kpk May 2025 Report for GnosisDAO

This report provides an update on kpk’s contributions and impact for GnosisDAO in May 2025, focusing on treasury overview, operations, including liquidity and diversification, ecosystem development, technology and governance.

Big Picture

This month, we reflect on how delegation is reshaping participation and governance across GnosisDAO.

Over our 5-year history, activity across the DAO’s governance has oscillated. From highs of several hundred participants per proposal showing up to vote several times a month, activity and forum discussion had declined in recent months.

In 2024, and after a series of proposals failed to meet quorum, momentum began to shift. We, together with StableLab, proposed a new delegate programme, which aimed to allocate 50,000 GNO from the treasury to empower 10 new delegates. Despite some delays in the implementation due to infrastructure challenges, the delegations were executed.

The initiative bore immediate fruit. Last month, four proposals entered the spotlight, including two contested votes that drew clear battle lines among delegates:

-

A proposed engagement for Gnosis Guild to steward governance infrastructure was narrowly defeated, with debate centring on whether the initial pricing justified the value.

-

A request to honour past bonus rewards from a retired node operator scheme also failed to pass, exposing philosophical differences on whether DAOs should act as retroactive compensators for early contributors.

Meanwhile, competing proposals for governance monitoring tools and delegate dashboards stalled in forum discussions, again on questions of value for money and necessity.

To address this disparity across proposals, a new Call for Proposals is being discussed, which aims to clarify the areas where external service providers may add value and solicit a range of offerings to help the DAO make informed decisions. This promises to become a significant step forward in tackling new governance initiatives.

The delegate programme has clearly sparked some new energy within the DAO, driving up participation, opening public discourse, and narrowing the margins of contentious votes. Though none of the proposals in May are currently on a course towards execution, the significant change in these deliberations may reflect a wider systemic change.

We look forward to continuing our support for the evolution of governance across GnosisDAO.

Headline Figures

The figures for the month of May:

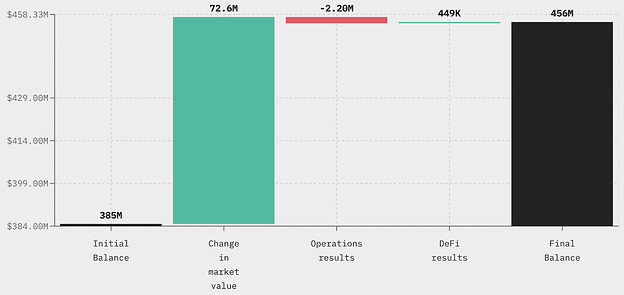

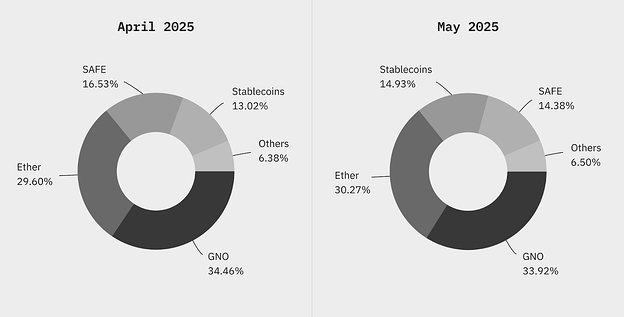

- Treasury Value: $456 million, which is an increase of $71 million from last month. This increase is primarily due to a 40% price increase in ETH, as well as a 14% increase in GNO.

- Performance by Category:

- DeFi Results: $449,000. This figure mainly reflects gains from deploying ETH across multiple DeFi protocols, as well as the appreciation in the value of these rewards.

- Operations Results: -$2.2 million. This included payments to HQ and Centrifuge Prime, kpk fees and funds distributed for incentive programmes.

- Change in Market Value: $72.6 million. As mentioned above, this is mainly due to the price increases for ETH and GNO.

- Gnosis Chain Metrics:

- DeFi TVL: $281.67 million. This represents a $23.52 million increase from last month, which is a 9.1% growth. This performance is broadly in line with the overall DeFi market, which has seen the TVL increase by approximately 12% over the same period, reflecting a continued market recovery and growing user engagement.

