Update: GIP-92 karpatkey spin-off and KPK token launch

karpatkey Investment Memo

Summary

This memo highlights karpatkey’s progress since February 2024, when GIP-92 was introduced, while reaffirming our firm commitment to GnosisDAO. Over the past six months, we have achieved significant revenue growth, expanded our team, and strengthened our treasury management services for DAOs. As we continue to build the leading on-chain investment banking solutions for DAOs, our focus remains on delivering exceptional value to GnosisDAO and the broader DeFi ecosystem.

We are committed to increasing transparency, aligning our future success with GnosisDAO’s long-term vision, and deepening our contributions to the Gnosis ecosystem.

Key Achievements

- Significant revenue growth

- Expansion of our pipeline, including new DAOs onboarded

- Extended solution offerings and expanded total addressable market (TAM)

Commitment to GnosisDAO

To reaffirm our alignment with GnosisDAO and GNO token holders, karpatkey commits to allocating 10% of our monthly revenues over the next year to purchasing GNO tokens. This move reflects our belief in the significant undervaluation of GNO and presents a strong investment opportunity for both investors and DAO treasuries. We are fully aligned with the strategic goals and long-term vision of GnosisDAO.

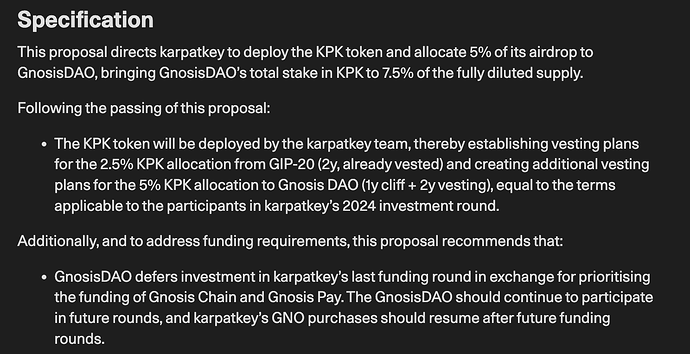

Modifications to GIP-92 phase-2

The initial proposal called for GnosisDAO to invest $5M in karpatkey through a $2.5M stablecoin investment and a $2.5M GNO-KPK token swap.

However, given the current market conditions and the undervaluation of GNO, we propose replacing the token swap with a $2.5M USDC investment. To reinforce our commitment to GNO, karpatkey will allocate 10% of its total revenue over the next 12 months to purchasing GNO in the open market, which we estimate will add +$2M GNO to our treasury. Purchases will be made at our discretion and included in monthly reports to maintain transparency.

The final GIP-92 structure consists of a $5M investment for 2.5% ownership at a $200M valuation, with an additional 5% ownership through an airdrop, totalling 7.5%. The total ownership of the Gnosisdao will amount to 10%.

karpatkey’s Financial Growth

Since February 2024, when GIP-92 was introduced, the total value of our DAO treasuries grew by 133%, from $900M to $2.1B. This growth was primarily driven by the onboarding of SafeDAO’s treasury in Q2 and the general market uptrend in crypto assets.

We continue to explore opportunities with leading DAOs such as Arbitrum and dYdX and are confident in expanding our revenue partnerships before year-end.

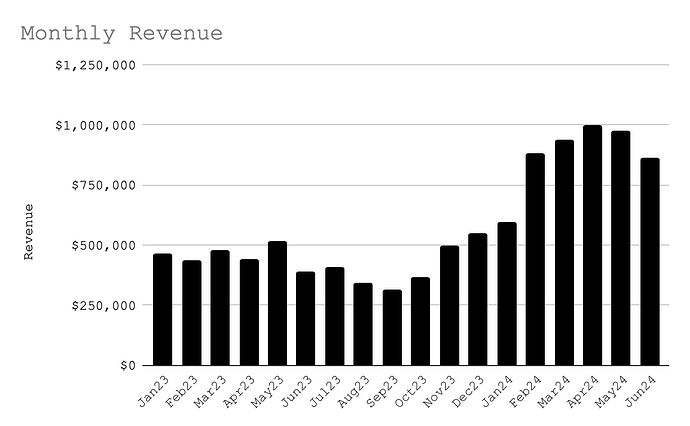

From the beginning of 2024, our non-custodial Assets Under Management (ncAUM) grew by 53%, from $654M to over $1B. In the first half of 2024, we recorded $5.26M in revenue and are on track to achieve $12.5M in total revenue for 2024, more than double our revenue from 2023.

The chart below shows a solid uptrend in revenue over the past 18 months. We remain focused on sustainable growth and see benefits from improved operational efficiency and the overall scaling of our business.

karpatkey’s Operational Milestones

In 2024, karpatkey expanded from 29 to 50 full-time contributors. This growth was driven by reorganising our treasury teams to better serve clients, improving our risk management infrastructure, and expanding our services.

Key growth drivers in 2024 include:

- Team expansion to 50 contributors

- Reorganisation of treasury teams to improve service delivery

- Execution of 9,000+ DeFi transactions with zero security incidents

We remain committed to improving our risk management infrastructure to support our partners.

karpatkey’s DAO Expansion

- Safe–Gnosis Joint Treasury. With the passing of both GIP-97 and SEP-24, karpatkey was chosen to manage the joint treasury owned by SafeDAO and GnosisDAO.

- AAVE Financial Services - Phase II. karpatkey extended their agreement with the AAVE DAO for an additional six months. This joint service agreement provides financial services to the Aave DAO focused on treasury management, GHO adoption, and the Aave DeFi product stack.

- Uniswap Treasury Working Group. We were selected as a Uniswap Treasury Working Group member to provide subject matter expertise and treasury management research for the Uniswap DAO.

- Nexus Mutual DAO: karpatkey was appointed as the Treasury Manager.

- Arbitrum Stable Treasury Endowment Program : Appointed as a member of the STEP Committee evaluating, vetting, and selecting candidates for the program, as well as recommending specific allocations toward successful applicant’s RWA products.

- Balancer Expanded Scope: We increased our scope to offer Balance Statements, Fund Flow Analysis, Expenses Breakdown, and Cash Flow Forecasting.

Investment Opportunity

KPK Token Value Accrual: All value generated from karpatkey’s business operations accrues to KPK holders, providing direct exposure to our financial success.

Governance Influence: With 10% ownership of KPK tokens, GnosisDAO will retain significant influence over karpatkey’s strategic direction.

Financial Returns: Our recent seed round, closed in Q1 2024 at a $200M valuation, represents a 5x increase from GnosisDAO’s initial investment via GIP-20, demonstrating karpatkey’s strong return potential for investors.

GNO Exposure: karpatkey’s commitment to add +$2M in GNO to its treasury over the next 12 months, combined with existing GNO holdings, highlights our focus on creating long-term value for GNO holders.

Strategic Alignment: karpatkey’s success contributes directly to the growth of the Gnosis ecosystem, reinforcing GnosisDAO’s position in DeFi. The spin-off allows karpatkey to create an interconnected network of DeFi treasuries, with GnosisDAO at its core, driving value and activity to Gnosis Chain.

Further Notes:

- Vesting Period: KPK tokens from GnosisDAO’s $5M investment will vest linearly over two years.

- OTC Deals: KPK tokens will be non-transferable at TGE until governance approves transferability. Still, karpatkey will facilitate OTC deals for Gnosis using our investor network, which can accrue value directly to GNO through buybacks.

- Upcoming Funding Round: karpatkey will initiate a new funding round at a higher valuation, reflecting our strong growth. This round presents an opportunity for existing investors to see an increase in their initial investment value.