GIP-86: Should the GnosisDAO commit to additional rETH usage in treasury operations?

- In Favour

- Against

0 voters

GIP: 86

title: Commit to Additional rETH Usage in Treasury Operations

author: AnotherViszla

status: Draft

type: Meta

created: 2023-05-10

Category

Governance/ Treasury

Executive Summary

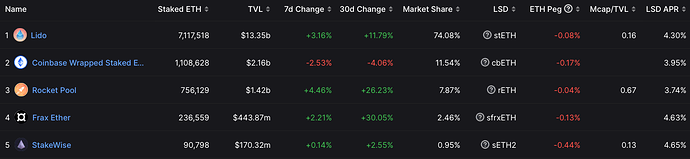

Gnosis DAO / Chain has decentralization as its core ethos, focusing on a distributed validator set for the chain and an open DAO structure run by GNO holders. Despite this, our Treasury has nearly all of its staked ETH assets sitting with LIDO as stETH. Given the success of RocketPool Protocol in creating a massively decentralized validator set through rETH and RPL, this proposal recommends that Gnosis DAO commit to moving at least 50% of their stETH holdings to rETH holdings over time in order to support Ethereum decentralization and reduce single protocol and “bad actor” risk that comes from Lido’s limited node set (29 nodes vs Rocket Pool’s 2550 and growing nodes).

Introduction

As of last notice, the Gnosis Treasury (managed by Karpatkey) holds 64,124 wstETH (~$130mm) and 5,725 stETH (~$10mm), 712 rETH (~$1.4mm), and 18,622 ETH. Full report here: 20230424 - karpatkey’s Weekly Report on GnosisDAO Farms.pdf - Google Drive This concentrated holding of a centralized staking provider token is a risk to Gnosis DAO and against the DAO’s core ethos of decentralization. This GIP is intended to direct Karpatkey to move to reduce stETH dependency and introduce additional rETH into their DeFi strategies in order to reduce risk to the DAO and provide support to decentralized ethereum staking.

Proposed Changes

The Gnosis DAO will instruct Karpatkey to reduce stETH dependency and increase staked ETH diversity, but WILL NOT dictate how this is best accomplished. Karpatkey, once instructed, will move forward with whatever strategies are in the best interest of the DAO to reduce stETH exposure and provide additional usage of rETH / RocketPool

Impact and Benefits

Over 500,000 ETH is currently staked with Rocket Pool, making it the third-largest TVL after Lido and Coinbase among liquid staking providers.

Diversification into rETH is wise for a number of reasons:

- Insurance

rETH has best-in-class resistance to black swan events, such as a massive slashing resulting from client bugs.

If a slashing event were to occur, funds are first deducted from the following sources before impacting rETH holders:

- Node operators’ ETH Share(~185k ETH)

- Node operators’ RPL Bonds(~200k ETH)

In contrast, Lido’s insurance fund only has around 6k stETH total, which (A) is stETH-denominated itself and (B) services 25 times more TVL.

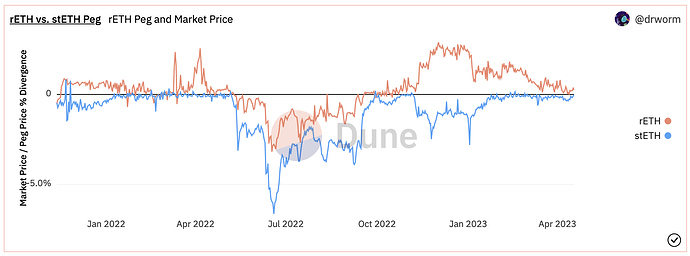

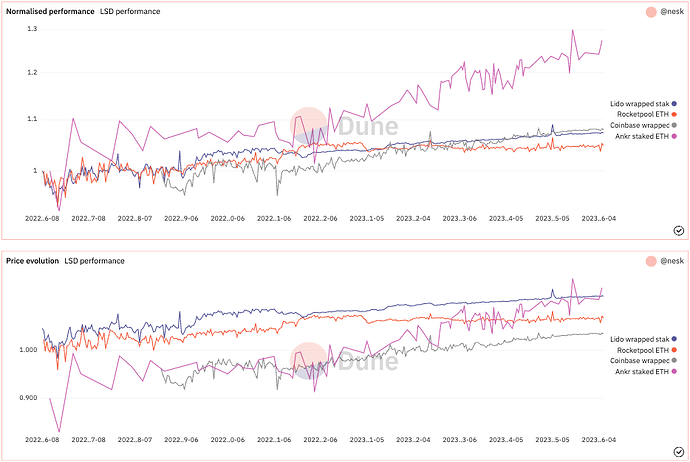

- Peg Performance

rETH has shown more resistance to negative de-peg than stETH.

