GIP-100: Should Gnosis DAO conduct a large-scale buyback program?

- In Favour

- Against

GIP: 100

title: <Should Gnosis DAO conduct a large-scale buyback program?>

author: <Nay, Thanefield Capital>

type: <Meta>

created: <2024-05-17>

duration:<6 months>

funding:<$30 million>

Category

Treasury

TL;DR

I represent Thanefield Capital, a multi-strategy crypto fund; GNO is one of our thesis-driven investments.

Currently, GNO is significantly undervalued relative to its book value. To address this, we propose initiating a large-scale buyback program. Our plan involves deploying $30 million, representing about 5% of the estimated assets of Gnosis DAO, over a six-month period.

Introduction

Gnosis DAO has consistently been at the forefront of innovation, successfully developing and launching products such as Safe and CoW Protocol. These initiatives began as internal projects and were later spun off into independent ventures. Despite these successes and several previous rounds of buybacks, the GNO token has not adequately reflected the value generated by these and numerous other activities.

GNO is currently trading below its book value, considering only the marketable tokens owned by Gnosis DAO. This valuation suggests that the market is assigning a negative value to all other Gnosis DAO assets. These assets include, but are not limited to, Gnosis Chain, Gnosis Pay, Gnosis Wallet, Circles, a venture capital portfolio of over 40 companies, and investments in four crypto VCs. This means that long-term GNO holders have not financially benefited from the DAO’s successes in product development, venture investments, and treasury management. Additionally, it becomes uneconomic to allocate any GNO that already belong to the DAO for ecosystem growth or other initiatives, as it would result in a negative value transfer for the DAO.

Gnosis DAO is well-positioned to address this undervaluation as one of the most capitalized DAOs, holding over $630 million in assets and ranking second only to Mantle in terms of non-native marketable tokens. We propose initiating a substantial buyback program to correct this disparity. If approved by a DAO vote, @Karpatkey will manage the execution of this program.

It’s important to note that this proposal operates independently but complements the vision outlined in Gnosis DAO v3, which aims to establish protocol-owned liquidity between GNO and portfolio projects. If approved by the DAO, these initiatives should progress concurrently.

Objectives of the program

- Transfer value from sellers to long-term holders by acquiring GNO below its intrinsic value. The acquired tokens could then be utilized for treasury swaps, incentives, growth initiatives, and further investments.

- Signal to the market a commitment to establishing a valuation floor for GNO that consistently exceeds its book value.

- Drive attention to the products of the DAO. Given the attention-driven nature of the crypto market, where price often influences fundamentals, large-scale buyback program can elevate both market perception and fundamental value.

Gnosis DAO assets breakdown

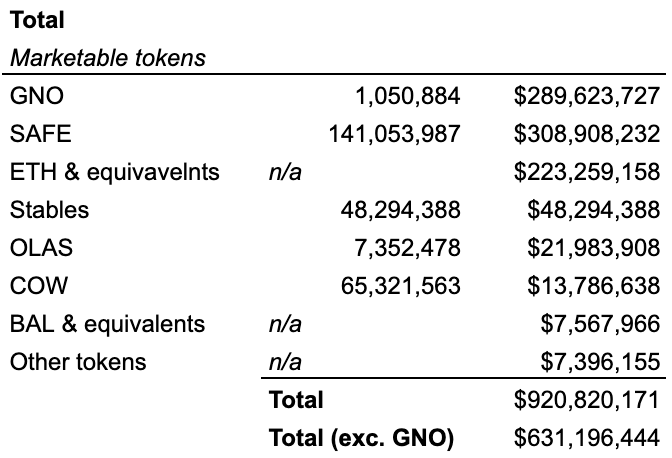

This discussion is centered on the marketable tokens and illiquid venture deals & investments in venture capital funds, specifically excluding other significant assets like Gnosis Chain, Gnosis Pay, and Gnosis Wallet.

- Marketable tokens

As of today, Gnosis DAO holds $631 million in tradable tokens, not including GNO (this number corresponds to the assets that belong to Gnosis DAO that we could locate onchain). This figure serves as a foundation for valuing Gnosis DAO’s assets. It’s important to note that not all these assets are immediately liquid. For example, approximately half of the SAFE token allocation is yet to vest. Furthermore, a significant portion of both SAFE and OLAS tokens has been voluntarily placed into lock-up contracts to demonstrate commitment. The primary assets in the treasury include ETH and equivalents, SAFE, stablecoins, OLAS, and COW. In 2023, the treasury generated $10.2 million by engaging these assets in DeFi activities.

Additionally, Gnosis DAO has a 50% stake in the Safe <> Gnosis joint treasury, which owns 5% of the SAFE token supply, valued at approximately $115 million currently. These assets are not included in the above calculation.

- Illiquid venture deals

According to the list published by Ernst on this forum, Gnosis DAO has made about 50 venture investments over the years either directly or through in-house Factor VC.

Investments that remain illiquid/are not located include:

Flashbots, Matter Labs (ZKsync), Aztec, RISC Zero, IDEX, Succinct, Orca, Anoma, Zerion, POAP, ImmuneFi, WalletConnect, Kinetex.io, Fileverse, NFTfi, Li.Fi, Hedgey, Azuro, Harbor, Snapshot, Diva, Phaver, Rated Network, Mimic.fI, Sablier, Coinshift, Vibe.xyz, Parcel, Mean.finance, Collab, AMMalgam, Topos, Bootnode, Stablelab, Backed, Least Authority, Cypherock, Gateway.fm, Den, Mystiko, Shutter, Altlayer, Karpatkey (spinoff).

Additionally, Gnosis DAO is an LP in the following VC funds:

1kx, Lightshift, LongHash Ventures, Seed Club Ventures.

While it is challenging to precisely value these illiquid venture deals due to many unknown variables, this portfolio includes high-profile deals and ensures growth in Gnosis DAO liquid treasury as these tokens launch and vest, widening the discount at which GNO is currently trading.

Gnosis DAO’s GNO holdings

According to CoinGecko, the circulating supply of GNO tokens is listed as 2,589,589, which is valued at approximately $703 million. However, this figure does not include 1,050,884 GNO tokens owned by Gnosis DAO, many of which were acquired through buybacks and are unlikely to be released into circulation, at least before GNO is back to its book value. Therefore, the actual circulating supply is reduced to 1,538,705 GNO, amounting to approximately $424 million.

GNO book value

With our ballpark estimate of the venture book & investments in VCs at $100 million, we arrive at $730 million in assets. With the current GNO real market cap at $424 million, it’s currently trading 42% below its book value of $475. To reach its book value, GNO has to appreciate by about 72% based on current numbers. Since the treasury contains volatile assets, it should be calculated dynamically as the program progresses.

It is important to note that the book value of GNO does not fully represent its intrinsic value, which should also account for future cash flows generated by the DAO. Therefore, the book value should be considered merely a baseline or minimum value before the DAO decides to spend any GNO it already owns or acquires through this program.

Proposed execution

To address the undervaluation of GNO and effectively utilize the treasury assets, we propose allocating approximately 5% of the treasury funds, amounting to $30 million, for a structured buyback strategy. This amount will be divided into two distinct parts, each employing a different strategy to optimize the overall impact.

- CoW-TWAP

- Allocates $15 million over 6 months;

- Executes orders at any price below the dynamically calculated book value of GNO;

- Results into $83,333 daily buy pressure.

- Discretionary, executed by Karpatkey

- Allocates $15 million;

- Provides Karpatkey with full discretion to capitalize on the best opportunities.

Assessment

After the conclusion of the program, we should assess its results and consider whether to continue, modify, or end the buyback strategy going forward.