While I agree with you - some people will just sell their position once buybacks kick in and gno price appreciates - i don’t think your argument is valid overall. I think there are two perspectives on this that show buybacks are very reasonable in this situation

-

Sure, if the dao can invest in projects that are even more profitable than buybacks and/or are important to the gnosis ecosystem then it should prioritise that. However it seems very unlikely all of the funds currently held by gnosis dao will be used for that. And then buying back tokens undervalued just means you can create value for gno holders or sell/spend them again (e.g. in a way martin suggested) once gno is not undervalued as much anymore

-

taking your argument to the extreme, it would not hurt gnosis dao if gno price went to $1 right now. that is simply not true. once again - i agree with you that making more profitable investments or making good investments into gnosis ecosystem is more important, but you cannot rule out creating value for gno holders at some point, otherwise there won’t be many gno holders left (like why would you hold the token longterm if the token doesn’t hold any value?).

imo a gno price appreciation will lead to more interest in gno, more interest in gno ecosystem, that leads to higher gno price again and so on.

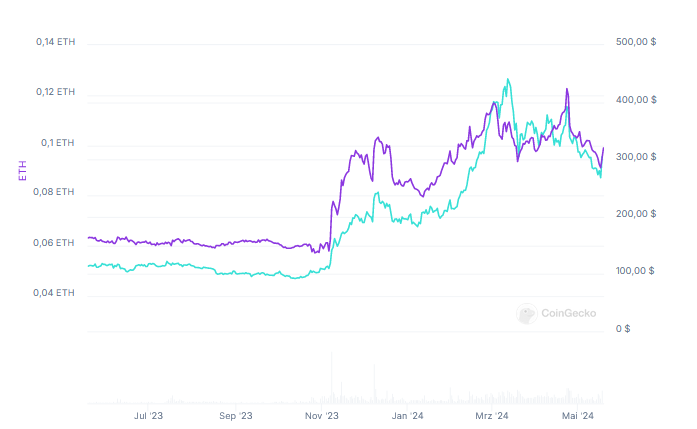

i have no idea why gno is so undervalued, but this looks extreme enough to take advantage of the situation