Source: Dune Analytics

Both stETH and rETH are expected to be better able to maintain their respective pegs via significantly different methods. Lido will request their NOs to exit as needed to restore supply/demand balance. Rocket Pool will primarily balance using deep liquidity and market arbitrage opportunities for rETH holders. If needed, arbitrage opportunities for NOs that create/exit validators serve as guardrails for the peg.

- Tail Risks

Every liquid staking protocol has some level of risk.

Rocket Pool’s decentralized and on-chain nature means that protocol-related bugs are the primary concern. Comprehensive and continuous audits, bug bounties, and an engaged community of node operators are the primary methods of mitigation.

Lido’s group of trusted node operators with no personal bond currently means that a node operator could keep all execution layer rewards for themselves and refuse to exit validators. This risk is mitigated through legal contracts and by specifically choosing operators that are trusted members of the Ethereum community.

While one can argue which tail risks are larger, a key practice in risk management is diversification.

Implementation Plan

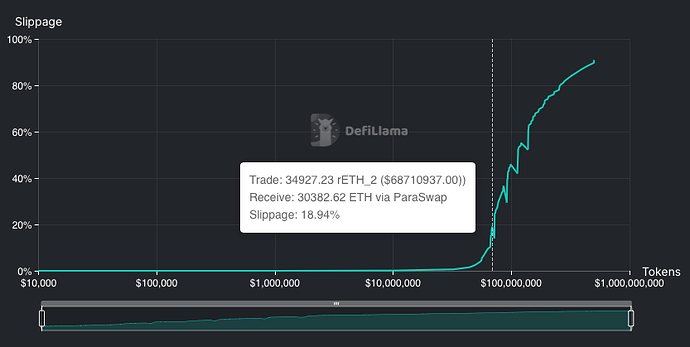

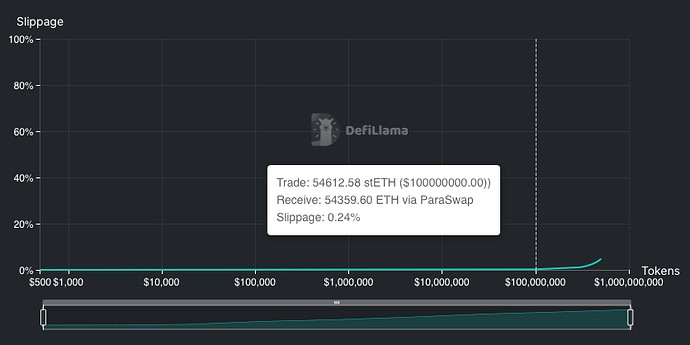

Once support is indicated in the above poll, we will move this GIP to a formal on chain vote. The implementation will simply consist of instructing Karpatkey to begin transitioning our Treasury away from stETH and towards rETH. The expectation is that Karpatkey will work to reduce slippage associated by any conversions by swapping stETH for rETH in smaller batches, or in some cases waiting for Lido redemptions to unlock if swapping on DEXs is not feasible.

Risks and Challenges

- wstETH is currently being used by Gnosis DAO to collateralize our Maker loans of ~22mm DAI. Any actions to reduce this and replace the collateral with rETH will need to be carefully managed by Karpatkey to prevent any liquidation risk.

- Assuming Gnosis DAO wants to move some stETH exposure to rETH ahead of the Lido withdrawal unlock, Karpatkey will need to manage any slippage associated with the swaps. Today, the stETH discount is just 0.4%, but my recommendation is that we move the majority of our stETH position to rETH once withdrawals are enabled. 0.4% is significant when considering the size of the Treasury and Lido unlock is expected around May 15th. Given this poll closes on May 15th, this may be a moot point

Team/ Organization/References

Viszla is not a team, just a poorly spelled dog reference. I am a solo ETH and GNO staker, hold RPL, and plan to stake all future ETH with the RocketPool protocol.

Gnosis Snapshot

TBA