GIP-91: Should the GnosisDAO onboard into Centrifuge Prime?

-

In Favour

-

Against

GIP: 91

title: Should the GnosisDAO onboard into Centrifuge Prime?

author: akhan.eth

status: Phase-3

Type: Funding

created: 2023-12-15

Duration: 12 months

snapshot: https://snapshot.org/#/gnosis.eth/proposal/0xa779ccda18ee2aeb56894e8b5baafd3d2568e99b0fea4a03dd246f548084a93c

Executive Summary

This proposal initiates the onboarding of GnosisDAO into Centrifuge Prime by investing ### of the treasury into Real-world assets (RWAs). The onboarding will be contingent upon the establishment of a Legal Conduit for GnosisDAO by Centrifuge for the safe investment of RWAs. This proposal will integrate existing treasury management processes and services providers such as karpatkey DAO. The benefit of this proposal will provide the GnosisDAO Treasury with an additional diversified source of yield, a resilient legal infrastructure for engaging with RWA investments, and access to additional diversified sources of credit through Centrifuge.

Service Description

This proposal initiates the onboarding of GnosisDAO into Centrifuge Prime to invest part of the treasury into RWAs. Centrifuge will provide the services to establish a legal structure that supports safe RWA investments, integrates GnosisDAO’s treasury management processes, establishes any technical integrations needed, and facilitates the curation of a diversified investment portfolio.

Once established, this proposal targets an initial allocation of $10m USD into Centrifuge Prime, through pools such as Anemoy LTF, New Silver, and other available pools.

Centrifuge has been collaborating closely with karpatkey DAO and GnosisDAO contributors on a variety of RWA initiatives within the Gnosis ecosystem. Beyond bringing new exposure to the GnosisDAO treasury, possible ideas include:

- deploying Centrifuge Liquidity Pools directly on Gnosis Chain;

- leveraging the Centrifuge Securitization Engine for the issuance of unique pools for the Gnosis community; and

- exploring deeper partnerships with specific parties and efforts inside the Gnosis ecosystem.

We view this proposal as the first step in bringing the Gnosis and Centrifuge ecosystems more closely together and establishing a flourishing partnership for Real World Assets in DeFi and Gnosis Chain.

- Key aspects

This proposal will accomplish:

- Establishing a Legal Conduit for the safe investment of real-world assets.

- Integrating the existing treasury management process to utilize this conduit.

- Facilitating ongoing management tasks including portfolio and asset curation, reporting via the Centrifuge Credit Group, and dedicated technical and user support.

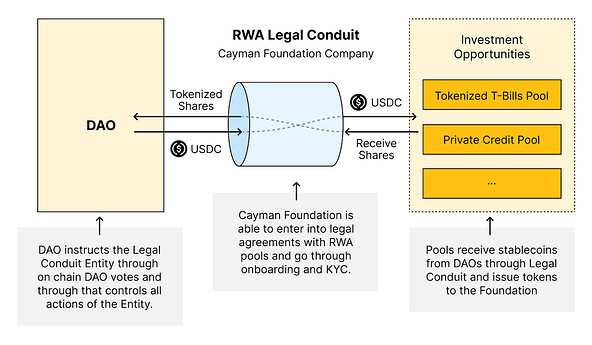

The Legal Conduit

The legal structure will be integrated with DAO governance to ultimately be owned and operated by GNOtoken holders. The principle idea behind the structure is to establish an entity that is capable of signing and fulfilling legal agreements on behalf of the DAO, ultimately enabling GnosisDAO’s path to legal recourse. This provides a high degree of reliability and security for RWA investments, without compromising the principles and position of the DAO.

This framework is based on our extensive experience in MakerDAO setting up similar structures. There, the same structure supports a >$1B in deployed capital.

While the legal conduit is initially intended to facilitate an investment by GnosisDAO into RWA offered through Centrifuge Prime, the same structure could potentially also be used to diversify GnosisDAO’s treasury into RWAs available through other platforms/issuers/brokers, thereby expanding the scope of treasury management activities currently available to the DAO.

Integrated Management Process

GnosisDAO has an existing sophisticated and high-quality non custodial treasury management process, pioneered and led by karpatkey DAO. The services in this proposal will be fully integrated to support the existing processes efficiently, while also supporting any future developments within the DAO. These processes and overall structure will be developed in collaboration with the Gnosis community.

Ongoing Management and Support

Centrifuge Prime provides dedicated access to the Centrifuge ecosystem and community. As part of this proposal, the Centrifuge team will work directly with karpatkey DAO to provide ongoing support for the RWA portfolio allocated through Prime.

