GNO Utility and Value Proposition

With the GIP16 proposal that suggested a merger between xDAI and Gnosis, many questions have arisen about the utility of the GNO token. The Snapshot proposals from both teams, xDAI & Gnosis, have since passed successfully, paving the way for Gnosis Chain.

This post aims to shed some light on the main value propositions and utility of the GNO token beyond governance. The post will be updated periodically. Below are the main use cases for the GNO token within the Gnosis Chain and GnosisDAO ecosystem.

GNO as staking token for the Gnosis Chain

GNO will be the staking token for Gnosis Chain. To understand what Gnosis Chain aspires to be, read this Tweet thread from @mkoeppelmann on what role Gnosis Chain should play in the wider Ethereum ecosystem.

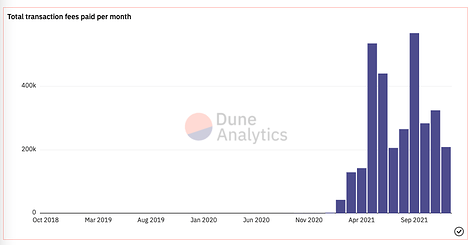

Since xDAI’s inception back in November 2020, the chain has seen a significant amount of activity. Since May 2021, transaction fees have exceeded 200k xDAI every month, with some months seeing fees over 500k xDAI. Until EIP-1559 these fees went to the validators, now they are partially burned and partially paid out to the validators. Burning xDAI leaves “orphaned” DAI on mainnet that are used to buy back and burn STAKE (soon GNO) – this means both the burned and the disbursed part of the fees directly benefit GNO holders.

Significant revenue is also generated by the bridges.

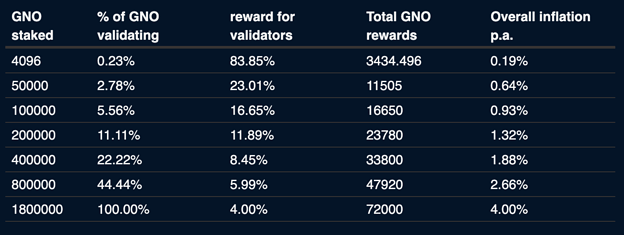

The Gnosis Beacon Chain is live and allows any GNO holder to become a validator. The minimum requirement to run a validator is 1 GNO. Please find a rewards table with different validator scenarios below.

High yields can be expected, depending on the number of validators. If you are interested in running a node, check out the official documentation for more information. If you are interested in the technical details of the Gnosis Beacon Chain, check out the official Github organization. Very soon a DappNode.io package will be released, which will allow a much-simplified validator user experience for everyone.

Airdrops

GNO holders will also benefit from projects incubated within Gnosis that are in the process of spinning out. For example, as a GNO holder, you will be entitled to participate in CowSwap’s airdrop. As stated in the proposal submitted to the GnosisDAO, if the proposal passes, GNO token holders will get up to 20% of the total supply of CowSwap tokens. This 20% can be understood as follows:

- 5% as a direct airdrop to GNO holders. Snapshot for the airdrop was taken already.

- 5% as a vested airdrop to GNO holders who commit to holding their GNO for 1 year. This is completed. You were able to lock tokens here: https://lock.gnosis.io/

- 5% vested to GnosisDAO and thus under the direct control of GNO holders.

- 5% as investment options to buy vested COW tokens with GNO at a fully diluted valuation of $150M. Snapshot for this option was taken already.

All vesting periods are for 4 years with linear vesting.