- DeFi Volume: $277.42 million. Thus, reflecting an increase of $24.29 million (9.6%) from the previous month. While this growth is more modest compared to the 24.8% increase in DeFi volumes on Ethereum mainnet, it remains directionally aligned with broader market trends, indicating healthy participation and consistent momentum.

This report derives all details on GnosisDAO’s portfolio performance from kpk’s monthly reports, which are published on the website. Information regarding the aggregate performance of Gnosis Chain is sourced from DefiLlama’s website.

Treasury Operations

Liquidity and Diversification

This month, we took a selection of actions aimed at supporting liquidity and improving and optimising the yield across several assets and protocols. We also reallocated a portion of funds into stablecoins to enhance capital efficiency and risk management. These include:

-

We increased the allocation to the ETHx Hyperloop vault by Stader Labs on Enzyme by a total of 248 ETHx.

-

$3 million USDC was allocated to the Pendle wstUSR pool. This deployment aims to capture attractive yield opportunities within the Pendle ecosystem while maintaining exposure to tokenised real-world assets via the wstUSR underlying.

-

Uniswap V3 Pool Creations on Gnosis Chain: As part of ongoing efforts to support liquidity and deepen market infrastructure on Gnosis Chain, the following Uniswap V3 pools were created:

- wETH / wstETH Pool

- 32.5 wETH paired with 399.98 wstETH

- EURe / USDC.e Pool

- 600,000 USDC.e paired with 481,983 EUR

- wETH / wstETH Pool

-

A total of 4000 GNO was allocated to the Balancer GNO/osGNO v2 liquidity pool. This contribution enhances pool depth and supports trading activity between GNO and osGNO on the Balancer platform.

-

Provided 90,000 sDAI and 559,582 BRLA liquidity to the Balancer BRLA/sDAI pool to maximise capital utilisation and further support Gnosis Pay’s rollout in the Brazilian market.

-

A full withdrawal was executed from the Hyperdrive platform, effectively closing out the position and consolidating assets. The withdrawn assets are now available for redeployment across other yield-generating or strategic positions. These include:

- 370.0869 wstETH

- 210,670.22 GYD

- 188,965.37 WXDAI

- 387.5 stETH

-

Withdrew €1,000,000 worth of EURe from the Aave lending protocol as we deem the market to be sufficiently organic and self sustaining.

-

GnosisDAO conducted a series of cluster validation tests with Obol, which were successful and resulted in the chain being validated. However, it was decided not to proceed further with the initiative and all associated funds, including any rewards, were subsequently returned in batches. This month, 2,478.28 GNO was received.

We also withdrew ETH across several existing deployments, either for sale to support operations or bolster newer deployments:

- GnosisDAO redeemed its entire balance from the Diva Early Stakers stETH Vault, totalling 3,169.91 stETH.

- Initiated the standard unstaking process for its 519 AnkrETH holdings.

- Unstaked 2,080.19 ETH from StakeWise, converting staked assets into liquid ETH.

- Removed 421.1451 wstETH from the Balancer pool, effectively exiting the position and consolidating exposure back to liquid ETH.

- As part of our ongoing funding and diversification strategy, two Time-Weighted Average Price (TWAP) transactions were executed over May. A total of 7,100 ETH was sold, generating 18,114,363.37 DAI in proceeds. The average sale price achieved was $2,551.32 per ETH.

Ongoing monthly efforts:

- Continuously rebalance the stkGHO/GHO pool on Maverick to support liquidity and efficient trading.

- Transferred 0.2 ETH to the Across Relayer to support ongoing cross-chain bridging operations.

- Successfully claimed all eligible rewards from ongoing Merkl distributions.

Ecosystem Development

Integrations & Partnerships

- Strategic ETH Reserve:

- This month, we led a new partnership for GnosisDAO with the Strategic ETH Reserve, a project aimed at bringing together the industry’s leaders to demonstrate their commitment to Ether by tracking their portfolios and sharing details of their holdings. This establishes GnosisDAO as a key advocate and supporter for Ethereum, joining together with other leaders to reinforce the strength of our community. The goal of the Strategic ETH Reserve is to position ETH as a strategic reserve asset by promoting transparent, on-chain treasury accumulation.