This will involve ecosystem and pipeline management with dedicated relationships to high-quality asset managers, service providers, and other actors necessary to maintain and curate a diversified RWA portfolio. The Centrifuge Credit Group, a DAO entity setup to provide risk and credit analysis, can be utilized to provide general-purpose reporting for investors. This provides an additional level of ongoing monitoring and independent analysis for karpatkey DAO and the community to utilize.

Finally, Centrifuge is committed to providing technical and user support to the Gnosis community. This includes community education and engagement, support for technical integrations, and dedicated support to the investment and portfolio management team.

Beyond US treasuries, the Centrifuge Prime setup would also allow the Gnosis DAO to allocate into the following asset classes:

| Bucket Focus | Description | Targeted Returns | Liquidity Thresholds |

|---|---|---|---|

| Liquidity | Lowest risk while maintaining US Treasuries, MMF, AA+ rated short term bonds | 5-6% | Daily |

| Preservation | Investments in senior secured loans such as real estate, corporate bonds etc. | 6-8% | 3-6 months |

| Acceleration | Trade finance, non-bank originators, emerging markets | 8-20% | 3-24mo |

- Service Scope - Describe the scope of the service, including any limitations or exclusions that apply.

The scope of services described above intends to cover the RWA investments made through Centrifuge Prime.

- Service delivery - Give an overview of how the service will be delivered, including any key processes, procedures, or technologies.

The process for establishing the legal conduit is as follows:

The Centrifuge contributor team will retain external legal counsel in the Cayman Islands to represent the Gnosis DAO’s interests. The results of this work will be presented to the Gnosis DAO, and the community will have time to process, provide feedback, and otherwise request changes in the legal structure. The structure will only be implemented and executed with DAO approval, via the requisite process as requested by the community.

The follow-on processes and procedures will be developed over further collaboration with the community.

- Support - Provide a brief description of the support services that are provided.

The support services are mentioned above.

Pricing and payment

The pricing for this proposal is structured to streamline fees. The usage of GNO as a reward helps to align incentives towards long-term interests versus short-term benefits.

The fee structure is as follows:

| Fees | ||

|---|---|---|

| Structural Setup | up to 50,000 USDC | To be paid immediately into a Safe controlled by Centrifuge to pay for lawyers and Cayman service providers to set up a Cayman foundation company to the benefit of the Gnosis DAO, any unused budget will be returned to the GnosisDAO treasury. The structure may require ongoing fees but will be assessed on a periodic basis and only after approval from the DAO. |

| Portfolio Fee | 0.35% p.a. on assets in Prime up to $50M, 0.2% $50-100M, 0.1% >$100M | Accrued on an ongoing basis to Centrifuge for maintenance and support and payable upon redemption. |

| Gnosis Rewards | 250 GNO, paid incrementally over 12 months into the Centrifuge treasury, starting with the first $1M Deployment into Centrifuge Prime. GNO would be locked for a period of 12 months. | To cover costs of resource and facilitation time for the development of the infrastructure and processes. Centrifuge DAO intends for this to create better alignment with strong skin in the game incentives for success. |

Service Terms and Exit Strategy

Centrifuge Prime can be unwound and offboarded with 30 days’ notice. The positions and structures can be off-boarded entirely or transferred to new ownership. Investments themselves will be subject to the policies of the investment contract, but can also be unwound.

Team/Organization

Centrifuge has a long track record of working with DAOs to bring RWAs on as collateral. Notable firsts include minting MakerDAO’s first real-world asset, structuring the first on chain securitization, launching the RWA Market with Aave, and partnering with BlockTower to bring the first credit fund operations on chain. Centrifuge Prime is built for the needs of large decentralized organizations. It provides the infrastructure and services to quickly and easily onboard and scale a fully diversified portfolio of real-world assets. Through Centrifuge Prime, decentralized organizations can get access to an institutional ecosystem of RWA partners and service providers.

Centrifuge is a DAO-governed protocol. K/Factory contributes to the Centrifuge protocol by providing development, and infrastructure, and working with users to ensure adoption.

More contributor information can be found on the Centrifuge website.

Conclusion

This proposal represents a significant step forward for the Gnosis community in its RWA engagement. Centrifuge Prime is an optimal solution for developing a diversified RWA portfolio that the DAO can integrate into its existing treasury management solutions. Centrifuge has collaborated with karpatkey DAO on the development of this proposal and, with support from the Gnosis Community, would like to continue this collaboration to add additional exposure to the GnosisDAO treasury.