For GNO Token holders the snapshot was taken on January 9th. GNO holdings on Ethereum as well as Gnosis Chain were eligible for the airdrop. If you wanted to participate in the potential airdrop of COW Tokens, you had to swap your STAKE on January 9th at the latest (you had time until January 9th midnight 24:00 UTC). All GBC validators were be eligible, as well as the following LP Token holders:

- Balancer v2 (Mainnet)

- Uniswap v3 (Mainnet)

- SushiSwap (Mainnet)

- HoneySwap (GnosisChain)

- Symmetric (GnosisChain)

- Swapr (GnosisChain)

- Elk (GnosisChain)

- SushiSwap (GnosisChain)

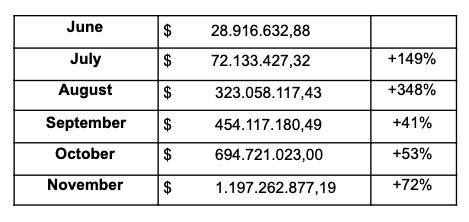

CowSwap had over $3.2 B in trading volume over the last months and is currently on par with ParaSwap. The growth rate CowSwap has experienced in their monthly trading volume is sizeable:

It has been proposed by community members that the Gnosis Safe will do a similar airdrop.

It is expected that as a staker on Gnosis Chain, you will be eligible for all airdrops.

A large diversified treasury that doesn’t rely on GNO

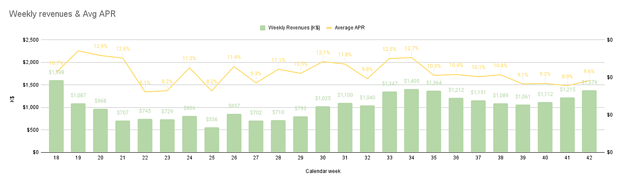

The transition of Gnosis from a traditional for-profit organization to a DAO has left the GnosisDAO with a substantial treasury to manage. It currently holds +165K ETH without considering seed investments, making it the largest existing DAO treasury without considering native tokens by https://openorgs.info/. The treasury is currently in two accounts, both controlled by GnosisDAO: Wallet 1, Wallet 2. In the chart below, you can see some of the weekly revenues such a treasury produces.

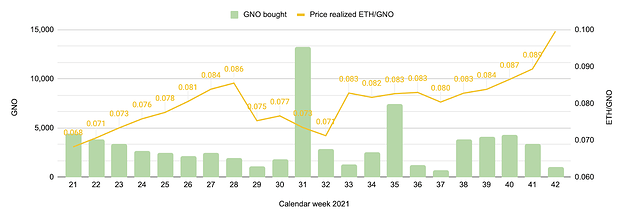

GnosisDAO’s treasury will be utilized for yield farming activities. The activities yield roughly $1M in income on a weekly basis, making GnosisDAO effectively an index fund for all of the innovation happening around Ethereum. For the last several months, a fraction of the non-strategic farming rewards were used to buy back GNO. 71115 GNO have been bought back since then. For more information about GnosisDAO treasury management read the treasury management proposal.

Current GNO distribution and GNO burn

As outlined in this post, the unknown release schedule for the outstanding GNO, which is over 80% of the total supply has always been a concern for investors. This is why GIP-19 proposes starting burning the remaining unutilized GNO.

Below is a breakdown of the current GNO token distribution and future allocations:

- 1.86M GNO are currently in circulation out of 10M total supply.

- 0.5M GNO started vesting linearly in November 2020 to Gnosis Ltd for the period of 5 years.

- 8M GNO started vesting linearly in November 2020 to Gnosis DAO for the period of 5 years.

- 285,398 GNO were taken out of the already vested GNO to GnosisDAO to allow the STAKE merger.

- 75,000 GNO were taken out of the already vested GNO to Gnosis Ltd to pay outstanding debt.

- The merger proposal also allocates 400k GNO to ecosystem development. This will be taken out of the vested GNO contract to GnosisDAO on an on-demand basis.

- To pay for the validator rewards on Gnosis Chain, additional GNO has to be reserved. Given a likely inflation rate of 1.32%, it is unlikely that more than 300K GNO will be needed in the foreseeable future (10 years). It might as well be the case that GNO will be deflationary at some point in the future thanks to EIP-1559.

Given these numbers, it seems unlikely that more than 3M GNO will ever be needed to maintain a thriving Gnosis ecosystem (1.86M circulating supply + 0.4M for ecosystem growth + 0.3M for validator rewards = 2.56M). The possibility to burn the remaining GNO should be considered. GIP-19 is the first step in this direction.

This post will be updated to reflect the latest changes to GNO.