemes. SAFE holders will be able to curate and validate community-built Safe Modules.

Signaling

-

Safe Apps: Show interest in a specific Safe App idea to educate developers about user preference and demand.

-

Infrastructure: Help prioritize tasks in Safe-related Github repositories (see example).

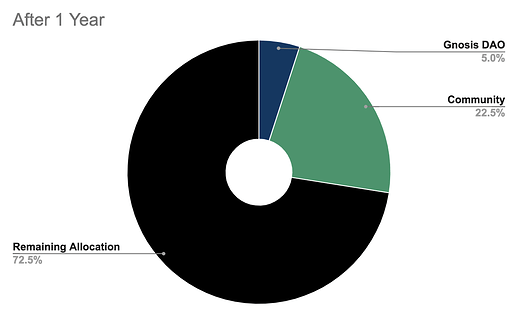

There is no immediate need to have all activities described above to be community-governed from day one. Rather, Gnosis will take a cautious and progressive approach, decentralizing governance over different components successively over time to prevent any disruptions to users. The governance process would likely be conducted using a SAFE Treasury app that allows SAFE holders to vote on proposals. The transition to open governance is a long term goal, and we aim to establish a sustainable governance system that lasts for decades.

Gnosis Safe will always remain a fully self-custodial asset management solution, in which the user is in full control. The governance enabled through the SAFE Token is limited to curation activities and building initiatives that drive the Gnosis Safe ecosystem forward.

SAFE Token Distribution

Though the proposal is about whether a Gnosis SAFE token should be investigated, in the following we outline specification ideas as to how such tokens could be distributed, assuming the proposal to issue Gnosis SAFE tokens finds your support and will end up being implemented.

When designing the SAFE Token distribution model, we followed this principle:

Distribute the SAFE Token fairly and sustainably across a wide range of relevant stakeholders to foster active governance of the Gnosis Safe ecosystem.

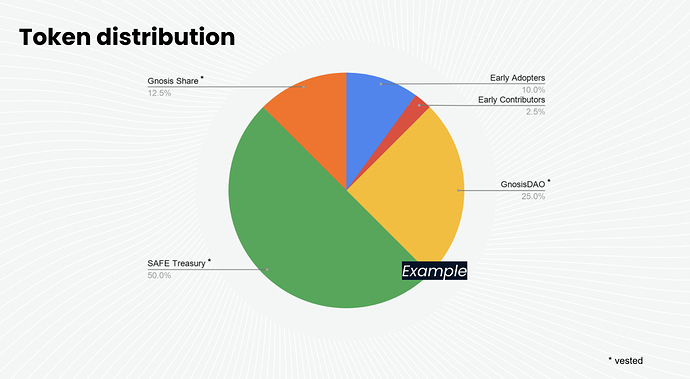

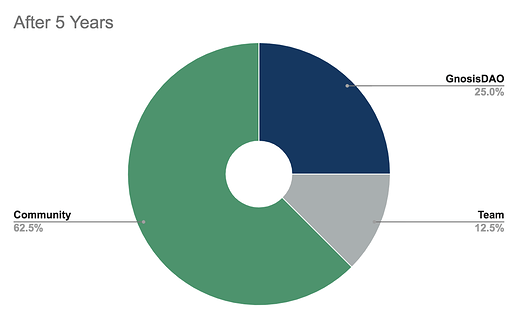

At genesis, 1 billion SAFE Tokens are proposed to be minted with the following distribution:

- 10% Early Adopters (Users)

- Early adopters are retrospectively awarded for funds stored and transactions made in the past according to a predetermined formula. Additionally, there will be an initial “liquidity mining” launch program for users.

- 2.5% Early Ecosystem Contributors

- Early contributors are retrospectively awarded for ecosystem contributions according to a list of contributions consolidated by Gnosis.

- 25% GnosisDAO

- To be decided (see options in “Benefits for GnosisDAO Holders” section)

- 50% SAFE Treasury

- SAFE Treasury is a vehicle for rewarding future ecosystem contributions initially controlled by Gnosis, but over time, it will be governed by SAFE Holders. The SAFE Treasury would have a 10 years vesting period. It might also be an option to introduce a yearly inflation rate of 1-3%, which would be granted to the SAFE Treasury to sustain its ability to reward contributions beyond the vesting period.

- 12.5% Gnosis Share

- Gnosis Share is incentivising Gnosis and its staff as core maintainers to have aligned incentives and long term commitment to the SAFE Token and the Safe ecosystem. Gnosis Share would have a 5 years vesting period.

Relationship between SAFE Tokens and GNO Tokens

To recognise the importance of GNO Tokens in the development of Gnosis Safe, we propose that 25% of the total SAFE Token supply shall accrue to GNO Tokens. This can be achieved through various ways, including a combination of:

- Direct vesting to GnosisDAO: SAFE Tokens are vested into the GnosisDAO Treasury over a period of time via a vesting smart contract.

- Uniswap Pool Liquidity Shares: SAFE Tokens are locked in a Uniswap liquidity pool and are matched by GnosisDAO with GNO Tokens. The resulting liquidity shares are then split between GnosisDAO and the SAFE Treasury to assure mutual incentive alignment.

- Bonding curve: A bonding curve is set up, issuing SAFE Tokens for GNO Tokens at an increasing exchange rate. If demand for SAFE Tokens increases, this results in an increased demand for GNO Tokens.

- Initial price finding and aligning interest: To find a fair initial price, we propose to conduct an initial price finding for GnosisDAO’s SAFE Token share on Mesa. The GNO Tokens received through this are given to the SAFE Treasury to ensure their aligned interest with GnosisDAO.

Which options do you approve?

- Direct Vesting

- Uniswap LP Shares

- Bonding Curve

- Initial Price Finding

Disclaimer

The plans outlined in this proposal are subject to discussion and change. They may also need to be (re)structured to take account of legal, regulatory, or technical developments as well as governance considerations. This document should not be taken as the basis for making investment decisions, nor be construed as a recommendation to engage in any transactions. You are solely responsible for your own investment decisions and transactions.