TL;DR: Gnosis has evolved from a prediction market platform (Gnosis 1.0) into a cornerstone of Ethereum infrastructure (Gnosis 2.0), and is now embarking on its most ambitious phase yet: Gnosis 3.0: A collective of aligned projects connected by the GNO token. This collective is focusing on revolutionizing payments and financial infrastructure. Gnosis 3.0 aims to bridge the gap between blockchain technology and practical, everyday applications for the masses. With a suite of in-house ventures, including Gnosis Pay and Gnosis Wallet, and a strategic shift towards open financial rails, we’re poised to make decentralized financial tools accessible to everyone. Dive into our journey, our current ecosystem, and the future we’re building at Gnosis.

Gnosis started in 2015 as an Ethereum-based prediction market platform. We call this phase Gnosis 1.0. This still lives on as “The conditional token framework” or as a product: Omen. From there Gnosis morphed into a prolific builder of Ethereum-centric infrastructure—Gnosis 2.0. This phase included the development and scaling of Gnosis Safe, CoW swap, the treasury management of the DAO by karpatkey, the Open Ethereum client, Zodiac DAO tooling, and last but very much not least: Gnosis Chain, a sister chain to Ethereum built out of the premise that Ethereum will require horizontal scaling in addition to vertical scaling via L2s to meet demand for credibly neutral blockspace.

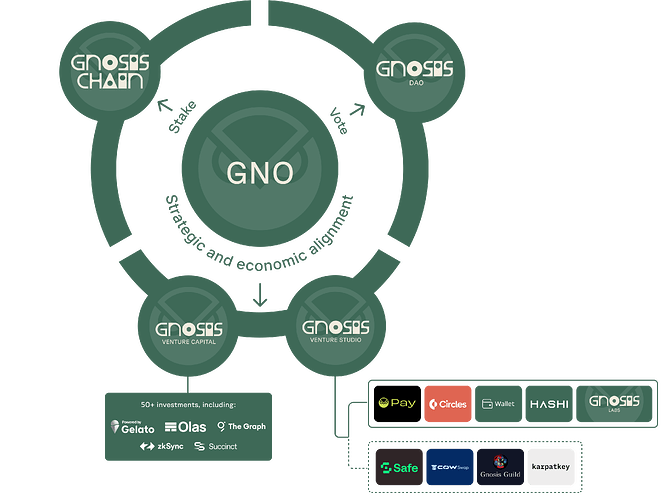

Before turning to the Gnosis 3.0 vision and roadmap, it’s worth taking a moment to map out how Gnosis 3.0 is structured. Doing so will help to clarify where we’ve come from and where we’re going. To break it down, we created a visual diagram with the GNO token at the center.

- Gnosis Chain is a sister chain to Ethereum. It’s secured with staked GNO, either through solo or liquid stakers.

- Gnosis DAO allocates the Gnosis treasury. GNO is the governance token for the DAO.

- Gnosis Ventures incubates, invests in, and supports projects in all early stages, spinning incubated projects out where appropriate. The relationship between these ventures and the token can take several forms: Either GNO is used as a token directly or the Gnosis token is economically coupled with the project tokens.

Gnosis Chain is the heart of Gnosis 2.0. The relationship between Gnosis Chain and the Gnosis token is pretty straightforward: All validators are required to stake GNO. Fees paid for transactions on Gnosis Chain are paid in xDAI. These fees go partially to validators directly (“priority fee”) and are partially used to buy back and burn GNO tokens (“base fee”).

Gnosis DAO is the entity GNO token holders can participate in directly and make their voices heard. Similar to Ethereum, Gnosis Chain is governed by a complex set of entities and individual actors that have a vested interest in the chain. This includes core developers, node runners, validators, RPC providers, bridge operators, centralized exchanges, important applications on the chain (think stable coin issuers, big dexes, oracle providers, etc), and GNO holders themselves. However, Gnosis DAO does control a significant treasury and other assets like ENS domains and therefore indirectly exerts influence over the Gnosis ecosystem.

Gnosis Ventures (Studio and Capital) has been operating for many years in a less formalized way. Some Gnosis Ventures never made it past the public goods / public infrastructure stage (Gnosis Auction, Open Ethereum, etc). Ventures that have economic traction on their own can be spun out, with a portion of the token allocated to Gnosis DAO. Successful examples of this are Safe and CoW DAO, an ongoing example is Karpatkey.

Gnosis Ventures also invests in early-stage third-party projects as a VC. We are well placed to do that because we have both a deep technical understanding of the ecosystem and its opportunities and challenges and a bird’s eye view of the ecosystem that lets us invest in projects that are missing, contributing to the flourishing of the greater whole. While individual projects are expected to be economically successful as stand-alone projects, even if they are not, their existence and continued operation also contribute to overall ecosystem success.

