Simple Summary

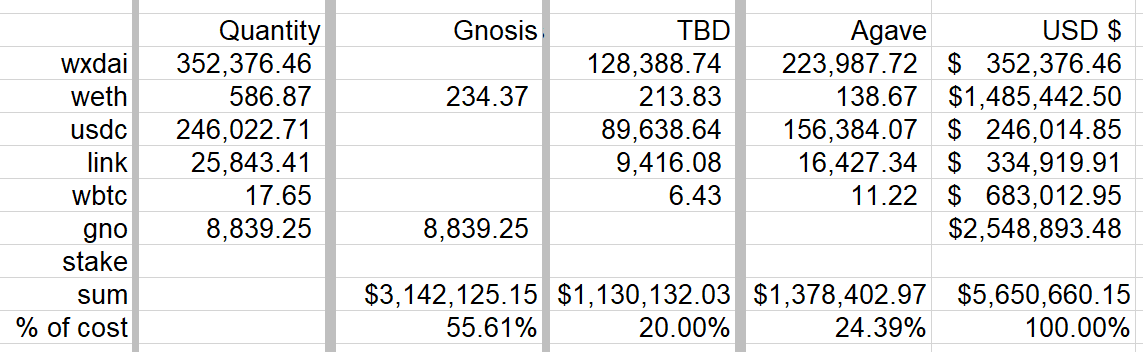

- GnosisDAO sends 8839.25 GNO and 234.37 ETH to the Agave treasury, equivalent to 55.6% of the hacked funds.

- Agave Initiates a Gnosis Auction of 25K AGVE denominated in ETH and uses the raised funds to cover wxDAI, USDC, LINK, ETH and WBTC equivalent to 24.39% of hacked funds and builds its treasury.

- GnosisDAO bids a price equivalent to the last 6 months average moving price for the total AGVE auctioned using Tradingview 180 day MA on day of the exploit.

- Agave refunds 80% of the hacked funds to users in agTokens, and will evaluate in the future how to repay the remaining 20% of the hacked funds.

Details

After extensive deliberation we believe this exploit of hundred finance and agave on march 15th 2022 does not 100% fall on the users, the protocols, or the bridge (Gnosis Chain). Therefore we believe all parties should share the burden. Since this is a proposal to the Gnosis DAO we would like to make our case as for why we believe Gnosis should be a part of the solution. Although it is unfortunate that Gnosis inherited the bridge and token state on chain as part of the acquisition, gnosis among some reputable unbiased accounts (quote mudit and shegen tweets), suggest that this ‘feature’ to be significant enough of a problem to propose a hard fork. Hence we offer the following proposal.

Agave intends on fully reimbursing all the lost funds of the users in 3 methods, the first two methods are intended to cover 80% of the reimbursement effective immediately . The third will be for the Agave DAO to determine how to reimburse the remaining 20% and is out of scope for this post. Issuing a debt token or investigating various loan options are currently being discussed as probable solutions.

As for the first two methods, Agave will be holding an open auction to raise enough capital to repay 100% of agave’s current circulating mCap of $1.378M and uses the raised funds to cover wxDAI, USDC, LINK, ETH and WBTC in the amounts shown in the figure below, which is equivalent to 24.39% of hacked funds.

Agave circulating mCap $1.37M, calculated subtracting 1hive+Agave DAO holdings from max supply then multiplied by closing price of token on day of the exploit, $55.75. (100,000-70,275.283-5,000 x $55.75 = $1,378,402)

25,000 agve tokens will be listed on the gnosis auction we are asking GnosisDAO to set the floor price of the auction to the 6 month moving average ~ $127.4458/agve. Anyone is welcome to participate in this auction and/or buy agave on the open market. Note: there are less than 30k agave tokens in circulating supply; 1hive holds 5k, there are ~9k staked, ~11k in various wallets, and only ~5k agave tokens on the open market so no $USD amount can currently purchase more than 5k agave tokens on the open market.

Agave is requesting the lost $GNO funds which would include ~8839.25 lost GNO + the remaining loss of ~234.37 ETH be covered by the GnosisDAO. As outlined above, the agave community isn’t taking this lightly, agave users and the Agave protocol is absorbing a significant amount of the loss relative to their ability and we believe this to be far from a gnosis bail out and a fair respectable offer. We are hopeful this lays the foundation for a continued positive mutual relationship between the DAOs. The details and breakdown of each asset is shown below. We welcome and look forward to any and all community feedback.