- Centrifuge Prime:

- In accordance with GIP-91, a payment of 250 GNO was executed and sent to Centrifuge Prime. Centrifuge Prime assisted GnosisDAO in establishing a legal conduit for RWAs. This legal framework allowed GnosisDAO the ability to invest in RWAs through Centrifuge Prime or any other platforms or partners. This step was a foundational infrastructure for GnosisDAO’s current and future involvement in the RWA space.

- Circles:

- In May, we were delighted to support the launch of Circles V2. After many months of development, the launch saw a series of launch events drawing significant traction, with over 5,000 new Circles accounts created. Behind the scenes, we provided vital support for the liquidity backing for Circles.

- Last month, we reported on the treasury’s strategic allocation of yield-bearing sDAI to multiple Cirlces multi-sig Safes. That distribution has enabled Circles to maintain operational stability, support initial liquidity needs, and fund core infrastructure without compromising capital efficiency.

- With the system now live, Circles is positioned to scale user participation, deepen integrations, and explore further on-chain utility, supported by a sustainable funding model.

- We are also pleased to have launched our kpk DAO Circles group, with group CRC tokens. Our group tokens are supported by our Balancer BLP and are currently being distributed on Circles. We look forward to growing our community within Circles and making full use of this exciting new technology.

- Headquarters:

- This month, as part of GIP-120, GnosisDAO officially completed the acquisition of HQ.xyz, which is now rebranded as Gnosis HQ. The transaction was structured in multiple stages and involved both stablecoin and token payments.

- Payments completed this month by GnosisDAO:

- 3,338 GNO and 377,321 SAFE distributed to founders.

- 922 GNO and 104,283 SAFE distributed for Ex-HQ Team Bonus, HQ Team Bonus, and HQ Advisor Compensation.

Initiatives & Incentives

- Executed weekly distributions of incentives and rewards for:

- Gnosis’ Curve liquidity pool:

- The May incentives totalled 4.8 wstETH. Cumulative total incentives now sit at 23,431.90 GNO and 108.92 wstETH.

- CoW Solvers:

- In May, a total of 26,908.87 xDAI was awarded to CoW solvers, which brings the total solver rewards to 345,199.67 xDAI.

- Backed:

- For bCSPX, 369 GNO ($48,643.65 at time of transfers) has been distributed in May. Since the start of the programme, a total of 1,474 GNO has been distributed (valued at $203,805.23 at the time of the relevant transfers).

- For bTSLA, 693 GNO ($84,512.11 at time of transfer) has been distributed since commencement on the 27th March 2025. In May, 369 GNO ($48,655.35 at time of transfers) was distributed.

- Gnosis Pay Cashback Programme (GIP-110):

- A total of 5,607.92 GNO has been awarded to date (56.08% of the total) among 3,584 users. 1,210 GNO was distributed in May alone.

- See the Dune Dashboard, which shows the weekly and total number of GNO rewarded, USD equivalent and users rewarded.

- Gnosis’ Curve liquidity pool:

- Continuously claiming and locking rewards on Aura Finance to maximise yield through reward compounding while ensuring long-term participation in the ecosystem.

Technology

A new feature has been introduced to streamline the GnosisPay rewards process. This functionality enables the ability to queue distribution transactions directly to the rewards safe, simplifying and improving workflow efficiency.

Fees

For this month, the management fee charged was $166,667 (1/12 of $2 million per annum). The performance fee is 20% of DeFi results from assets on Mainnet, which resulted in 26.07 ETH.

| Management Fee | Performance Fee (ETH) | |

|---|---|---|

| January | $166,667 | 33.72 |

| February | $166,667 | 25.07 |

| March | $166,667 | 36.04 |

| April | $166,667 | 42.20 |

| May | $166,667 | 26.07 |

This corresponds to a total fee of c. $1,207,947 from January to May 2025 (calculated by substituting 20% of the USD value of DeFi results for the ETH fee charged). Relative to the $2,616,198 in DeFi results, kpk’s fees represent around 46% of the total. Therefore, the majority of earnings generated by our work remain with GnosisDAO. However, this analysis only accounts for the basic yield generated and does not factor in kpk’s additional activities or value-added contribution.