Looking at successful spin-offs like Safe and CoW DAO, we recently introduced a framework of how Gnosis DAO can use these tokens to achieve economic upside for GNO holders, long-term alignment with the projects, and strengthen economic activity on Gnosis Chain. The way the framework achieves these objectives is via protocol-owned AMMs (bonding curves) of GNO/ project token pools, implemented as CoW-AMMs on Gnosis Chain. This means GNO is not only a governance and staking token, but also an index token for the Gnosis ecosystem. In the same vein, the same can and will be done with liquid Gnosis VC investments, reinforcing bilateral economic alignment between Gnosis and the portfolio projects. It should be noted that Gnosis VC often takes a very active role in shaping early ecosystem projects and invests engineering, strategy, legal, and audit resources into the growth and maintenance of these seedling portfolio projects.

As you can see, the Gnosis ecosystem is larger than the sum of its parts: There are very tangible network effects between these various undertakings centered around the Gnosis token holder community. We can use this to actively and decisively push specific goals more effectively by having different portfolio projects contribute in different ways.

The Gnosis token holds the three domains together: GNO is the voting token for the DAO, the staking token for Gnosis Chain, and the ultimate beneficiary of the growth of internally incubated projects and external investments.

Now that we have the Gnosis 3.0 structure down, what is the Gnosis 3.0 vision? For a long time, we Web3 builders have concentrated on infrastructure. It was necessary to get anything done! However, the pendulum has swung the other way now and we’re somewhat over-indexed on infrastructure and under-indexed on actual applications that bring real value to a very significant number of people. It’s time to come out of that very technical niche and build applications for humankind. So we asked ourselves: In which area can we build that will yield the most value to the most normies the quickest? And for us, the answer is unequivocally payments and financial rails. Gnosis 3.0 is Gnosis as you know it but with an intense focus on payments and generalized, open financial infrastructure. We are still building, we’re still investing, we’re still pushing Gnosis Chain, but payments is the direction we are planning to conquer next. What does that look like in practice?

In addition to Gnosis Chain, there are four active in-house ventures focused on payments and open financial infra:

- Gnosis Pay

- Circles

- Gnosis Wallet

- and Hashi

Gnosis Pay focuses on Web3/ existing financial rails integrations and aspires in the longer run to replace existing financial rails with more resilient and efficient blockchain-based infrastructure.

Circles is a decentralized web-of-trust-based universal basic income – after a very impressive first run in 2020, we will relaunch Circles on properly scalable foundations later this year.

Gnosis Wallet is a WIP but the summary is we’re bringing all of Gnosis’s infra together into what’s functionally a full-stack mobile-first bank built on open + decentralized rails, including Safe, Gnosis Pay, Circles and other products like CoW, enabling users to seamlessly spend, swap and remit funds. Think: Onchain neobank, usable for anyone comfortable with mobile banking. To achieve this level of usability, we are heavily leveraging account abstraction and advanced cryptography. Keep your eyes peeled, we’ll properly announce and launch Gnosis Wallet soon!

Hashi is the only venture without a direct payments focus: Hashi is foundational infrastructure to improve bridge security between chains. Having secure bridges to the Ethereum Mainnet and other chains is non-negotiable for Gnosis Chain. In a nutshell, Hashi is a lightweight protocol that compares the block headers as relayed by different bridges between the same chains and only lets you bridge funds if every bridge agrees about the state of the target chain. An attacker would have to break every single bridge simultaneously to steal funds, a nearly impossible feat. Hashi was initially incepted at Gnosis in 2023. With increased adoption from projects and ecosystems outside of Gnosis, Hashi was recently formalized into The Cross-Chain Alliance in collaboration with an external team of experts.

Gnosis 3.0 represents a pivotal shift from infrastructure to application, with a focus on democratizing payments and financial services. Our goal is to bridge the gap between blockchain’s technical potential and everyday users’ practical needs, making decentralized financial tools accessible and usable for all.

The last thing I haven’t discussed in the org chart is Gnosis Labs. It’s where R&D stage efforts live. Currently, it’s full of AI-related activities, and agent-to-agent payments are a very significant proportion of the total payments on Gnosis Chain. We see 10k-20k weekly payment transactions for Autonolas alone.

And it’s not just Autonolas that uses Gnosis Chain for payments: HOPR and Althea are other well-established examples of native micropayments on Gnosis. Monerium EURe is natively issued e-money on Gnosis Chain and the majority of EURe transactions also happen on Gnosis. RWA projects like Backed and Centrifuge operate on Gnosis, and Spark, Aave, Balancer, 1inch, and many others provide financial infrastructure. We will start a regular ‘State of Payments on Gnosis’ report soon, to give you a sense of how things are developing.

Gnosis 3.0 is a convergence of what we think Gnosis can be, given where we and the ecosystem are at, and what we think the world is missing. It’s been over 15 years since the Bitcoin whitepaper announced peer-to-peer electronic cash. Meanwhile, we and countless others in the ecosystem have worked hard to lay the foundations for creating usable permissionless systems. Pushing p2p cash and open financial rails towards consumer adoption would be the ultimate bow to Satoshi.

We will follow up with many more details on all of these endeavors! What are your thoughts on the Gnosis 3.0 vision?

Let’s build this together ![]() . As always: Onwards and upwards!

. As always: Onwards and upwards!